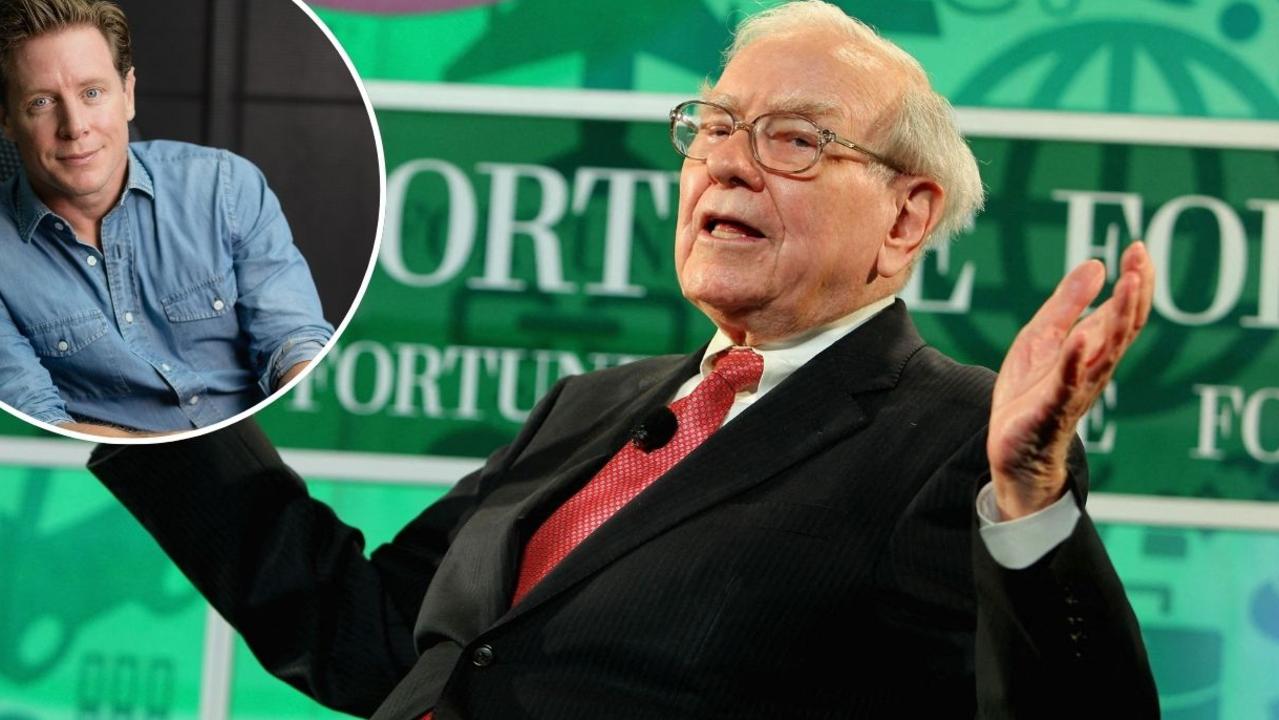

Barefoot Investor shares his top tips for budding business owners

Bastards, bust-ups and borrowing too much are the ‘three Bs’ to avoid in business says Scott Pape, who this week for the first time shares how he runs his own Barefoot Investor set-up.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

I’ve spoken a lot about how I manage my money… you know, the Barefoot Buckets, the orange cards, and the super-cheap index funds.

However, I don’t think I’ve ever discussed my money set-up for how I run my business. And I don’t think I ever would have, except for the fact that I was roped into doing a talk for small businesses in my hometown this week.

Here’s what I told them.

Some people get excited about designing their logos, websites and socials. Yet when I started my business I looked at the most common ways small business owners go broke, and set out to avoid them.

I call them the ‘three Bs of business’… bastards, bust-ups, and borrowing too much.

Firstly, the bastards (the Australian Taxation Office).

It’s true, the biggest killer of small businesses – at least early on – is none other than the ATO.

My golden rule:

Thirty-five per cent of every dollar I earn gets transferred immediately into that online savings account, which I’ve nicknamed ‘tax man’. (Side note: When I was setting everything up, I went with a totally different bank for my business – actually a credit union – to keep things separate from my personal stuff. I have a basic business transaction account, and an online saver, which currently pays 4.6 per cent p.a.).

Why 35 per cent?

Well, it accounts for my company tax and my GST (which many small business people forget about).

It’s a conservative number – too conservative – because I always have extra money sitting in that account after paying my tax. And when I’ve paid my taxes I take that surplus and invest it into the business to make more money.

My accountant, Stubby Fingers, tells me I should be more ‘sophisticated’ and use the tax savings to manage my cashflow.

He’s right, of course.

But I don’t like doing budgets, much less trying to stick to them. And I hate having heart palpitations when my BAS is due. (So stick that in your spreadsheet and smoke it, Stubby Fingers!)

Secondly, bust-ups.

I can count on one hand the number of business partnerships that have lasted the distance. Most don’t, because relationships are tricky… especially when there’s no sex, and there’s money on the line.

So early on I decided to not take on any business partners. Never. Ever.

And, thirdly, borrowing too much.

This is why I run my business without debt.

The upside is I don’t have to hock my home for a business loan (the banks almost always want a personal guarantee).

The downside is that it’s my back up against the wall, and the buck stops with me.

And that’s why I have a fourth ‘B’ – burn money.

When I first met my wife, she was slightly petrified that I ran a small business. (Her parents were academics, so she had no concept of ‘you only get to eat what you kill’). So each month I work out my ‘monthly burn number’, which is all the fixed expenses of the business that I have to pay to keep things running, including paying myself a basic wage plus super.

My aim is to have three months of burn money sitting in my business transaction account, and I try not to let it dip below that amount on a month-to-month basis. Having an accurate burn number burned into my brain keeps me both hungry (at the start of the month) and humble (when I have a good month).

Then, anything left over and above my three-month burn figure goes into blasting through the Barefoot Steps … and these days into shares.

Yes, it’s simple. But it needs to be, because being in business is bloody hard!

Tread Your Own Path!

ING Totally Sucks!

Hi Scott,

Let me count the ways that ING sucks. Their customer service absolutely sucks. Their security sucks (a four-digit passcode, really?), and now they are dropping their international ATM rebate, which TOTALLY sucks because I’m heading overseas soon. Are you still in the ‘orange army’ or, like me, do you think it sucks too much?

Angela

Hi Angela,

So I had my own sucky experience with ING a while back.

They called my wife about suspicious transactions on our account. It turned out the suspicious transactions in question were actually payments we received.

Odd, right? Yet it gets odder.

The dude from ING kept asking what the payments were related to, and my wife answered that she honestly had no idea. Then I remembered I’d sold some sheep troughs on eBay, and that was the transaction in question. It was all very … sheepy.

So what do I think of ING?

Well, these days ING is a lot like U2. The Joshua Tree was an awesome album, edgy and original … but now they’re just a little bit same, same, lame. There are better accounts on offer.

Still, their online saver is currently paying 5.25%, and they don’t charge transaction fees. And as for them ditching the foreign ATMs, well, I’m as likely to use that as I am to listen to All That You Can’t Leave Behind.

Barefoot OnlyFans?

Hi Scott,

I’d like to learn to do forex cash trading as a side hustle to supplement my income (so eventually I might be able to move to part-time work and have more time to spend with my daughter, who’s eight and was diagnosed with anxiety last year). Can you recommend any online trader training and trading access platforms? I’ve started searching for options but am bamboozled by the plethora of trader-training companies out there. And it bothers me that some of them take ongoing commissions and monthly fees as well as significant training charges ($5000 to start with!), not to mention all the hard-sell emails and phone calls I’m now receiving! Any advice would be much appreciated.

Linda

Hi Linda,

You dabbling in forex is like me joining OnlyFans as a side hustle.

No one is going to pay to see me wobble my dad-bod around the farm. After all, I’m competing against very good-looking people (who also know how to milk a cow).

Just like you will be competing against billion-dollar hedge funds and the biggest financial institutions in the world, both of which not only employ the best traders but spend millions on their AI trading algorithms.

My thoughts?

You will lose, and with fast-trading forex the odds are that you’ll get wiped out quickly. Stay away from the gurus cold-calling you – they’re all bad news.

Leaving a Cult

Hi Scott,

I’ve known about the Barefoot Investor for years, but I couldn’t buy your book as I was being severely controlled physically and financially by my parents, who raised my siblings and me in a religious cult that considered living in poverty as absolute for being a devoted follower.

My parents literally took every cent I earned for over a decade and coerced us into paying off their five personal investment properties. Last year, after getting a good legal team and a Supreme Court hearing – and breaking free of the cult I was born into – I purchased your book as a birthday present to myself (celebrating birthdays was forbidden in the cult).

My husband and I are now working through the Barefoot Steps together and I have purchased your book for my siblings and their partners, as well as the few close friends who haven’t shunned me after I escaped the cult. I’m truly happy for the first time in my life and have control over my own finances. Thank you.

Rebecca

Hi Rebecca,

There are no winners in this situation … but a couple of sinners.

Your parents applied a religious lens to justify their behaviour, but they were really motivated by greed, power and control. (Though you don’t need to be in a cult to practise monetary manipulation. I meet plenty of women in abusive relationships who have been forced to take out car loans … but don’t have a licence.)

Standing on your own two feet financially will be part of your recovery, and it’ll help rebuild your self-confidence. Welcome to the … Barefoot ‘cult’!

Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions