Construction industry hit hard as insolvencies soar

Businesses in one sector are collapsing at an alarming rate and being “hammered from multiple fronts” because the government “got it wrong”.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

The number of business insolvencies surged to its highest level since 2015 in the three months to September 30, with construction industry collapses leading the way.

The data, from the Australian Securities and Investments Commission (ASIC) shows that 2486 businesses hit the wall during the last quarter.

It’s the largest number of insolvencies reported in a single quarter since the December 2015 quarter, when 2499 businesses collapsed.

Of the collapses in the September quarter, 783 of them – or 31 per cent – were in the construction industry.

For the same quarter in 2022, 605 construction firms failed, while the September quarter of 2021 booked just 238 construction failures.

Liquidator Nicholas Crouch, from insolvency firm Crouch Amirbeaggi, told news.com.au that he was “not surprised” that insolvencies in the construction sector had leapt over the past two years.

He said the hundreds of billions in Covid-19 stimulus pumped into the economy by the Australian government helped prop up struggling business and resulted in long delays between an insolvent event and liquidators being called in, as business owners tried to hang on.

During Covid, the government relaxed the threshold for creditors to issue statutory demands for payment and the time frames for businesses to respond to statutory demands for payment.

Directors were also released from any personal liability for trading while insolvent during that time, and insolvencies fell dramatically.

Mr Crouch described the size of the pandemic stimulus as “bad economic management” and said that the government “got it wrong”.

He said that the higher interest rate environment meant it was unlikely that the pain was over for the building sector.

“Construction is getting totally hammered by interest rates,” he told news.com.au.

Mr Crouch added that when the relaxed rules and added stimulus during Covid combined with “historic low interest rates that were out of kilter with the real level of economic distress” the uptick in insolvencies was inevitable.

“You can’t have zero per cent interest rates and not expect consequences. You can’t have too much sugar and not expect a crash.”

The woes in the building industry are also taking a toll on some of Australia’s largest builders.

Australia’s second-biggest private construction firm, Hutchinson Builders, today announced a 93 per cent fall in net profits for the 2022-23 financial year.

Earlier this year chairman Scott Hutchinson told The Australian: “It’s been very hard work and we’ve just had to battle it out.”

“We haven’t had a good year since 2017. What’s killing us is the rain and the fact that we can’t get materials and labour. It is not sustainable and that is why so many of us are going broke. We’re hoping 2024 will be better.”

The ASIC data shows that the number of construction firms that went into external administration in the September quarter was more than double that of any other industry, and 27 per cent higher than in the June quarter.

CEO of credit reporting agency CreditorWatch, Patrick Coghlan, told news.com.au that construction industry insolvencies had now surged above pre-Covid levels.

Mr Coghlan said that builders had been “hammered from multiple fronts” including supply chain issues and inflation affecting the cost and availability of materials, labour shortages affecting the cost and availability of labour and high interest rates affecting demand for construction projects.

A squeeze on the margins of small to medium residential builders working to fixed rate contracts had also played a role.

Mr Coghlan told news.com.au that he expected the overall number of business insolvencies to continue to increase, along with those in the construction sector.

CreditorWatch’s monthly Business Risk Index forecasts that business failures are likely to continue to rise over the next 12 months, from the current rate of 4.5 per cent to 5.8 per cent.

“Let’s see what happens if there’s another interest rate rise next month,” he said.

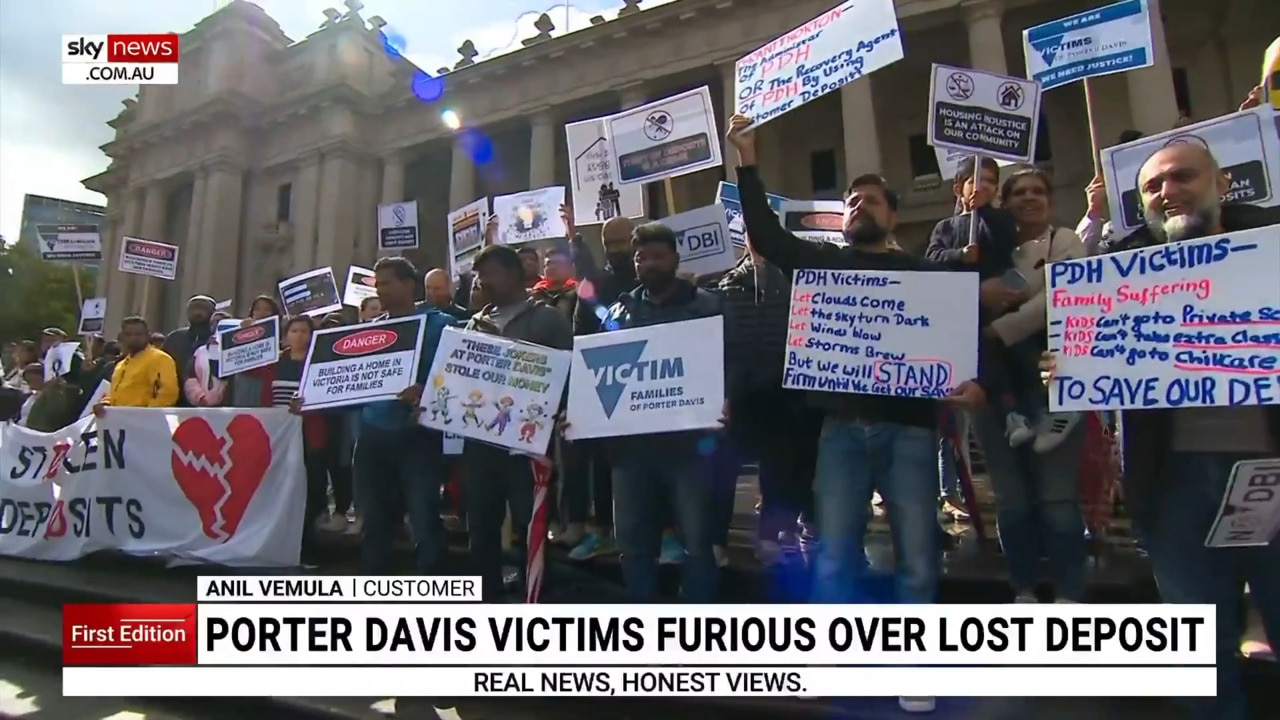

Over the past year, news.com.au has reported on dozens of building industry collapses.

Snowdon Developments, Probuild, Porter Davis and Hotondo Homes’ Hobart franchise, Tasmanian constructions, are among some of the biggest construction firms to have failed.

More Coverage

Originally published as Construction industry hit hard as insolvencies soar