NAB’s economics boss Alan Oster has been planning to walk away before ‘another bloody budget’

The big four bank chief economist has analysed and probed every data point over nearly four decades. This is what he has discovered.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

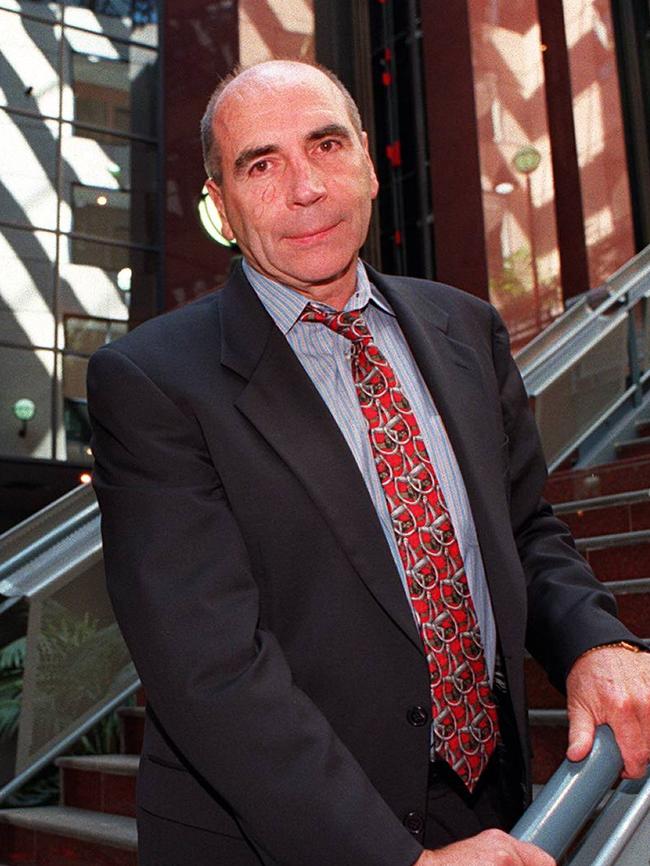

As a former Treasury official and across a multi-decade bank career, Alan Oster has stayed on the sidelines of politics. This time, the National Australia Bank chief economist had been quietly hoping an election would be called sooner, than later.

“As long as they don’t have another bloody budget,” Oster says.

Nearly 50 federal budgets (of mostly fiscal deficits) is more than enough for anyone to take – even an economist. It wasn’t to be. Late Friday Treasurer Jim Chalmers was planning a March 25 budget. It means Oster, 71, will squeeze one last budget in just days before his planned retirement.

When Alan Oster started with Treasury in the late 1970s, no one really had any idea how the economy was really travelling.

There was the 1980, 1982 recessions and then a painful one in 1990. It was possible there could have been a wobble in between, but people like Oster, whose job it was to build forecasts around the economy, were flying blind. At one point, “we didn’t know we had a recession for six months,” he says. Indeed, even banks and other arms of government were in the dark about whether the RBA had changed interest rates. Now the whole country knows the instant the cash rate is hiked or cut.

Economists today have far more sophisticated analytics, monthly inflation or NAB’s own business survey. Being a big bank economist gives you the advantage of real time spending data, anonymised of course.

Oster says you have to make sure you don’t get caught up in the moment of the data.

“These things bounce all over. Chinese New Year, Easter, these things have different effects, so we tend to focus on the monthly data”.

Still, this real time data can send a pretty strong signal.

“The difference between not knowing you had a recession and Covid? What we saw in Melbourne in Chinese restaurants within a week, activity was 40 per cent down. That was really frightening”.

Oster is speaking to The Australian at NAB’s towering Bourke St headquarters as he prepares to sign off after a career spanning near five decades.

From next month Sally Auld, the chief investment officer at JBWere and former JPMorgan head of Australian economics, takes over.

In Treasury, Oster worked with governments on both sides of politics. He also had a stint with the OECD in Paris, crunching the numbers while the Eiffel Tower blocked the view from his office. When he joined National Australia Bank in 1993 unemployment was 11 per cent, inflation was 2.7 per cent and the cash rate was 5.75.

Headway has really been made on jobs, which is now in the low 4 per cent. The cash rate today is at 4.1 per cent, underlying inflation is running at 3.2 per cent.

Australian economy ‘resilience’

The story of the Australian economy is one of resilience, Oster says.

There’s a lot going in our favour with a globally well-regarded central bank. It’s open, with good trading links, strong fundamentals and even though it doesn’t always feel like it a relatively strong fiscal position. The states, including his own Victoria, need to do better. Victoria will take some time to get out of its problems, although growth will eventually catch up.

“Fundamentally, when I look at Australia, I say this is an economy that has a lot of opportunities. It’s well-placed, it’s reasonably well run, and therefore I think things will improve,” Oster says.

Inflation targeting, introduced by former Governor Bernie Fraser in the early 1990s, was the single most important economic reform for Australia. It gave the means for Australia to set its economic direction without being hit with the wild swings of the 1970s and 1980s.

“It’s not about inflation, per se. It’s about the direction and speed of the economy. So take away the punch bowl or get some more punch, depending on how it’s going”.

It was only the shock of punishing 17.5 per cent interest rates in the early 1990s and the external hit of the Covid pandemic that has derailed growth in the past three decades. Other hits, like the global financial crisis, the dot.com crash and even the Asian currency crisis, Australia managed to navigate through.

Oster gives the RBA a mixed scorecard for its performance through Covid. The messy way the central bank abandoned yield curve control caused a lot of pain in bond markets. Former government Philip Lowe “went too far” in terms of telling people he had no intention of raising rates for some time. “What he (Lowe) was trying to say is; ‘guys go out and borrow because rates are really low’. Now that was a problem”.

Still, he said the RBA should get credit in the way it was trying to protect against unemployment just as it was trying to fight off inflation.

“You don’t want an inflation bubble, and, they increased rates a lot. Compared to overseas, it was bugger all”.

‘No recessions’

He backed the subsequent Reserve Bank review that made explicit the dual mandate of full employment and low inflation. He doesn’t think the two aims are incompatible, and the central bank will modify its settings to whatever needs the most attention. Keeping the gains made is important for the fundamental strength of the economy.

“I don’t like recessions. Having been through a number of them, I really don’t like recessions. I want GDP to be stable. And I say it all the time, the reason I want that is I want my kids to have a job, and that’s much more important”.

However, policymakers can do much better. Long term growth will be stuck in the low 2 per cent mark, with Oster tipping 2.25 per cent for trend. December quarter figures this week show Australia is currently running annualised growth at 1.3 per cent, and Oster reckons it will return to this trend figure this year.

“We will probably still have unemployment with a four in front of it. We’ll still we’ll have a cash rate basically around three, and we’ll be back in an inflation target. That’s a good outcome, but I don’t think you can grow faster,” he says.

The three things that are holding Australia back from growing faster are the three Ps: participation rates in labour force; population growth; and, productivity.

“My simple answer on productivity is you need structural reform, and both sides have done none for the last 10 years. So it’s not a surprise”.

He says the tax burden needs to shift more to spending with a higher GST than from income, but that won’t happen politically. Immigration is the answer as well as the problem. While immigration certainly surged into Australia in recent years, it was the wrong mix, mostly dominated by lower-productive students or those who were prevented from having their own skills like healthcare or engineering recognised. That comes as NAB’s own economic surveys show businesses are crying out for skilled workers.

Still, after the pain of the 1990s recession, the one good thing that came out of it was that it killed off inflation for the longer term. Even after the Covid supply squeeze, Oster reckons Australia can return to being a low inflation economy again, and that is good for interest rates.

It’s still too early to declare victory, although we’re firmly on the right path. The recent December quarter GDP figures showed growth was picking up again after being too soft for last year. The public sector is still dominating demand, and the private sector is no longer detracting. Encouragingly, consumer spending has improved a bit and it is broader based.

The perennial question for Oster is around the rates’ outlook. The good news is he is more dovish than some. He has three more cuts pencilled in this year from May and one cut early next year. That sees the cash rate falling to 3.1 per cent through the cycle, depending on the inflation or jobs market. The cuts will come, he says, but expect them gradually.

Originally published as NAB’s economics boss Alan Oster has been planning to walk away before ‘another bloody budget’