‘Hanging by a thread’: Australian economy bracing for petrol price hike

Fill up your tanks now, Australia, because in a matter of days, petrol prices will go through the roof and may never come back down again.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

Big explosions in Saudi Arabia made front page news this week as they took out a major chunk of the world’s oil production.

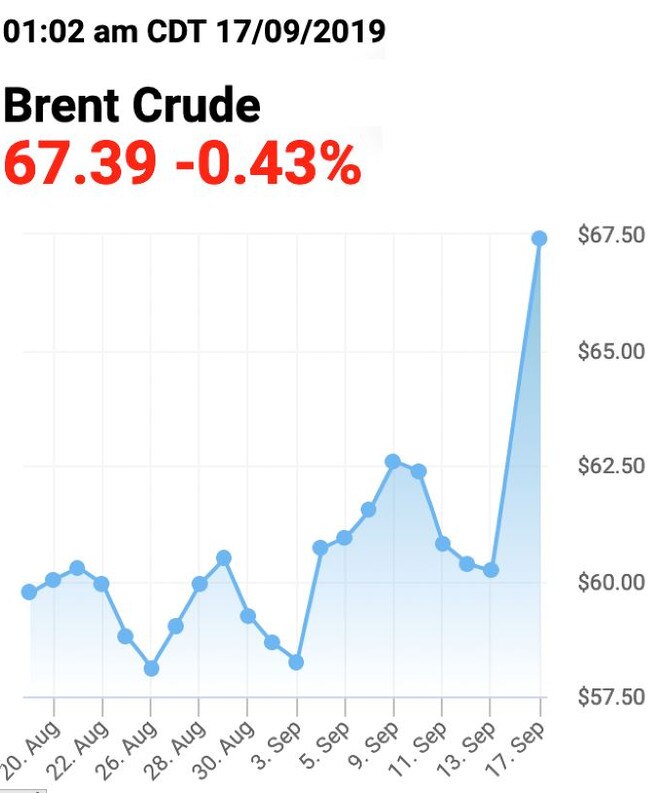

The interruption to supply saw the global oil price shoot up which means Australians can soon expect higher petrol prices.

Attacks on a major oilfield and a nearby processing plant in the oil-rich Middle Eastern kingdom affected nearly 5 per cent of the world’s oil supply. Saudi is the world’s biggest oil supplier and if its production is affected, the world oil price jumps.

Sure enough, when markets opened, the price of oil shot up 20 per cent, before relaxing slightly but still settling around 10 per cent above where it was.

The minute the news broke, I knew Australian petrol prices were likely to rise. Our fuel prices depend on the price of fuel in Singapore, and that depends on the world oil price.

The raw oil price is only about half of the price we pay at the pump though. Our petrol prices also depend on wholesale and retail margins, and taxes.

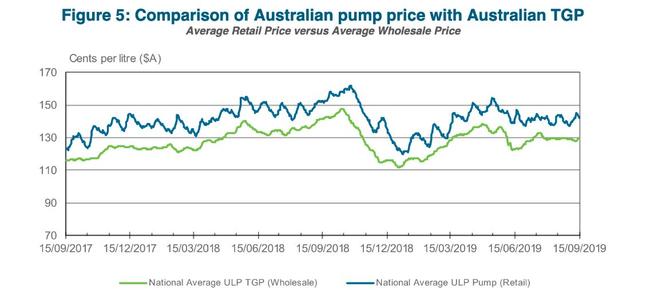

Australian petrol prices were already rising before the recent explosions in Saudi Arabia.

In January this year, the price at the pump was a nice low number — the national average was $1.21/L. Those are 2006 prices! Now it is $1.44/L, as the next graph shows.

According to the Australian Institute of Petroleum it can take a couple of weeks for global prices to flow through to the pump, so the shockwave of the Saudi attacks might not have reached us yet. But when it does it will be bad news.

THE ECONOMIC EFFECT

Petrol prices are a bit like mortgage repayments. They are very hard to avoid in the short term (yes, in the long term you can sell your house or your car, but in the short term you’re stuck with them).

When these costs go down, people have more wages money left over to spend. When they go up, people have less money left over to spend.

In this way, a rising petrol price is bad news for the economy. Like rising interest rates, it crimps our discretionary spending. And as everyone knows, that’s the big problem in our economy right now.

We have weak wages growth and we’re not spending enough at the shops to keep the economy ticking. The RBA is slashing interest rates in the hope that will get things going, but when Iranian drones fly over and create explosions in the Saudi Arabian desert, it pulls the Australian economy in the opposite direction.

For the average Australian household, mortgage payments ($80/week) are higher than fuel costs ($50/week). So you might think that a petrol price hike has less impact on the

economy. But of course, petrol prices are involved in the cost base of almost every product we buy. Whether it’s an apple from the supermarket or a ride in an Uber, the cost of petrol is hurting the supplier and squeezing their margins.

GEOPOLITICAL DRAMA

The whole global economy has been hanging by a thread recently. Growth is timid around the world and confidence it will recover is almost totally absent. Government bonds are at record low yields, many below zero, and so are official interest rates.

It all looks like a big pile of tinder just waiting for a spark. And we’ve been looking in many places for that spark. Brexit, the trade war with China, the wobbly prospects of major tech companies like Uber and Lyft with whom the markets are losing patience.

But now a new contender has entered the scene. A big conflict between Saudi Arabia and Iran could very easily provide that spark.

The two major powers of the Middle East sit on opposite sides of the narrow Persian Gulf and are mortal enemies. They’ve been backing different sides in the long-running war in Yemen, and now it looks like the conflict is spilling over.

The United States, which is on the side of the Saudi Arabians, could get involved too.

Donald Trump has said on Twitter (the online messaging service most likely to spark World War III) that the US is “locked and loaded”.

Saudi Arabia oil supply was attacked. There is reason to believe that we know the culprit, are locked and loaded depending on verification, but are waiting to hear from the Kingdom as to who they believe was the cause of this attack, and under what terms we would proceed!

— Donald J. Trump (@realDonaldTrump) September 15, 2019

If this initial attack spirals into a bigger conflict, the recent 10 per cent jump in oil prices could turn into a happy memory, and with where oil prices go after that, we will probably all be fighting to get our hands on electric cars.

Jason Murphy is an economist. He is the author of the new book Incentivology. Continue the conversation @jasemurphy

Originally published as ‘Hanging by a thread’: Australian economy bracing for petrol price hike