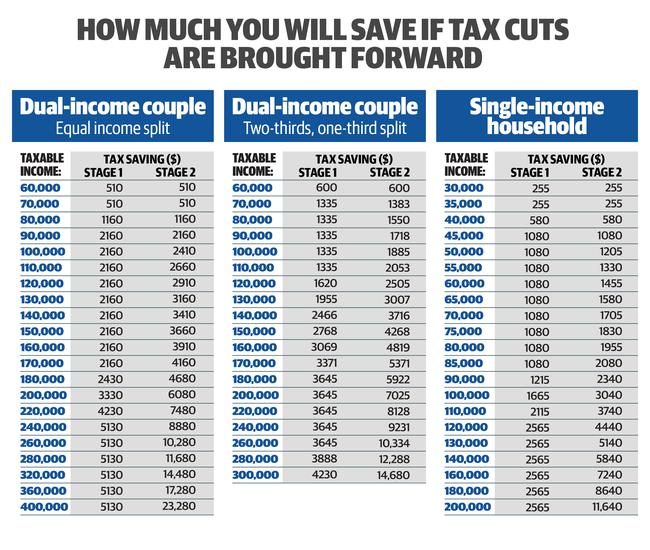

How much you could save thanks to tax cuts

Tax cuts could be brought forward as part of a plan to kickstart the economy after the coronavirus pandemic. See how much would go back in your pocket.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Tax cuts announced in last year’s federal budget may be fast-tracked in a bid to reboot the economy after coronavirus.

While it won’t be part of Treasurer Josh Frydenberg’s ‘mini-budget’ on Thursday, the boost could be included in the delayed budget in October.

It would bring forward cuts to personal income tax which were legislated last year.

“We are looking at that issue and the timing of those tax cuts because we do want to boost aggregate demand, boost consumption, put more money in people’s pockets, and that’s one way to do it,” Mr Frydenberg said recently.

The tax cuts were scheduled to come into force in stages – in 2022 and 2024.

But bringing the changes forward is seen as a way to boost consumer spending.

Here’s how much could be flowing back into your pocket.