Commonwealth Bank cracks down on mortgages and changes repayment rules

THE nation’s biggest bank will hit home loan customers with tens of thousands of dollars extra in interest charges by drawing out the life of their loans.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

EXCLUSIVE

THE nation’s biggest bank will hit some home loan customers with tens of thousands of dollars extra in interest charges by drawing out the life of their loans.

The Commonwealth Bank has more than 1.5 million mortgage customers and has notified borrowers of upcoming changes to their repayments and redraw balances, with some changes beginning this week.

CBA will automatically reduce minimum repayments for customers who get ahead which will slow down the rate they pay off their mortgage — but it will not extend the loan term beyond 30 years.

FASTER PAYMENTS: Real-time banking has arrived in Australia

The bank will also automatically reduce minimum repayments for customers if their interest rate falls — previously this did not happen.

The only customers unaffected are those who have set their home loan repayments above the minimum.

Other customers who want their regular repayments to remain at the original level will have to “opt in” by manually increasing their direct debits.

This means customers will end up paying more in interest charges and pay off their principal at a slower pace.

And the repayment schedules are changing resulting in customers having their weekly and fortnightly repayments reduced if the opt to pay the minimum amount.

MORTGAGES: How to easily negotiate your home loan interest rate

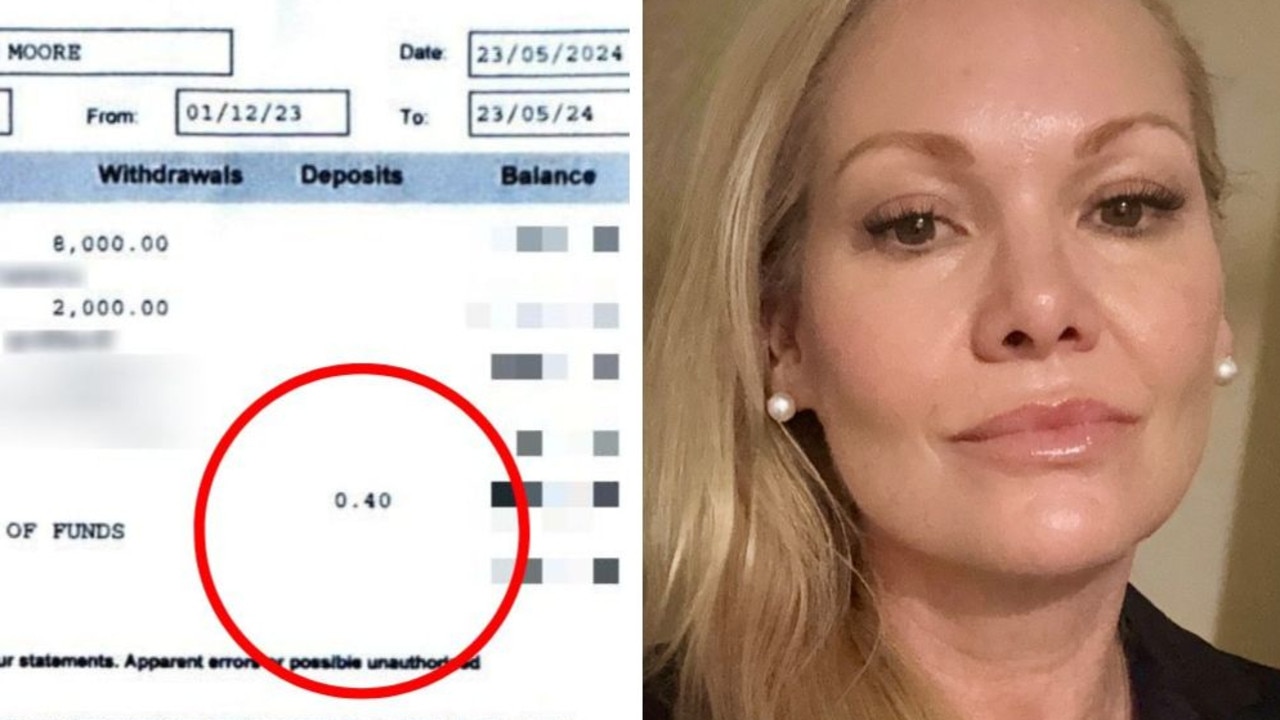

Analysis by financial comparison website RateCity estimated on a $300,000 30-year home loan based on CBA’s standard variable rate of 5.22 per cent a customer making minimum fortnightly repayments will have it dropped from $825 to $762.

This will cost customers an additional $55,000 in interest charges over the life of their loan.

RateCity spokeswoman Sally Tindall, “it’s disappointing to see a bank make this kind of decision at the start of a royal commission.”

“This move will see many loyal customers shell out thousands in extra interest and rake in millions in additional revenue for the bank,’’ she said.

The move falls in line with many other lenders.

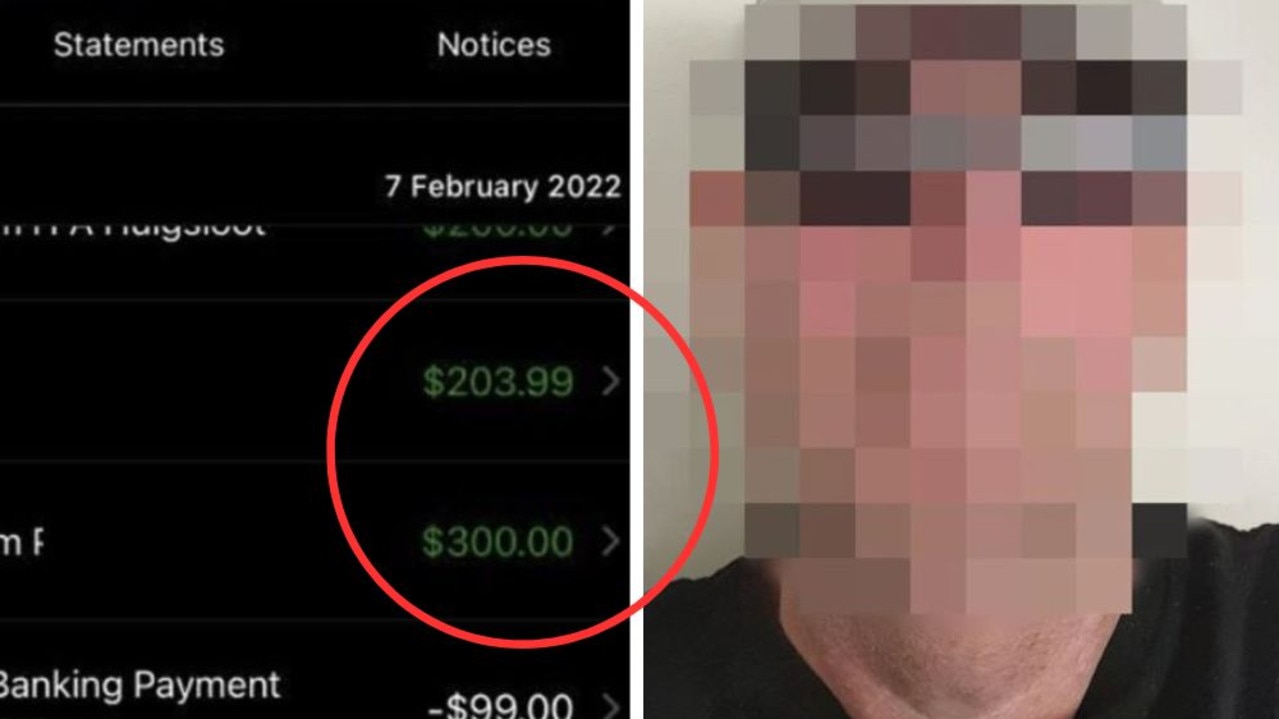

And on top of this CBA is also restricting the way customers can dip into their redraw accounts where additional repayments on their loan are held.

This includes only allowing customers access to their redraw funds once their full monthly repayments are made on their loans.

And also making sure customers are not withdrawing large amounts which will set them back on where their scheduled repayments should be.

A CBA spokeswoman said the charges will provide more “flexibility” to customers.

“We encourage customers to speak with us so we can help them with their loans,’’ he said.

Earlier this month CBA announced its half-year profit at $4.735 billion which fell by 1.9 per cent.

Home Loan Experts managing director Otto Dargan said it’s “beneficial” if customers pay as much extra as possible on their loans.

sophie.elsworth@news.com.au

HOW MINIMUM REPAYMENTS WILL CHANGE

— Samantha has a loan with a monthly minimum due of $1000 per month.

WEEKLY

— Before changes, $1000 divided by 4 = $250.

— After changes, ($1000 x 12) divided by 12 = $231.

FORTNIGHTLY

— Before changes, $1000 divided by 2 = $500.

— After changes, ($1000 x 12) divided 26 = $462

Source: CBA