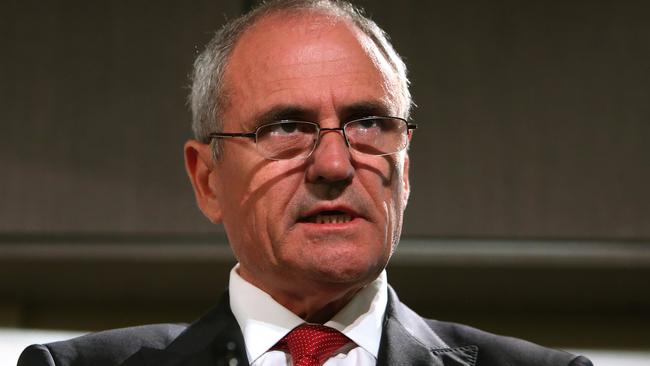

Ken Henry’s ‘horrible’ tax truth our politicians can’t face — the total take is too low

THE fiery arguments over company tax rates in Australia is strangely ignoring the fact the “total tax take is too low”, according to former Treasury secretary Ken Henry.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

THE fierce debate over company tax rates in Australia is obscuring the fact the “total tax take is too low”, former Treasury secretary Ken Henry says.

Dr Henry will today say the debate overlooks a reality that “seems too horrible to admit”: that the current tax take is too small to support a spending strategy “both sides of politics have signed up to”.

COMPANY TAX CUTS SHOULD BE TARGETED, SAYS ORICA CHIEF

LABOR’S TAX REFORM PLANS WOULD COST VICTORIA $24B: ANALYSIS

PART AND PARCEL OF BEING A MODERN LETTERBOX

‘BANKERS’ NOW A DIRTY WORD FOR LOBBY GROUP

In a speech to be delivered in Melbourne, Dr Henry — now the chairman of National Australia Bank — will back calls for a cut to the company tax rate. But he will say the cut is “only a small part” of a necessary overhaul of the tax system as part of a broader policy reform program.

Dr Henry authored the last substantial review of Australia’s tax system, for the Rudd government, between 2008 and 2010. Today, he will say a cut to the company tax rate is inevitable.

“Of course we will have to cut our company tax rate; in a world of mobile capital, countries don’t get to choose their own company tax rate in perpetuity,” Dr Henry will say, according to a copy of speech seen by Business Daily.

“There is good reason to think that a lower company tax rate will drive a faster rate of investment and labour productivity growth, and that should support higher wages growth over time.”

But broader reforms are needed to “ensure that all Australians have the opportunity to choose a life of real value”, he will say.

“Our current tax debate appears very strange. We know the total tax take is too low, but that simple fact seems too horrible to admit.

“So instead, we have chosen to have an argument about which tax rate should be cut first: company tax or personal income tax.”

Dr Henry will speak at the Australian Governance Summit, hosted by the Australian Institute of Company Directors. His speech also highlights urgent problems, such as population growth outstripping the level of investment required for new roads to sustain the extra traffic.

Dr Henry also will say the present tax system “is not capable of supporting the medium-term fiscal strategy that both sides of politics have signed up to”.

“Our tax system is too narrowly based and relies too heavily upon tax bases that are subject to international tax competition, including the company tax; taxes that we will have no option but to cut over time,” he will say.

Federal parliament has already approved a cut in the tax rate for smaller companies — those with annual turnovers of up to $50 million — to 25 per cent by 2027.

Other companies will continue to pay 30 per cent, although Finance Minister Mathias Cormann has vowed to fight to reduce the rate for all businesses.

Dr Henry will also say today that government has grown significantly since his review was commissioned, which “will have to be paid for”.

He will nonetheless assert that Australia’s economy is “fundamentally” in a good place with strong jobs growth and near-record high business conditions.