‘I’m freaking out!” Barefoot’s guide to tackling the mortgage cliff

Scott Pape has some advice for one young Aussie couple who are freaking out after discovering they will soon have to fork out 70 per cent of their pay on mortgage repayments.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

Are we heading for another Global Financial Crisis?

That’s the number one question I’m getting right now … and it makes perfect sense.

After all, banks are going bust around the world, inflation is burning a hole in our wallets, and interest rates are being hiked at the most aggressive rate in years.

So, what comes next?

Well, the honest answer is … I don’t know.

No-one does.

However, what I can do for you is to suggest three books that will help prepare you for whatever results from the bursting of the biggest global debt bubble in history.

The Great Depression: A Diary, by Benjamin Roth

No, I don’t think we’re heading into a depression.

However, this book is the actual diary notes of Benjamin Roth, a small-town lawyer living through a decade of the Great Depression. What makes it a fascinating read is that he’s writing it in real time – he doesn’t know what’s coming next.

The key take-outs?

You probably think of the Depression as bread lines and poverty. However, Roth’s diary notes show that there were plenty of years in which there were huge rallies in the sharemarket, with newspapers chock-full of experts predicting that the worst was over. And then the market would crash again.

From the peak, the stock market fell a staggering 89 per cent, and took 25 long years to regain its high. Interestingly, Roth started out thinking that stocks were a scam, and that rent-paying property was a sure bet. However, he came out of the Depression believing the exact opposite.

And if that 89 per cent plunge has your head spinning, you really need to read the next book …

The Ulysses Contract: How to Never Worry About the Share Market Again, by Mike Kemp

So this book has just been released … and I wrote the foreword. Yet I did it for a very good reason: the author, Mike Kemp, is the man I turn to for investing advice.

Mike was on the floor of the Stock Exchange the day of the 1987 crash, and over four decades of investing he’s not only become a very wealthy man, he’s done it while totally ignoring day-to-day share market fluctuations.

Key take-outs?

The main aim of this book is to show you how to never worry about the share market again. Really. He does that by doing a deep dive into economic history, backing it up with sound logic, and then, for the crescendo, encouraging the reader to enter into a weirdly effective Ulysses contract.

The Barefoot Investor, by Scott Pape

Okay, so this is totally shameless … however, I really believe it. My book is written for times like this. When you think you’re lost – and you’re not sure which way to go – follow the Barefoot Steps to safety.

Key take-outs?

You can’t control what RBA boss Phil (high) Lowe does, or what the economy does, or what your boss does. However, the fact is, you have more control than you think.

So, instead of fretting, focus on the things that you can control. There are things you can do right now – tonight – that will put money in your pocket, boost your confidence and set you off on a totally different path. All you need is a bottle of wine and your phone … and a few good books.

Tread Your Own Path!

The Seven Stages of Grief

Hi Scott,

My fiance and I purchased our house in December 2021 and had a fixed rate for two years at 2.59 per cent.

With the constant increase in rates, he says our repayments will revert to around $5,000 a month come December, and I am freaking out! He earns $115,000 a year (pre-tax, less his child support!). I earn zero. What do we do? Should we sell our house and hold on to our money until rates come back down and try again? This is so overwhelming and confusing.

Natalie

Hi Natalie,

My calculator just broke: you’ll be paying 70 PER CENT of your take-home on your home loan?!

Cracker Jack!

So it sounds like you’re in a state of shock …

Excellent!

That’s the first step. Now we need you to move through the other stages of grief, and pronto.

The next step is denial.

Here’s you: “Maybe everything will sort out … and rates will come down … and we’ll be okay?”

Here’s me: “No you won’t. Even if rates come down slightly, you’ll be shooting in a paper bag with only 30 per cent of your take-home left over.”

Let’s move on to anger.

Here’s you: “It’s the bloody bank’s fault for lending us so much!”

Here’s me: “That’s it, let it all out! Do you feel better? Good. Still, it won’t change your situation one iota.”

Next, let’s move on to regret.

Here’s you: “Why did I borrow so much money?”

Here’s me: “Woulda, coulda, shoulda … but you did … and here we are.”

And now, to depression:

Here’s you: “It’s hopeless … there’s no way out.”

Here’s me: “This is where most people who are in severe debt end up: feeling defeated and depressed. That causes them to stop talking to their lender, and the situation gets worse.”

Natalie, I know it’s hard but you need to break through to the final stage of grief – acceptance and hope:

You may need to accept the harsh truth that you can’t afford your home based on your current income. So, unless the two of you can bring in substantially more, it’s likely you’re going to have to sell your home.

And what about the hope?

Well, the hope is that you take control of your situation early, rather than letting things happen to you.

So please call 1800 007 007 and team up with a financial counsellor, and take control today.

Revenge of the Bong-Smoking Boyfriend

Hi Barefoot,

Before I read your book I made the mistake of getting a Latitude credit card for a TV. Now I’m a smidge away from paying it off, thanks to you! But I just received an email letting me know that Latitude has been hacked! I have followed all of your suggestions up until now, such as locking my credit file through Credit Savvy. I have spent a long time getting my credit score to a respectable place from 273 to now where it is well over 800. I’m concerned this hack could affect or undo all of my hard work! Is there anything else I can do to protect myself?

Linda

Hi Linda,

Oh, no!

Latitude is the financial equivalent of that dirtbag boyfriend you’re planning on breaking up with because he spends too much time sitting on the sofa getting stoned and playing Xbox. And now you find out he’s been cheating on you as well!

Latitude’s consumer debt products suck almost as much as their cybersecurity … which the Director of the Australian Computer Society (ACS), Mr Louay Ghashash, described as “dismal … they have failed on all fronts”.

Now to your actual question:

The truth is that if you’ve shut down your credit file then you’ve done all you can. And I’d give even less latitude to credit scores – to me they’re the financial equivalent of a horoscope.

However, if you’re one of the 330,000 customers of Latitude reading this and you haven’t locked down your file, do it now. And from now on choose your financial boyfriends wisely!

Cards of Courage

Hi Scott,

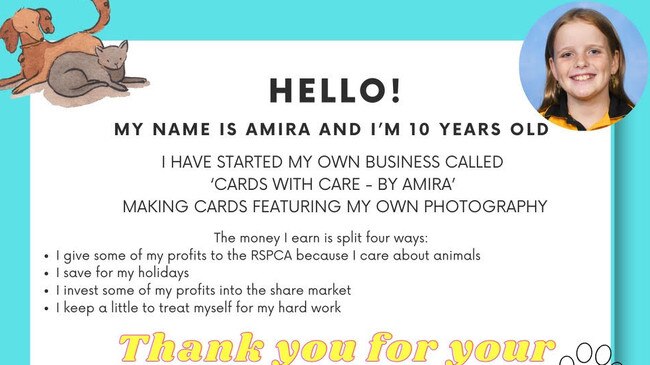

My name is Amira and I’m 10. For Christmas Mum got me Barefoot Kids. Thanks for writing a cool book. Mum and I read it together. We are following your steps and I now have my business, ‘Cards With Care – By Amira’, up and running in Darwin. I pitched my business to a local shop owner, who bought my cards to sell in her shoe shop. People are loving the photos I take for my cards. I have my buckets all set up and have purchased my first ETF with Mum’s help!

Love, Amira

Hi Amira,

Oh, I love this.

Did you know that the average Aussie gets 22 Birthday, Christmas, and ‘Sorry I voted for the Teals’ cards every year? (Ask your parents.)

For the rest of us, have a read of Amira’s pitch and tell me that you’d choose a cheesy Hallmark card over something as genuinely awesome as what Amira’s got going on.

You Got This!

Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions