‘Spreading the debt’: Apple’s BNPL move in ANZ partnership

Australians are already “struggling” with the cost of living crisis and now a new innovation from Apple has some worried.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

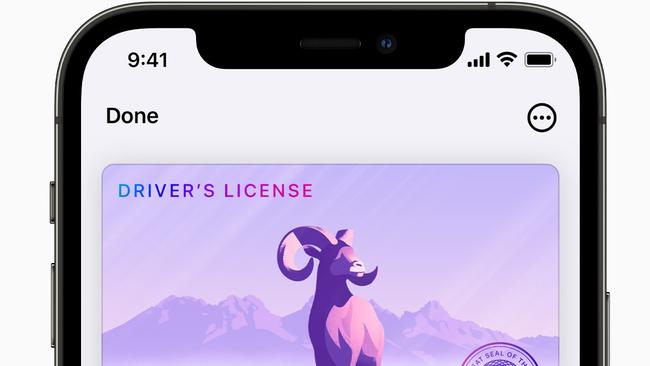

Apple is introducing buy now, pay later style loans to iPhone users via ANZ bank and may even bring Afterpay and Zip on to its payment platform.

The new partnership between one of the world’s tech giants and Australia’s major banks will only be available to existing credit card customers at this stage.

It will allow them to create repayment plans and pay an upfront fee at the time they wave their phone over a payment terminal or when they use Apple Pay in an app.

ANZ credit card customers can set up a three, six or 12-month instalment payment plans inside Apple’s digital wallet, Apple Pay, although spending would still need to remain under pre-approved limits and the product is regulated under existing financial rules.

Rather than charging interest like a normal credit card, ANZ charges an upfront fee worth either 1.5 per cent, 3.5 per cent or 6.5 per cent of the cost of the purchase.

But consumer groups have expressed concern about the new payment method.

“People who call us on the National Debt Helpline are already struggling to make payments on their credit cards, what worries me is that this ‘innovation’ encourages more spending and adds an extra layer of credit with extra fees and costs,” Consumer Action Law Centre director of policy and campaigns Tania Clarke told news.com.au.

“Instead of spreading out the debt, I would say don’t tap, call your bank and request hardship if you in difficulty, or the National Debt Helpline 1800 007 007 where you can get free advice to help stop you falling into a debt spiral”.

An international bank has named Australia as having one of the biggest ‘surges’ in buy now pay later (BNPL) services in the world as bad debts pile up.

The other major banks already offer their own form of BNPL with CBA’s StepPay and its partnership with Klarna, National Australia Bank also have their own product called NAB, while Westpac has PartPay which gives credit card customers the ability to pay for purchases in four instalments.

It is not yet known if they will follow ANZ’s lead.

Apple announced it was also bringing the US provider of BNPL Affirm on to its payment platform in that country, allowing customers to create these type of loans when they checkout on Apple Pay.

Apple’s move in Australia was no surprise as they already have their own BNPL offering in the US – which meant it was inevitable that would launch elsewhere, said founder and chief executive of payments consultancy McLean Roche Grant Halverson.

“BNPL is already at saturation point in Australia with seven million accounts and four million users,” he told news.com.au.

“ZIP’s Australian and New Zealand business is flatlined as is Afterpay and market leader PayPal is also at single digit growth. All of these app players now issue credit cards with high fees – so much for the claim BNPL apps would destroy cards.

“Apple has 45 per cent of the smart phone market – so what percentage of those will use BNPL is the key question?

“ANZ have held off BNPL and now will enter trying to cross sell their own customers who have Apple phones – good luck, it’s four years too late.”

The government has announced its plans to regulate the buy now, pay later sector and consumers could see some big differences to the fees they pay, how they apply for credit and the impact on their credit rating.

The Reserve Bank of Australia’s 2022 Consumer Payments Survey found mobile payments were used by nearly two-thirds of respondents aged between 18-29 in 2022, up from less than 20 per cent in 2019.

The majority of smartphone transactions are being made through iPhones in Australia. Overall, smartphone transactions in Australia topped $93 billion in 2022, with 15.3 million cards registered, according to Australian Banking Association (ABA).

But Mr Halverson said mobile wallets have grown off a very low base as Covid gave them a huge lift, but its all still small value transactions.

He added mobile wallets have a 17 per cent share of the market while $93 billion is 6.3 per cent of total retail payments.

The new offerings in Apple Pay, are part of a broader update to its operating system, which includes integrating artificial intelligence into its devices.

Originally published as ‘Spreading the debt’: Apple’s BNPL move in ANZ partnership