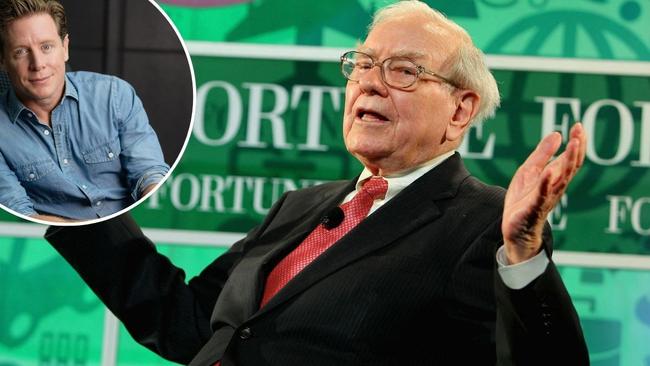

Barefoot Investor: 3 things Warren Buffett taught me that changed everything: Barefoot

He’s known as the greatest investor of all time. And there’s three things Warren Buffett taught me that made me rethink everything, writes Scott Pape.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

“Warren Buffett announces plans to retire this year in shock to shareholders,” read the ABC headline.

Seriously?

The bloke is 95 years old!

If I were his age, I’d be shocked if I could even get out of bed without sounding like a busted whipper snipper.

All jokes aside, this really is the end of an era: there will never be another Warren Buffett.

I’ve flown to Omaha, Nebraska, more times than I care to count for his legendary ‘Woodstock for Capitalists’ meetings.

I’ve interviewed him. I’ve spent time with his kids.

And over the years he’s taught me three lessons that I still live by.

1. Investing My Money

I was in the crowd at Omaha in 2016, notebook in hand, when Buffett casually mentioned he’d instructed his estate to put his money into a simple Vanguard index fund when he dies.

Now, this is the greatest investor of all time.

Since 1965, Berkshire Hathaway has grown in value by more than 5,500,000 per cent (not a typo!). The index returned ‘just’ 39,000 per cent in that time. Yet even he said it was smarter to bet on the index.

Why?

Because, as he got older, Buffett realised what most of us eventually do: that simplicity is the ultimate sophistication.

Rather than play the game, he set his family up with low-cost, no-fuss index funds.

That made me rethink everything. Over time I sold all my individual shares and moved to a set-and-forget portfolio.

More time with the kids, and less stressing over share prices. Best move I ever made.

2. Spending My Money

The media love talking about how much Buffett is worth (around $US169 billion).

But they always miss the real story:

He’s never sold a single share in his company Berkshire Hathaway, which doesn’t pay dividends.

In other words, he’s basically held a $180 billion lottery ticket in his pocket for decades … and never cashed it in.

That’s what Buffett’s done.

He lives in the same modest suburban house he bought in 1958. Still drives himself to work. In fact, his son once told me that, as a kid, he didn’t even know his dad was rich.

Is that a bit weird?

Hell yes!

But, in a world obsessed with more, one of the richest men in the world chose enough.

3. Working for My Money

When I interviewed Buffett, I asked him the secret to a happy life.

He didn’t even pause: “Find a job that makes you want to tap-dance to work every morning.” And he meant it.

While the world calls him the greatest investor of all time, he told me that he’s always seen himself as a teacher.

So, as my great teacher gets set to leave the classroom, let me ask you:

Could you see yourself doing your job at 95?

And if not … what could you be doing that would make you tap-dance to work?

Tread Your Own Path!

The $30,000 Pussy

Barefoot,

Our cat got bitten by a snake. $30,000 later she’s alive and well and having a great life.

Pets, to some, are their family.

They’re not replaceable. The 30 grand I spent wasn’t just for a cat’s life … it was for my children’s happiness, it was so I didn’t have to be eaten up by guilt for the rest of my life.

I look at this little cat now and wonder … what if I hadn’t spent it on her, what if I’d gone to Europe for a month-long family holiday instead. Would I be happier? I think not.

Jane

Hi Jane

You’re triggering me.

I almost got cancelled last year for advising a broke woman not to spend $60,000 on her sausage dog.

I got absolutely savaged: bitey emails from dog lovers.

I was mauled on social media, and the CEO of the Australian Veterinary Association published an open letter criticising my views (and justifying the cost of Range Rover Sport-level bills).

So … here we go again.

No parent wants to break a child’s heart (though my kids barrack for the Melbourne Demons, so there’s that), but I get where you’re coming from.

Look, I live on a farm, where the circle of life is on full display: the ewe prolapses and dies. The lamb gets pulled and bottle-fed by the kids. The fox breaks into the chook shed and kills the lot.

It’s hard – but it teaches them.

So I asked my eldest:

“If one of our cats got bitten by a snake, would we spend 30 grand to save it?”

He didn’t even blink:

“Don’t be ridiculous.”

“And what if Granddad got bitten by a snake?”

“Well … how old is he?” he smirked.

“Stop it – you’re scaring me.”

Still, you asked: What if I hadn’t spent the money?

So let’s go there. What if you’d put that $30,000 into your mortgage? Or invested it in shares for your kids’ future? Or wiped out your credit card debt?

Well, you’d have something else: financial peace of mind.

And that’s not nothing.

I’m not saying you made the wrong choice.

You saved your cat, your kids are happy, and your guilt is gone.

But next time (and there’s always a next time when it comes to pets) have a plan before the tears and vet bills start flowing.

Because, while pets feel like family (and they often are!), your actual human family needs you to make clear-eyed choices, especially when it comes to money.

Hello 5 per cent Deposits!

Dear Scott,

Albo’s back, and so is his housing policy.

So why would anyone want a 5 per cent deposit?

That just means borrowing 95 per cent! Who benefits?

The banks. It’s basic maths: smaller deposit = bigger loan = more interest over time.

Why are we encouraging people to dive deeper into debt in one of the most debt-ridden countries on Earth? Would love to hear your take on this.

Andrea

Hi Andrea

Give me a high five!

Who wins?

The banks! They get to lend out 95 per cent of the purchase price, and rake in decades of interest repayments.

Who loses?

Lots of people.

First, anyone who doesn’t own a home right now – because this policy will increase housing prices.

Second, anyone who borrows 95 per cent of the value of a home.

After all, they don’t even own the doorknob! One market (or employment) wobble and they’ll be underwater financially and emotionally.

Finally, you, Andrea, and all taxpayers.

That’s because, if these ‘five percenters’ end up doing a Dutton, the banks will simply pass on the losses to the taxpayer.

My view?

The Government should not be encouraging broke people to borrow huge sums of money and roll the dice on some of the most expensive real estate in the world.

This policy has ‘subprime’ written all over it.

Help! I’m Terrified I’m Going to Lose My Home

Hi Scott,

I’ve been following you for years, but right now I’ve hit a wall.

I bought my first home in August 2024, but by December I was already in financial hardship – and I’ve been stuck there ever since.

I left a well-paying job (long story) and ended up unemployed for four months.

Now I’ve found work, but it’s a long commute and I’m only earning $1,400 a fortnight … while my mortgage is $1,200 a fortnight.

There’s not much left over – financially or emotionally. I’m terrified I’m going to lose my home, and I don’t know what to do.

Maura

Hi Maura

Wait, you’re living off $200 a fortnight?

That’s not financial hardship, that’s a Centrelink-sponsored episode of Survivor.

Look, unless you can magic up a better-paying job fast, you need to seriously consider selling your home.

That’s where you are at right now. It doesn’t have to be forever. Maybe one day you’ll buy another home, on your terms, with a story that starts:

“Back in 2024, I bought a house I couldn’t afford ... and that’s when everything changed.”

Right now, though, you need backup.

Call the National Debt Helpline on 1800 007 007.

You’ll be connected to a free financial counsellor – someone like me.

They’ll help you talk to your bank’s hardship team and explore your options.

So here’s your reframe Maura:

Selling your home before the bank forces your hand puts you in control.

Maura, if you do this you will not be ‘losing’ your home.

You will be selling it on your terms to secure your financial future.

And it might just be the smartest financial decision you ever make.

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.