New Payments Platform speeds up payments enabling money transfers in a few seconds

REAL-time banking payments are now up and running, allowing banking customers to transfer money in a flash. But there’s a catch.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

REAL-time banking payments have started today — but one in five customers won’t be able to use the new platform.

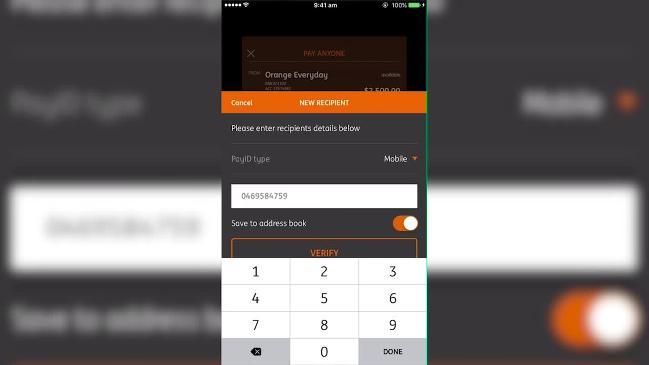

Customers making bank transfers will start to notice cash move in an instant from today and remove the pain of having to wait days for transfers to be processed.

They will also be able to transact using a phone number, email or ABN, doing away with the need to remember BSB and accounts numbers.

But only about 80 per cent of bank accounts will be connected to the NPP within about a month, leaving some customers in the dark on how quickly their payments will be processed.

The New Payments Platform has taken six years to develop and at a cost of more than $1 billion to financial institutions.

BANKING: How does faster banking work?

FASTER PAYMENTS: Fast payments will change the way we bank

The New Payments Platform’s chief executive officer, Adrian Lovney, said transfers can be made in real time 24-hours, 7 days a week.

“You don’t have to share or remember your bank account details and the other benefit is that when you pay using a PayID you will be able to see the name of the person before you push send,’’ he said.

“That will help to make sure you are not sending a payment to the wrong person and making a mistake.”

It is also expected the NPP will result in the graduation elimination of the need for cash payments and the reduction in the use of cheques.

Consumers will be able to create a PayID using their mobile phone number, email address or ABN, which links to their chosen bank account.

They can share their PayID with others to allow them to send to them.

There will be more than 60 financial institutions on board initially, including the big four banks, but it will be gradual rollout for many banks.

Australian Bankers’ Association’s chief executive officer Anna Bligh said the NPP “is the biggest thing to happen in the industry since the inception of internet banking 10 years ago.”

“When fully up and running this brand new, cutting-edge system will mean that Australians who want to pay a tradesperson, split a bill at a restaurant or sell a piece of furniture online can make and receive payments instantly,’’ she said.

Osko by BPAY is the first service built using the NPP that allows instantaneous payments and customers to make detailed descriptions of who they are paying of up to 280 characters. In some cases, emojis will be able to be used when sending cash.

sophie.elsworth@news.com.au