‘Most severe deterioration’: Horror sign Australian inflation ‘will surge’ within months

The Australian economy is struggling – and there’s one glaring factor that proves things could be about to get a whole lot worse.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

ANALYSIS

When it comes to the issue of inflation, policymakers often have a very different perspective to that of the average person in the street.

For the Reserve Bank of Australia, the focus is generally on the annual rate of inflation seen in the consumer price index, whether it be the headline figure or its increasingly favoured metric, the trimmed mean.

But for the typical Aussie, the cost of living and inflation is far more nuanced and personal than simply the annual rise in consumer prices as assessed by the CPI.

People generally tend to examine their cost of living and rises in costs on a far longer timeline than the one year focused upon in the CPI.

When inflation is contained, the difference in perspective on inflation between policymakers and the average person is generally not that large, but during and after periods of high inflation, this can lead to some major differences in opinion.

In order to explore this from a quantifiable standpoint, we’ll be looking at the cumulative increase in consumer prices over the last four years of data and contrast that with the annual rate of inflation across the same time period.

Lived experience

Between December 2020 and December 2024, consumer prices rose by a cumulative 18.9 per cent.

To put this into perspective, the cumulative increase in consumer prices across the three four-year blocks of time prior to the pandemic were: 10.7 per cent (2007-2011), 7.9 per cent (2011-2015) and 6.7 per cent (2015-2019).

While year-on-year inflation is now moderating, the last four years have seen the highest rolling four year rate of inflation in more than 30 years.

Another element of the cost of living puzzle is real wages.

In the last four years, wages have risen by a cumulative 13.8 per cent, while headline inflation has risen by 18.9 per cent.

This marks the most severe deterioration in real wage outcomes for the nation’s households since the Australian Bureau of Statistics Wage Price Index began in 1997.

Given these challenging conditions and the impact of bracket creep on the inflation-adjusted take home wage packets of workers, it’s little wonder why so many households feel like they have fallen behind, even as the rate of annual inflation continues to moderate.

The number up in lights

In the years since the pandemic arrived on our shores, underlying inflationary pressures have changed dramatically.

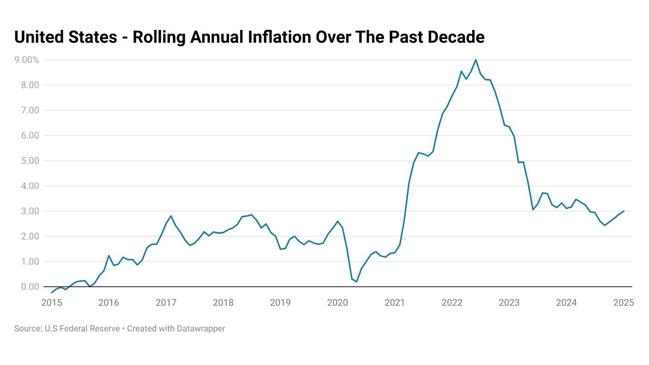

In the five years prior to the pandemic, annual headline inflation ranged from 1.6 per cent and 2.6 per cent, averaging 2.0 per cent.

Since then, annual headline inflation has ranged from -0.3 per cent (Q2 2020) to 7.8 per cent (Q4 2022) and averaged 3.7 per cent.

As of the latest quarterly inflation print which covers up until the end of last year, year-on-year inflation had come down to 2.42 per cent.

However, this comes with something of a qualifier.

The level of headline inflation is being significantly impacted by electricity subsidies implemented by the Albanese government and select state governments.

It has also been driven somewhat lower by a 10 per cent increase in Commonwealth Rent Assistance (CRA), in addition to the normal indexation of the support payment.

If these changes were removed from the equation, headline inflation would increase drastically from 2.42 per cent to 3.60 per cent.

The increase to CRA is permanent, but the impact of electricity subsidies is temporary.

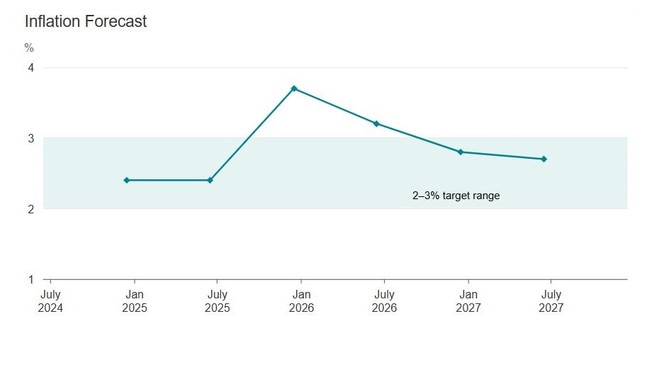

As their impact expires, the RBA is forecasting that headline inflation will surge back out of its 2-3 per cent target band, reaching 3.7 per cent in the December quarter of 2025 and not returning to the target band until the second half of 2026.

The political consequences

From Canberra to Washington DC, incumbent governments generally like to talk up their success in fighting inflation in annual terms.

But this strategy has an inherent issue, telling the electorate that the fight against inflation has largely been won, from a perspective on the issue that the average person often does not share – which can lead to frustration in some quarters.

It can also have significant consequences at the ballot box.

The Biden administration spent a sizeable amount of time in the second half of its four-year term talking up the reduction in inflation from the peak under its watch.

Yet when the time came to go to the ballot box for November’s presidential election, 76 per cent of voters surveyed by CNN who experienced “severe hardship” resulting from inflation voted for Donald Trump.

For those who experienced “moderate hardship”, 52 per cent gave their vote to Mr Trump, while of those who experienced “no hardship”, just 21 per cent voted for Donald Trump.

Polls like this could be of some concern for the Albanese government as the clock ticks down to the upcoming federal election.

Americans overwhelmingly have fixed rate mortgages with durations in excess of a decade.

And the US generally saw the end of outsized rent renewals some time ago.

But higher interest rates and significantly larger than average rent increases are still heavily impacting Australian households.

While there are hopes within the government that the rate cut from the RBA and the expectation of further cuts will boost their political fortunes, how it will balance out against how the electorate perceives cost of living pressures and individuals’ personal views on inflation is an open question, with an answer that could define who holds the keys to the Lodge.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as ‘Most severe deterioration’: Horror sign Australian inflation ‘will surge’ within months