Barefoot Investor: Betting on the stock market isn’t as easy as you think

We are in the midst of a deadly pandemic that shows no sign of slowing, but before you turn to the volatile stock market to make some extra coin — there are easier (and safer) ways to invest your money, writes Barefoot Investor.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

Holy smokes!

I take two weeks off for the school holidays and my Barefoot inbox goes … to the craps.

Yes, it seems everyone wants to take a seat at the casino that is today’s share market.

And for those who don’t know their stocks from their jocks? Well they ask me … or their boyfriend.

Here’s a question I received last week from 22-year-old “Tina”:

“Hi Scott, I was wondering who the best companies are to invest in during this pandemic. My boyfriend is into the stocks and has made $1,500 in the last 24 hours, so I have given him some of my own money ($1000) to invest. But I was wondering what companies you would recommend.”

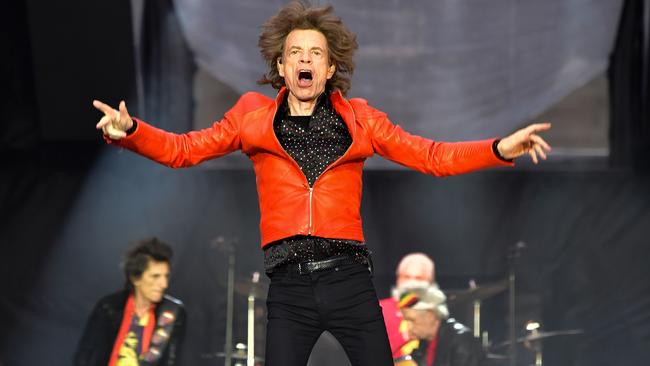

Tina’s boyfriend is “into the stocks”, and you can bet he’s got a swagger like Jagger over his … 24-hour track record.

“Hey girl, I’m going to make you rich.”

To be fair, for many people shares are just another way to gamble.

And to be even fairer, this is a worldwide phenomenon.

In the US, the three biggest brokers signed up over 1.5 million brand-new customers in the March quarter alone.

In China, trading apps are struggling to keep up as millions of traders “race to seek a quick buck in a surging market”, according to Bloomberg.

And in Australia the number of new investors has increased by more than threefold.

For me, these are worrying signs.

We are in the midst of a deadly pandemic that shows no sign of slowing and it’s causing real and lasting economic damage.

We are entering into a deep and sustained global recession.

And yet Tina’s boyfriend is making bank, baby! So, how long will his luck last?

Well, author Matthew Hale Smith wrote in his timely book Bulls and Bears of New York:

“Speculators do not make money, except by a turn as rare as good luck at a gambling table … Of the countless thousands who throng Wall Street from year to year, the great mass of speculators are ruined. Every broker on Wall Street has an entirely new set of customers once in three years.”

Wise words … written 146 years ago.

Tread Your Own Path!

READERS WRITE

MY SON HAS A PROBLEM

GARY WRITES: My 18-year-old son has no value for money and thinks I am a human ATM!

I still pay for his phone and his car insurance. He completed the VCE but did not want to pursue university. He is working part time at the moment and is also receiving Youth Allowance.

However, every week without fail he will ask for a loan of cash on an IOU basis. He still believes it is my responsibility to pay his living expenses, and I cannot get through to him on this.

BAREFOOT REPLIES:

I’m sorry but I think you’re wrong.

Your son doesn’t have a problem: he lives rent free in a nice joint, all his bills are paid, he’s getting a bit of money from Centrelink and a part-time job, and when that runs out he has access to cash whenever he wishes.

If I were to sit down with your son, I think he’d tell me his life is pretty sweet. No problems!

Gary, it’s you who has the problem.

So my question isn’t directed at him — he’s set himself up very nicely — it’s to you. What are you going to do about this caterpillar? You’ve got a slug munching away your food, and your wallet. The cocoon you’ve made for him sure is comfy!

Here’s the deal: he won’t find his life’s purpose sitting on your couch, eating your food, and spending your money.

If you want him to become a butterfly, he needs to spread his wings and fly off to a low-rent share house that has two-minute noodles as a staple meal.

(Yes, I’ve spent way too much of these holidays reading The Hungry Caterpillar.)

Given he’s still young, let him know that he’s welcome to fly back at any stage, on the proviso that he presents you with a solid plan (study, a trade, or a full-time job).

Good luck!

DEALING WITH GAMBLING ADDICTION

JENNY WRITES:

My daughter lives with her partner and three children in a property that I own.

They have many bills and are unable to pay rent. Her partner is wasting his money on gambling and will not change — he has even stated that he wants to keep his head in the sand. How do I get him to grow up?

I have given him your book and my daughter is trying hard and has since started part-time work. However, they have three car loans and have debt collectors visiting frequently. Help! I feel powerless.

BAREFOOT REPLIES:

It must be horrible to see your daughter go through this.

Now I know you’re coming at it from a place of love, but giving her partner my book won’t help one bit.

Why?

Because it sounds like he’s in the grips of a gambling addiction. And, if that’s the case, giving him my book is like giving an alcoholic a Panadol for a hangover.

So, what can you do?

A couple of things:

First, as hard as this sounds, drop the judgment.

I’ve learnt to view people with gambling addictions the same way I view anyone with a serious illness.

“When will you grow up?!” is like asking someone with a mental illness “When will you be happy?!”

Him telling you that he “wants to keep his head in the sand” sounds like a reaction to feeling judged.

Trust me, he knows how bad it is.

Second, encourage both him and your daughter to see a financial counsellor.

Ideally, it would be a specialist gambling financial counsellor (call Gamblers Help on 1800 858 858 for a referral).

However, if he’s not ready to get help, encourage your daughter to go on her own.

Reason being, the debt collectors will not let up, but a financial counsellor will sort them out and stop the calls.

Finally, you’re doing an amazing job providing them with a roof over their head.

Make sure they keep getting the basics: food, power and schoolbooks.

You say you feel powerless. Just remember, that’s probably how your son-in-law feels too.

WE HIT THE JACKPOT!

KYLIE WRITES:

This month, my husband and I will finally be debt free!

We owe nothing (though we also own nothing). My hubby used to have an addiction to gambling and a $120,000 debt on credit cards.

We have spent the past five years paying every last cent off, while having three children under five, and I’ve also been studying at uni.

My question is: moving forward, how can we make the best decisions to create wealth, and is trading shares just a form of gambling?

BAREFOOT REPLIES:

What a truly amazing all-of-family feat.

The fact that you guys bunkered down and paid off all your debts tells me a lot about the people you really are.

Know this: done right, investing isn’t the same as gambling. You’re saving so you can provide for your family’s long-term security.

That is the polar opposite of gambling.

My advice?

Invest — but do it via your boring-as-hell low-cost super fund. Do it via a regular, automatic direct debit. Never look at the balance. Only check it once a year when your statement comes in the post.

And keep repeating to yourself: I’m not gambling … I’m providing a better future for my family.

You Got This!

If you have a money question, go to barefootinvestor.com and #askbarefoot

Scott Pape is an independent, community-based financial counsellor. Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.

The Barefoot Investor for Families: The Only Kids’ Money Guide You’ll Ever Need (HarperCollins) RRP $29.99