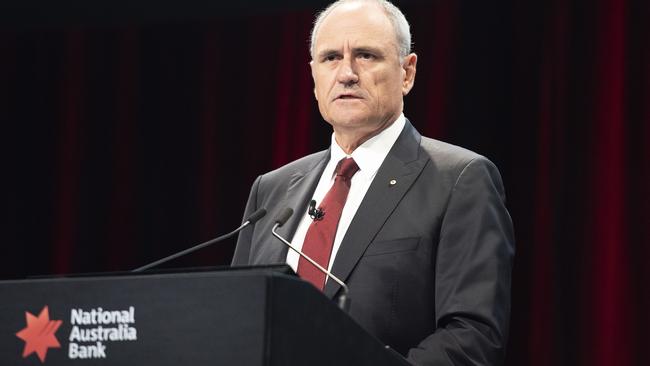

NAB trading halt: NAB chief Andrew Thorburn, chair Ken Henry ousted

Outgoing National Australia Bank chief Andrew Thorburn has expressed remorse after his joint resignation with chair Ken Henry today, with the contrite executive acknowledging the bank had “fallen short”.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

National Australia Bank has ousted both its chief Andrew Thorburn and chair Ken Henry after the damning bank royal commission final report.

The bank has released a statement saying they had advised they would leave the bank.

“The NAB Board will initiate a global search process for the CEO role while actively considering a range of quality internal candidates,” the statement said.

DAVID JONES BOSS QUITS RETAILER FOR ‘PERSON REASONS’

HOW BANKING PROBE AFFECTS HOME LOANS

5-MINUTE GUIDE TO BANKING ROYAL COMMISSION

Mr Thorburn will finish at NAB on February 28.

Dr Henry said he would retire from the board once a new permanent CEO had been appointed.

Senior banker Philip Chronican, a current NAB director, will serve as acting chief from March 1.

“We have fallen short, I am disappointed for that, I am sorry for that and I am accountable for that,” Mr Thorburn said on Thursday night.

“I realise the boards desire for change and I accept that, I accept that. I don’t have bitterness about it. Today mainly, I have been sad.”

“The board have the right to make that decision and they make it in the best interests of the company.”

Speaking outside his Middle Park home on Thursday evening, Mr Thorburn expressed remorse and sadness.

“It’s been a tough day. It’s been a sad day,” he said. “We haven’t delivered what we said and I’m sorry about that. I really love the bank. I’ve given it my everything.”

The outgoing NAB chief executive was certain the bank would improve its practices and be better following the scathing Hayne report.

“Our people are really committed to change and they will get through this,” he said.

“I hope this is a way of clearing, allowing people to move forward. The future is bright.”

Mr Thorburn refused to answer questions about his future or feedback from shareholders.

A close friend of former NAB chief executive Andrew Thorburn said he did the “right thing” by stepping down.

“I’m sure all he’d want is the best thing for NAB,” he said outside Mr Thorburn’s Middle Park home on Thursday evening.

“He’s a man of great integrity, love NAB, loves the bank. I think today he’s done the right thing.

“He’s like the board — has the exact same opinion as the board. They just want 33,000 people (employees) to focus on making it a better bank.”

The friend, who declined to give his name, arrived at the former chief executive’s Middle Park home with a bottle of 2013 red wine and we welcomed with open arms by people waiting inside.

LEAVING THE ‘RIGHT THING TO DO’: HENRY

NAB chair Dr Ken Henry was also contrite, unlike the arrogant royal commission performance which drew much criticism.

“I have been reflecting on our inability to meet community expectations and customer expectations in a way we would aspire to,” Dr Henry said.

“Andrew and I are deeply sorry for our inability to do that — that has driven the decision today.”

He said he was sad to be leaving NAB in these circumstances. “But it is the right thing to do — it gives NAB the ability to reset.”

Appearing on ABC’s 7.30 last night, he revealed he had re-lived his appearance at the royal commission — that ultimately brought him down — many times.

“I can’t tell you how many times I relived that appearance. I understand the criticism,” he said.

“I did not perform well. I really should have performed quiet differently.

“I should have been much more open.”

In his remaining time at the lender, Dr Henry said he would work to find a new CEO and kick-off board renewal.

“Despite the fact I am leaving … I don’t think it disqualifies me from making an assessment of who should lead the bank at an executive level in the years ahead.”

The pair would not reveal who resigned first.

“I don’t know the answer to the question,” Dr Henry said. “I can’t even recall the number of conversations we had in last 24 hours, we have come to this landing together.”

The outgoing chair would not comment when asked whether leaders of other major banks should lose their jobs as well.

“We have reflected and we have acted. I am proud of that fact,” Dr Henry said. “Andrew personally has demonstrated what senior executive accountability means.”

At 3.35pm today, shares in under-siege lender NAB were put in a trading halt as the lending giant prepares to announce “leadership changes”.

REPORT SCATHING OF NAB EXECS

The royal commission final report was released on Monday night; since then, there has been furious market speculation that the bank bosses could not last.

In his scathing comments, Commissioner Kenneth Hayne said NAB “stands apart from the other three major banks” and singled out criticism for Mr Thorburn and the chair Ken Henry.

“I am not as confident as I would wish to be that the lessons of the past have been learned,” Mr Hayne said of NAB.

“More particularly, I was not persuaded that NAB is willing to accept the necessary responsibility for deciding, for itself, what is the right thing to do, and then having its staff act accordingly.”

“I thought it telling that Dr Henry seemed unwilling to accept any criticism of how the board had dealt with some issues.”

“I thought it telling that Mr Thorburn treated all issues of fees for no service as nothing more than carelessness combined with system deficiencies when the total amount to be repaid by NAB and (superannuation trustee) NULIS on this account is likely to be more than $100 million.”

Some of the worst controversies of the commission were linked to NAB.

This included charging fees to dead people, and rogue National Australia Bank staff in Western Sydney falsifying documents to secure mortgages for customers in return for cash bribes paid across the counter.

NAB has already set aside $314 million to cover remediation costs to pay back customers for charging them fees but not providing a service.

The bank could also face civil or criminal charges after the commission referred some of its scandals to regulators for further investigation.

It is also not known if NAB is one of the unnamed lenders who Mr Hayne recommended to the corporate cop for possible criminal charges.

Also last year, it was revealed his former chief of staff Rosemary Rogers was embroiled in a fraud investigation.

The Herald Sun is not suggesting she was involved in any wrongdoing, only that there is an investigation.

This is the third loss of a senior executive since the commission kicked off in December, 2017.

Earlier this week, Mr Thorburn and Dr Henry fought to maintain their power, releasing a statement defending themselves in the wake of the report.

Mr Thorburn on Tuesday told the Herald Sun that he had the support of the board.

“I don’t feel that I have any less support and commitment today from our leaders and our people than I had six or 9 or 12 months ago,” he said.

A shareholder revolt in December saw NAB whacked with an unprecedented 88.11 per cent vote against its remuneration report during the bank’s annual meeting.

Major investors spoken to by the Herald Sun were angry with both the bosses hanging on after the damning report.