Home loans honeymoon interest rate periods catch out borrowers

BANKS are luring homeowners with enticing honeymoon interest rates and then hitting them with a rocketing leap — costing some borrowers tens of thousands of dollars.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

BANKS are at it again, by luring homeowners in with enticing honeymoon interest rates and then hitting them with a rocketing leap — costing some borrowers thousands of dollars more a year.

And big banks including Westpac and the Commonwealth Bank are among those slugging customers with significant jumps after honeymoon periods expire.

Financial comparison website Mozo warned customers that they should understand these promotions revert very quickly to a higher rate.

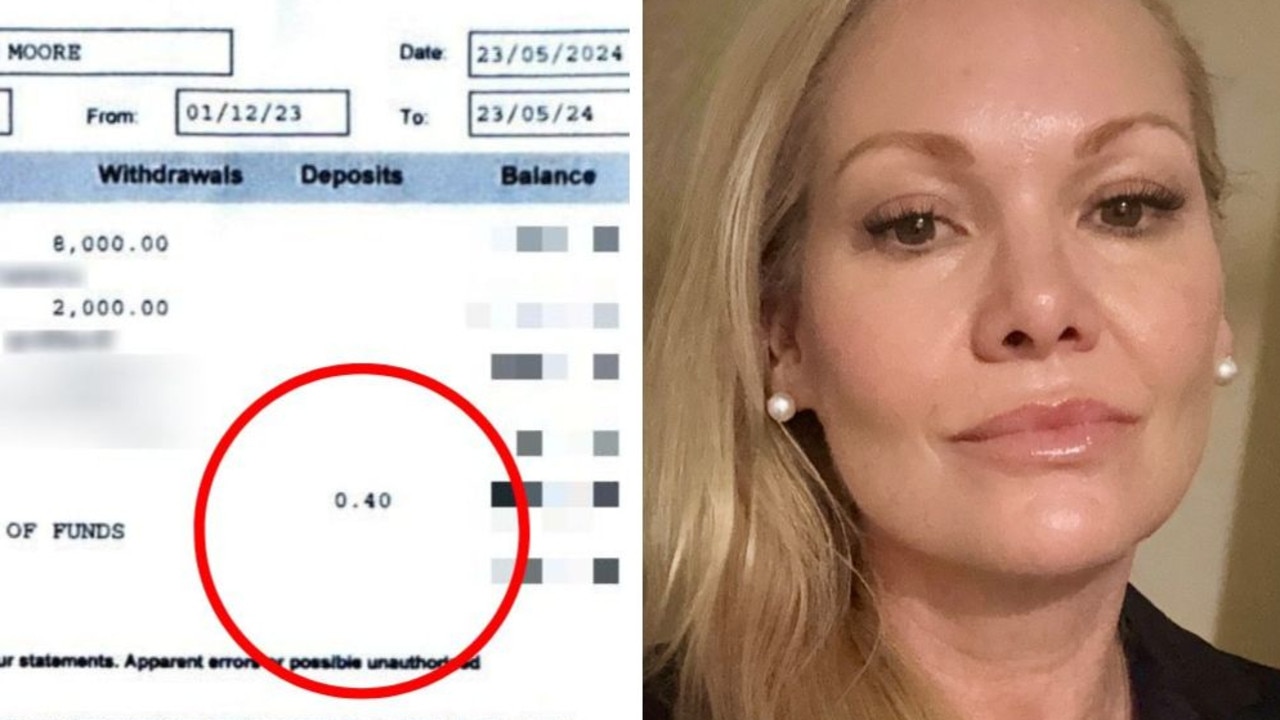

In comparing a “honeymoon borrower” to a borrower signing up on the lowest variable interest rate on a 30-year, $300,000 loan — the honeymooner would pay an extra $61,000 over the life of the loan.

Mozo research found there are 27 variable rate owner occupier principal and honeymoon interest rates available and the average jump is 75 basis points once the honeymoon period ends.

LENDING: Commonwealth Bank changes the way customers can repay their loans

And one of the biggest jumps is by Northern Inland Credit Union, who offers customers a discounted variable rate of 3.69 per cent before it increases to a much higher ongoing variable rate of 5.43 per cent.

This is a jump equivalent to seven rate hikes or 1.74 per cent.

Westpac’s flexi first option home loan two-year introductory rate is 3.59 per cent but once this ends it rises by 1 per cent.

On CBA’s first homebuyer four-year introductory rate the offer climbs from 3.79 per cent to 4.35 per cent once the period ends.

Mozo data found on a $300,000 30-year home loan this results in the customer’s monthly repayments jumping from $1362 to $1526 — or $164 per month.

MORTGAGE DEALS: Is your lender ripping you off?

The customer will pay a total of $245,600 interest over the loan term — this is compared to a the lowest variable rate of 3.49 per cent where the borrower would pay a total of $184,400 in interest.

But a Westpac spokeswoman said customers are “advised of the offer details when they apply for the loan”.

Aussie Home Loan’s chief executive officer James Symond warned customers to be wary of these types of deals.

REVEALED: Consumers win big in credit card changes

“Borrowers need to be very careful about being enticed into a honeymoon rate without first checking what the total repayments will be over the life of the loan,’’ he said.

“Many honeymoon rates step up payments after an initial period and the mortgage could well end up costing a lot more to the borrower in the long run.”

Mozo spokeswoman Kirsty Lamont said it pays to read the terms and conditions.

“If borrowers don’t check the fine print they could be stuck with a loan that has really uncompetitive rates after the intro period ends,’’ she said.

“If you do take out these loans is really important to review the rate before the intro period ends and compare their revert rate.”

sophie.elsworth@news.com.au