Maths that prove Aussie dream of home owernship is dead and buried

Is it still possible for the average household to upgrade from an apartment to their dream home? We did the maths and found out.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

ANALYSIS

Older Australians love telling younger ones that buying a house is still achievable - they just need to “accept less” and buy whatever they can in order to get their foot on the property ladder.

But is this actually true?

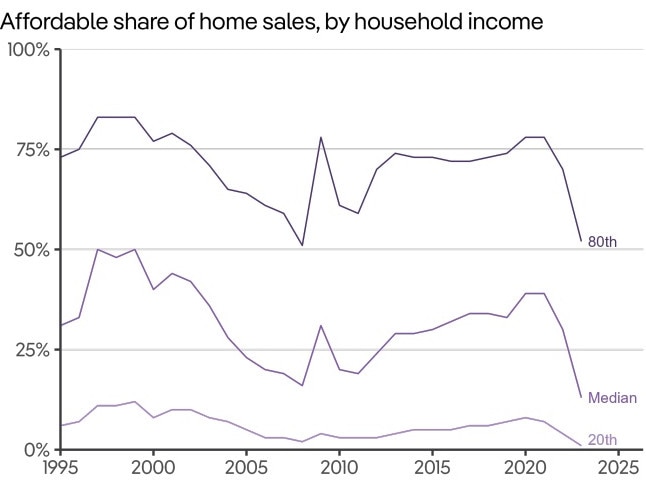

A recent PropTrack report, concluded that a household earning the national median household income could only afford 13 per cent of properties sold.

At the turn of the millennium, a household in the same relative financial position in society could afford roughly 50 per cent of properties sold.

So is the Australian dream of going from apartment to house still possible?

We’ve done the maths to find out.

Meet Tamsin (Tammy) and Christian

For the purposes of today’s scenario we’ll be inventing a hypothetical couple, Christian and Tammy, who are both 42 years old, have two children (aged six and four) and collectively earn 40 per cent more than Sydney’s median household income.

Six years ago, they purchased an apartment for the median citywide price of $760,800, following Tammy’s parents helping out by providing a majority of their 20 per cent deposit.

Purely based on the change in Sydney unit prices over that time, they have gained $76,400 in equity ($760,800 in 2018 and $837,200 in 2024).

In total, they have gained $126,200 in equity since purchasing the property in 2018.

Now with their earning power significantly greater than the median, they want to follow the well-trodden path of up trading to a freestanding house which is roughly reflective of the median Sydney house price of $1.395 million.

In total, their total equity after six years and help from Tammy’s parents amounts to roughly the 20 per cent deposit required to purchase the median priced house.

Based on stretching the repayments on their new prospective home to 37 per cent of their gross household income and starting a 30-year mortgage from scratch, they can borrow approximately $766,000.

This is a somewhat unrealistic scenario, since most banks would likely be unwilling to place such a large repayment burden on a household with two young children.

They also require just a little under $60,000 to pay for stamp duty and a further $16,000 to pay the real estate agent’s commission to sell their current property (based on the average Sydney agent commission rate).

In short, despite having parental help to buy their first home and dutifully paying down their mortgage for six years, they come up $350,000 short of the borrowing power needed to trade up to their desired freestanding home, plus the additional $76,000 in stamp duty and agent’s fees.

Rate cuts to the rescue?

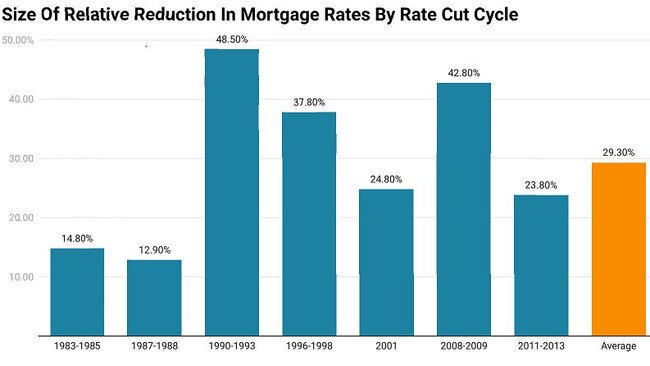

With Tammy and Christian coming up short, we’ll now attempt to tilt the odds in their favour. Based on historic rate cut cycles over the last 40 years, the average proportional cut in mortgage rates is 29.3 per cent.

If we apply that to the current average payable variable rate as measured by the RBA and round up a bit, it comes to a two percentage point cuts in mortgage rates, bringing the headline figure down to 4.39 per cent.

If we apply the impact of that cut to Tammy and Christian’s borrowing power, it rises to $953,000.

While the extra $187,000 in borrowing power does move the needle in our hypothetical couple’s favour, it ultimately comes up short of what is needed, even before transaction costs are factored into the equation.

The outlook

Despite the fact that Tammy and Christian ultimately came up short of their dream to buy a median priced Sydney house, relative to the median household in that city, their individual circumstances stacked the deck in their favour.

With an earnings capacity 40 per cent greater than the median and Tammy’s parents providing them with a large amount of assistance with their initial deposit, they are well ahead of many with young families in the more expensive capitals looking to buy a house or trade up to a freestanding home.

For now, this is the experience of a hypothetical couple in the nation’s most expensive housing market, but with housing prices tipped to continue to rise far in excess of wages across most of the country, it’s an experience that may unfortunately become all the more relevant for affected households in the coming years if current trends continue.

The message of “Accept Less” is arguably based on the sacrifice being temporary and that in time young people could achieve the same quality of housing and financial freedom as their parents of similar relative economic means.

But as Tammy and Christian’s situation illustrated, accepting less in the now may mean accepting that hand for significantly longer than anticipated.

Across Australian history, the stalling of social mobility over a protracted period has been rare, generally defined by periods such as the World Wars or the Great Depression.

But now as ageing demographics results in less and less housing turnover, and high housing prices prove to be a major hurdle, we may see more and more households effectively stalled and unable to move on to that next stage of life by the weight of circumstance.

Originally published as Maths that prove Aussie dream of home owernship is dead and buried