‘Growing gap’: Proof Boomers are raking it in as younger Aussies ‘go backwards’

A huge – and alarming – change is taking place in the Aussie economy right now. And one generation is behind it all.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

ANALYSIS

In the years since the pandemic first arrived on Australia’s shores, the balance of the economy has continued to shift dramatically.

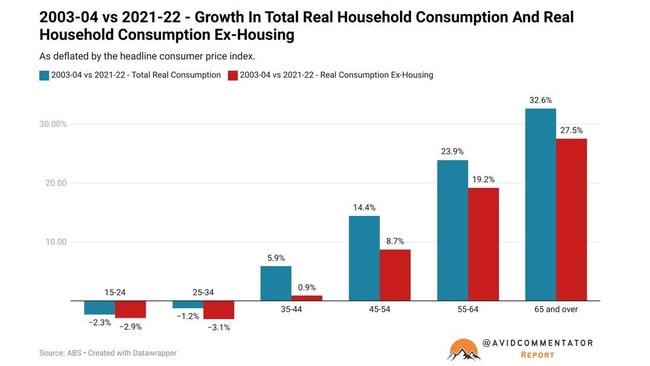

Where once upon a time the growth in the consumer economy was delivered by households across all age demographics, it is now increasingly concentrated in the hands of over 45s – with some younger demographics seeing their real household consumption go backwards.

In the short term, the recent cut in the Reserve Bank of Australia’s cash rate and further expected cuts to mortgage rates are likely to provide a tailwind to consumer spending for indebted households.

But in the longer term, overall growth in consumer spending is likely to continue to be driven by the consumption of older demographics significantly exceeding that of their predecessors.

Today, we’ll be looking at three of the drivers of this shift – inheritances, outflows from the nation’s superannuation system and the so-called “Wealth Effect”.

MORE: A guide to the average salary in Australia

Superannuation

Over time, as the duration between the introduction of compulsory superannuation and the retirement of a new cohort of retirees continues to increase, outflows from the nation’s superannuation system becomes a greater and greater proportion of cash flowing to Aussie households.

Over the course of the year to September 2005, a total of $27.6 billion was withdrawn from the county’s superannuation system. Of this, $17.1 billion was withdrawn in the form of a lump sum and $10.5 billion in the form of private pension payments.

MORE: Can you use superannuation to buy a house?

To put this into perspective, at the time, it was roughly equivalent to 5.2 per cent of total household consumption.

Fast forward to the present day, where the latest Australian Prudential Regulation Authority (APRA) data covers up to September 2024, and total superannuation withdrawals came to $119.9 billion – $65.1 billion in a lump sum and $54.8 billion in the form of private pension payments.

This is now equivalent to 8.7 per cent of total household consumption.

In aggregate, superannuation is working more or less as intended.

Retirees today have significantly greater financial means than they did a few decades ago, and since the pandemic, there is arguably also a greater willingness to spend that bonanza.

But as they say in the world of economics, “averages mask”.

While retirees in aggregate are enjoying the windfall from superannuation, 63.0 per cent of the population of pension age or older are still relying on a government aged pension.

Inheritances

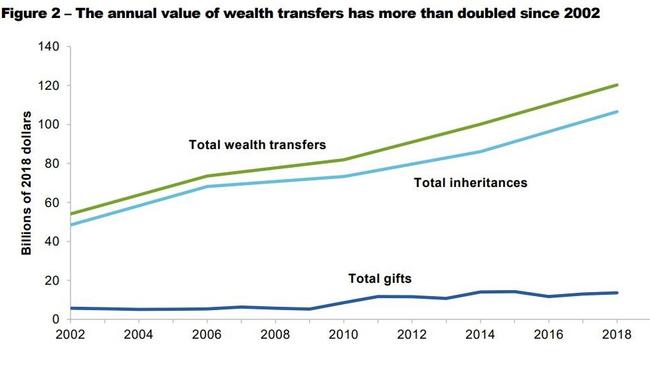

According to a 2021 paper by the federal Productivity Commission, during the 2018 calendar year, inheritances totalling a little over $100 billion flowed to beneficiaries.

Given the enormous growth in asset prices and household savings balances that has occurred during and since the pandemic, flows of inheritances have likely increased significantly in the six years since the Productivity Commission data was collected.

Older demographics are once again the primary recipient.

According to figures from the Grattan Institute, 64 per cent of inheritances by dollar value flow to over 55s, with 82 per cent flowing to individuals that are 50 years of age or older.

As with superannuation, averages once again mask an unequal distribution of flows.

The average amount received by a beneficiary was around $125,000, with the median amount just $45,000.

The ‘Wealth Effect’

There is another means by which the consumption of Australia’s older demographics is boosted – the so called “Wealth Effect”.

The foundation of this concept is that as a household’s wealth increases, whether it be on the back of rising housing prices or rises in the value of other assets, they are inclined to spend more.

According to a research paper from the RBA, in the long run, an increase in housing wealth of 10 per cent will lead to a 1.6 per cent rise in household consumption, while a 10 per cent rise in the value of a stock portfolio boosts household consumption by 1.2 per cent.

Given the much greater popularity of home equity withdrawals in Australia compared with most similar developed nations, the transference of rising housing wealth into consumption can be a much less abstract process.

The settings of the nation’s superannuation system also incentivise the use of home equity withdrawals.

If an individual is in their 50s and they know that the age at which they can access their superannuation is on the horizon, borrowing a sizeable sum of money to fund a holiday, a dream car or all manner of other expenses can make sense, depending on one’s circumstances and priorities.

That money can then theoretically be repaid in full when one’s superannuation preservation age is reached and in the meantime, a household can enjoy the fruits of their labour earlier.

The future

Bar some sort of dramatic shift in global markets, the ongoing trend of strong consumption growth for over 55s appears set to continue well into the future. After all, in a vacuum, this is all part of a plan more than three decades in the making.

Superannuation was meant to deliver strong incomes and flows of cash to retirees, and it has done that it spades. It was also meant to reduce reliance on the aged pension, which it has been much less successful than intended in accomplishing.

The growing gap between over 55s and younger demographics comes down to the fact that elements of the economy that younger Aussies rely on to improve their living standards are not adequately firing.

And while things have deteriorated further since the pandemic began, this is not a new trend.

Ultimately, changing the underlying status quo is a highly challenging task from a political perspective.

And as the run up to the election continues, this particular elephant in the room is yet to be meaningfully debated, let alone addressed.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as ‘Growing gap’: Proof Boomers are raking it in as younger Aussies ‘go backwards’