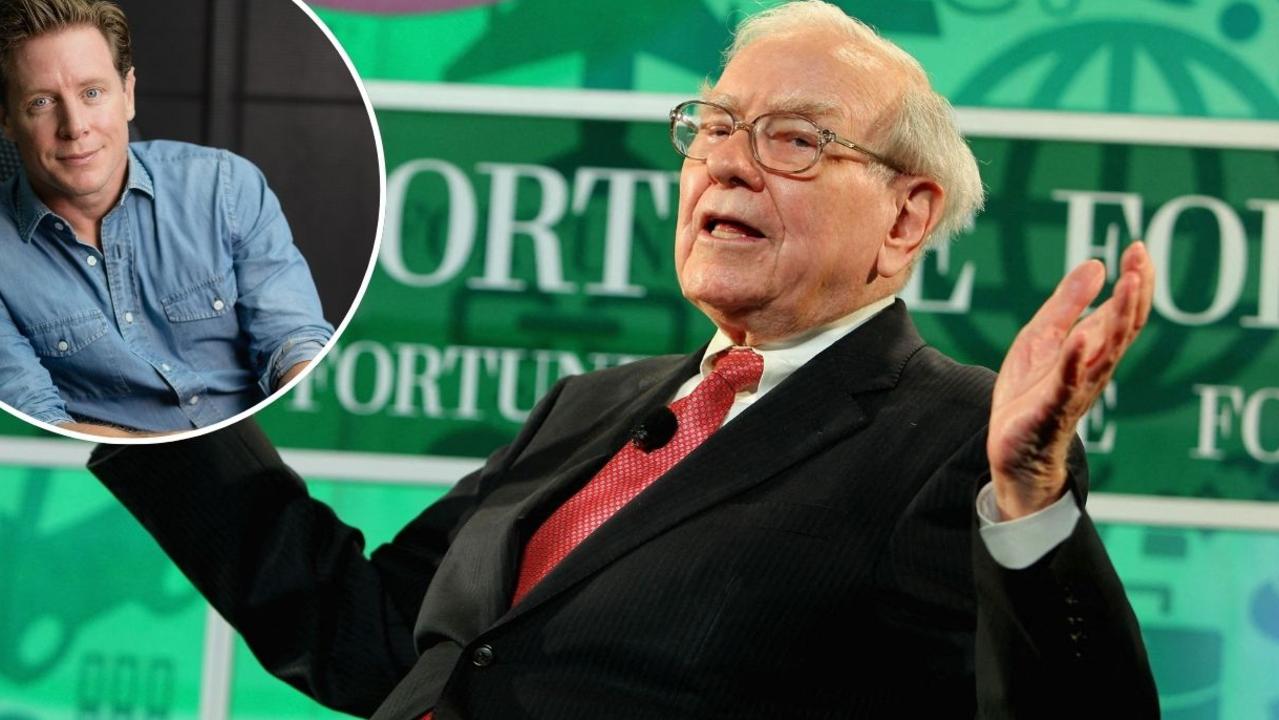

Barefoot Investor’s advice to struggling single mum with $10,000 inheritance

A struggling single mum who pays 85 per cent of her income on rent has received a $10,000 inheritance, with the Barefoot Investor offering some unlikely advice.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

“Why is Daddy crying in the shower?” asked my six-year-old daughter.

Truth be told, I’ve been doing a bit of that lately.

It all began 70-odd days ago when Wally, my 60-something editor, decided he needed to lose a few kegs. To keep him accountable he asked me whether I’d join him in something called the 75 Hard challenge.

My first response was, “Sure!”

My second response was, “What’s 75 Hard?”

It turns out that 75 Hard is a TikTok-inspired challenge that sounds totally fun on a 25-second video … but totally sucks in real life.

Here are the rules. For 75 consecutive days you must:

– Stick to a diet (with no cheat meals)

– Exercise twice a day for 45 minutes each time (with at least one session happening outside)

– Drink four litres of water a day (and consume zero alcohol)

– Read 10 pages of a self-help book every day.

And, because I don’t drink, Wally suggested I add a little bit of spice to the challenge by adding a two-minute freezing cold shower each morning.

Challenge accepted!

“This is extreme … and not well thought out,” frowned Liz as I emerged shivering from the shower.

Well, of course – it’s on TikTok!

“Shocking new data revealed that eight out of 10 young Aussies are turning to TikTok for medical advice,” wrote the Herald Sun this week. The researchers warned that TikTok can be even more dangerous than Dr Google… mostly because the experts dispensing advice tend to be other kids in their bedrooms.

And make no mistake, there’s a lot of bizarre advice on TikTok clocking up billions of views – like the baby food diet, the cabbage soup diet and, my favourite, the dog food eating challenge – promoted by a fit-fluencer because Fido’s food is packed with protein. (“No weight loss benefit, and can cause severe constipation,” warns clinical nutritionist Sally O’Neill. Woof!)

Yet the granddaddy of them all is the 75 Hard challenge, which has 2.5 billion views on TikTok and has been credited with transforming people’s lives (and sending the odd few to hospital for drinking too much water).

My results?

They were as much mental as they were physical.

You see, after a certain income level, the link between earning more money and improving your mental health is rubbery (at best). However, I’ve found the link between physical health and mental health is pretty much bang on. When I’m fitter, I’m happier and less stressed. I just feel better about myself, probably because I know I’ve earned it through hard work… each morning at 5am.

And the research backs it up:

Yale and Oxford universities collected data on the physical behaviour and mental health of over 1.2 million people and showed that, while money may make them happy to a certain degree, exercise is far more beneficial for mental health than economic status.

So, hypothermia aside, what this extreme challenge did was ingrain the daily habits of exercise and healthy eating into my belief system. And in doing so it changed the way I think about myself in a way no amount of money has ever done. After all, health is the ultimate form of wealth. (Next up… the dog food challenge.)

Tread Your Own Path!

The $10,000 Question

Scott,

I’m a university-educated freelance graphic designer. I’m also a single mum, with a 10-year-old. My rent is 85 per cent of my income and there are no housing solutions in sight. I receive no financial support from my family or my son’s father. We have moved 11 times since my son was born. I’m depressed, defeated, tired. I have $8,000 in debt, and a $10,000 inheritance I’m scared to accept – because I can’t do much with it except spend it on food and rent, and then it’s gone. I just don’t know where to turn or how to begin finding security for my son. I want off this rollercoaster. I go day by day, meal by meal, always seeming to find a way to feed my child but never getting ahead. With my massive living costs, and high debt repayments (I’ve already talked to the various hardship departments), my question is what should I do with the $10,000?

Sarah

Hi Sarah,

You’re doing an awesome job to just get through each day. In years from now your son will be proud of the sacrifices you’ve made for him.

However, the truth is that if 85 per cent of your income is going towards rent, you can’t survive long term.

The numbers just don’t stack up.

You need to either earn more money, or find cheaper accommodation – or both. (Which is very easy for me to say, as I’m not the one who’s had to move 11 times in the past decade.)

As for the $10,000, I’d suggest you spend it on survival. Don’t spend it repaying any of your outstanding debts. In fact, right now you shouldn’t be making any repayments. The only thing you should spend your money on is essentials: A roof over your head. Power. Food on the table. Clothes. Medicine.

What you do need to do is see a financial counsellor (1800 007 007). However, this week it’s going to be me who calls you, and I’ll do my best to help.

Finally, thank you for writing to me. There are well over one million people who have just read your question, and hopefully it’s given them a window into the world of a low-income single parent trying to survive in the richest country on Earth.

Willy Wonka Money

Scott,

You set me up on a good financial path when I started working as a graduate. However, I recently inherited a fortune from my grandparents in the sum of $6.3m. I’ve never had much money and I feel so blessed to have been gifted such a large sum. I want to conservatively manage this money. What’s the best way to invest it, taking minimal risks, for the next 50 years?

Sam

Hi Sam,

You just scored a ticket to Willy Wonka’s 1 per cent club.

And that’s how I’d personally think about the money you’ve just received: as a golden ticket.

If you invest that money into a number of ultra-low-cost index funds, the income the portfolio will generate will be roughly $200,000 a year (after tax and inflation). Every year. For the rest of your life. Shot directly into the bank account of your choice.

Even better, in 50 years’ time those index funds will have likely doubled in spending power – which your future children will be very happy about (if you choose to create some trustafarians).

So how do you set up a golden ticket?

First, talk to an accountant and an estate planning lawyer and have them set up a family trust.

Second, talk to a financial adviser who specialises in index funds and have them set up a simple portfolio of local and international funds. Do not pay any ongoing advice fees.

Finally, think long and hard about how you can ensure this money won’t totally screw up your life.

Wait! What?

I’ve seen it happen way too many times. It’s called a ‘poisoned chalice’ – receiving unearned money often brings up feelings of guilt and sparks frivolous spending (big houses cost a lot to maintain), and the results can be a lack of meaning in life. Remember, the main lesson from Charlie and the Chocolate Factory is to work hard, and help others.

Good luck!

Changing the Family Tree

Dear Scott,

Nine years ago I committed to following the Barefoot principles to change our family tree. When we started, our net worth was minus $10,000, and last week we hit the magic $1,000,000! When I realised our position I instantly remembered you saying most people over-estimate what they can do in one year but underestimate what they can do in 10! Thank you for all you do to help the community to take charge of their finances and accomplish their financial goals.

Chris

Hey Chris,

In this TikTok world of cringey 75-day hacks, it’s worth repeating that people massively underestimate the life-changing benefits of grinding away for years. After doing this job for over 20 years now – and receiving tens of thousands of emails – it seems that most people who write to me get themselves from the financial edge within a year, and then go on to become successful in six.

From then on, as you proved, it’s all gravy, baby. Well done!

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.