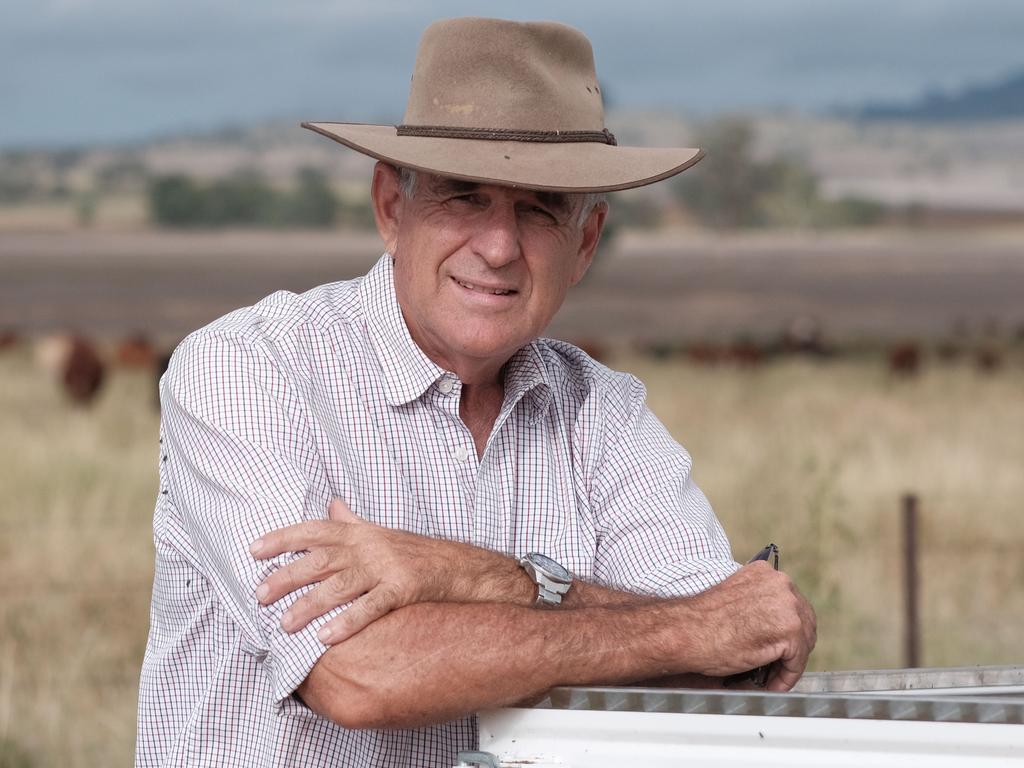

BHP chairman Ken MacKenzie tells shareholders ‘clear business reasons’ behind $2m voice donation

BHP was one of a host of corporate giants that backed the voice referendum with financial support. Chair Ken MacKenzie has explained the miner’s decision at its AGM.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

BHP chairman Ken MacKenzie has defended the company’s decision to tip in $2m to the Yes campaign in the Voice referendum, telling shareholders the mining giant had “clear business reasons” for the decision.

Speaking at the mining giant’s annual shareholder meeting in Adelaide on Wednesday, Mr Mackenzie said the company has a close connection to Indigenous communities.

“I can’t think of a social issue with greater connection to BHP’s business,” he said.

“(Our) relationships with traditional owners and other Indigenous partners are some of the most important relationships we have.

“We operate on the traditional lands of Indigenous peoples … and we have long term agreements with traditional owners and other First Nations peoples.

“These are critical relationships to BHP’s ‘ability to start projects, expand existing projects and to our operational continuity. They go to the heart of what we do as a mining company, and they’re integral to our businesses, and creation of shareholder value.”

Mr MacKenzie said the company respected the outcome of the voice referendum, and would continue to progress its own Reconciliation Action Plan. “We remain committed to incorporate Indigenous perspectives and knowledge in the way we operate and manage our business.”

His comments came as BHP chief executive Mike Henry again sounded a warning on the federal government’s industrial legislation, telling shareholders the bill – which BHP has vehemently opposed – “risks our national competitiveness”.

“BHP shares concerns of the broader business community that the Australian government’s same job same pay proposal will increase costs and reduce Australia’s investment competitiveness at a time when competition for investment is fierce globally and other nations are working to become more competitive and more attractive,” he said.

Mr Henry told the Adelaide audience that BHP strongly opposes the bill because of the damage it threatens to do to its business as well as the hit it will have on Australia’s economy, jobs, productivity and international competitiveness.

“The bill could reduce the value of any potential growth plans for a copper province of BHP assets here in South Australia by up to $US2bn. And it risks directly impacting dividends for the 17 million Australians who hold BHP shares directly, or indirectly via superannuation.”

More Coverage

Originally published as BHP chairman Ken MacKenzie tells shareholders ‘clear business reasons’ behind $2m voice donation