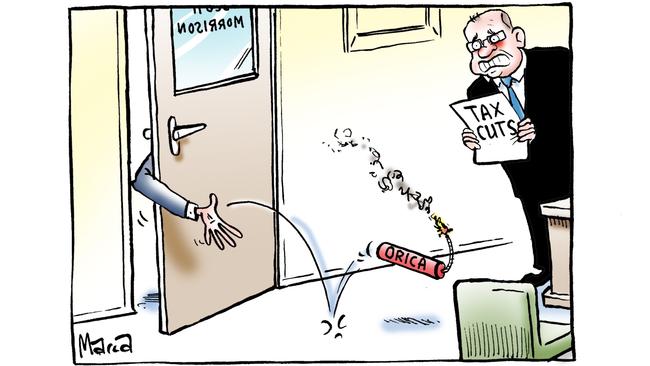

Tax cuts ‘should be targeted’, not across-the-board, says Orica chief

TARGETED tax cuts for businesses investing in Australia could produce more economic growth than a general reduction in the corporate tax rate, says Orica’s chief.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

TARGETED tax cuts for businesses investing in Australia could produce more economic growth than a general reduction in the corporate tax rate, according to the chief of manufacturing heavyweight Orica.

Alberto Calderon, who heads the world’s biggest explosives maker, said the discussion around reducing Australia’s corporate tax rate should be broadened beyond simply focusing on an across-the-board cut.

TAX REFORM TO INCREASE WAGES, BUT IT WON’T HAPPEN OVERNIGHT

UP TO FIRMS HOW TO USE TAX CUT: TREASURER

The comments set the chief of the Melbourne-based manufacturer apart from the nation’s peak business lobby group, The Business Council of Australia, which has thrown its full weight behind the government’s push to cut the company tax rate from 30 per cent to 25 per cent.

Mr Calderon said tax reform was critical if Australia wanted to maintain its record-breaking run of economic growth. And the move by the US to cut its corporate rate from 35 per cent to 21 per cent made the need for action more urgent, he said.

But the Yale-trained economist said there should be “much more discussion around the optimal combination to create the greatest benefits for society and the largest impact on growth”.

“I don’t think the discussion can only be based on the idea that we are going to lower the corporate tax rate and investment is going to grow,” Mr Calderon said at the Melbourne Mining Club yesterday.

“It’s not going to be automatic unless there is something more to it.”

Cutting the corporate tax rate would do little to boost much-needed business investment if companies simply passed on the savings to shareholders through higher dividends, he said.

The nation’s system of franking credits — which provides investors with a tax break on income received from dividends in order to recognise the tax already paid by the company — further complicated the situation, Mr Calderon said.

Improving research and development incentives or introducing more generous deductions on business assets could prove more effective in boosting business investment than a general cut to the corporate rate, he said.

The government could also consider providing capital-intensive or high-technology manufacturing businesses with targeted tax rates, Mr Calderon said. “There are complementary and alternative ways to encourage local and offshore companies to invest in Australia.

“What we need is investment … you really want to make sure whatever is done has the greatest benefit.”

Mr Calderon said Australia’s 26 years of uninterrupted economic growth had been built on the nation being able to attract private business investment. But with the investment phase of the mining boom over and residential construction set to shrink, Australia needed to overhaul its tax environment to boost non-mining investment.

“We need a tax environment that is conducive to growth and is competitive relative to the countries against which we compete for capital.

“Doing nothing will in time, maybe not next year but certainly in the near future, without a doubt, lead to very low levels of growth.”

Mr Calderon is not the only corporate chief to question the logic of a general cut to the corporate tax rate.

The former chief executive of blood products and vaccine maker CSL, Brian McNamee, has backed the idea of granting advanced manufacturers a discount tax rate on new plants over a universal cut.