Barefoot Investor: Sun will still rise after market madness

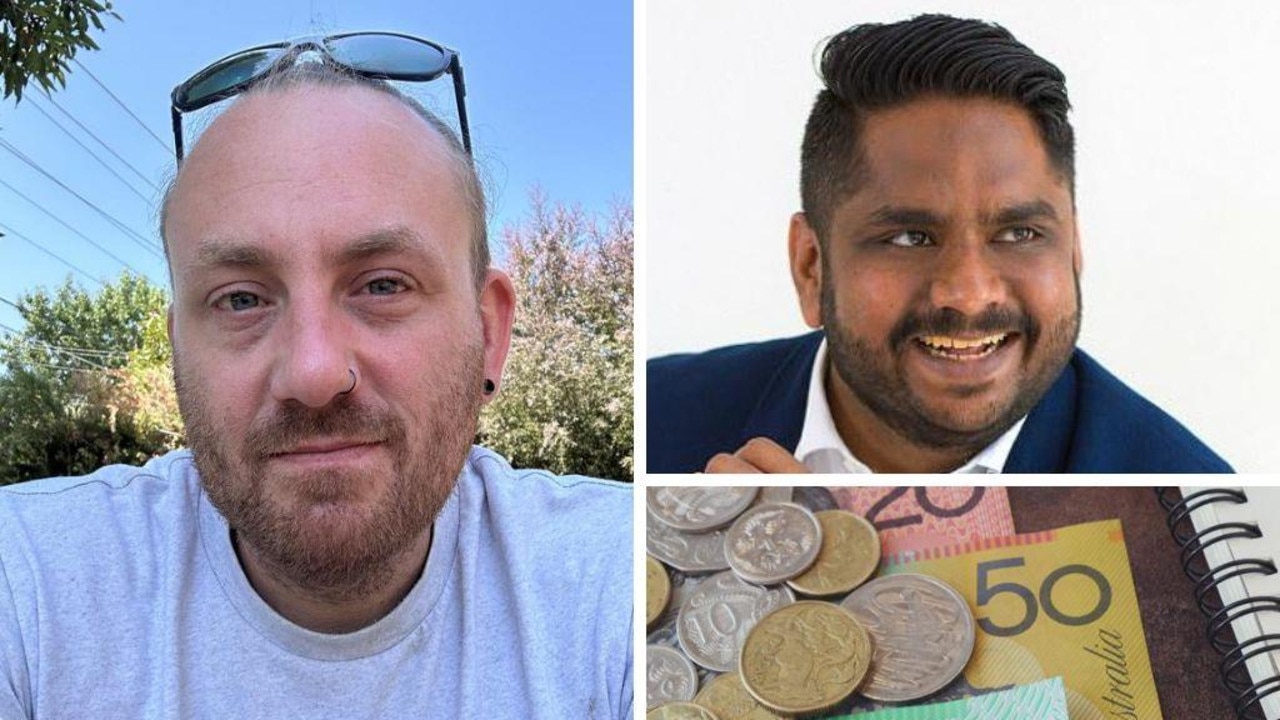

A WOULD-BE retiree who panicked over Monday’s market madness feels physically ill over the prospect over lost super. Barefoot Investor Scott Pape is ready with advice on how to ride the financial rollercoaster.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

A WOULD-be retiree panicked over Monday’s market madness and says he feels physically ill over the prospect over lost super.

But while this week’s volatility on global stockmarkets has left many people concerned as their investments take a turn for the worse, Barefoot Investor Scott Pape is ready with advice on how to ride out the financial rollercoaster.

The best-selling author says this is only the beginning of tougher times ahead — but with extra strain on budgets, the time to take action is now.

JOHN ASKS: As I write this, the Dow Jones has suffered its “biggest fall in history”. They are saying on Sunrise that our market will plummet today. I feel physically ill.

I am 62 years old, earn $110,000 a year (I work in logistics for a government department) and am due to retire in three years — or at least that was the plan until today! I feel so stupid.

This was the year I was finally going to sort my super, work through the steps in your book and get on top of it all.

But have I left my run too late? What should I do? Help! I’m panicking.

BAREFOOT REPLIES: Thanks for your email, which brilliantly captured the madness of Monday’s market.

It’s like you wrote it on a plane just as the oxygen masks fell from the ceiling: “Captain Kochie says the market’s plummeting!”

But then after a few scary bumps the pilot’s voice comes over the PA saying “sorry about that, folks, we just hit some unexpected turbulence; everything is back to normal now”.

So adjust your tray table, resume your in-flight viewing, and notice that Kochie has gone back to dancing with the Cash Cow. Okay, enough with the analogies.

Monday saw some brief market turbulence, but there will most certainly be a crash at some stage. That’s because, historically, the Australian stock market crashes every 10 years or so.

The good news is that it’s not too late.

What I’m saying, John, is that you need to harness the fear you were feeling when you wrote me this email on Monday, and make sure you strap on your financial life jacket right now.

Here’s what to do: First, get rid of any debt you have. Interest rates have never been lower — but that won’t always be the case.

The time to get out of debt is right now. Second, get rid of any dodgy investments you have. They fall into three camps: the ones your brother-in-law talked you into, the ones you’ve borrowed money for that aren’t paying their way and anything you don’t understand. Ditch ’em.

Third, my advice to anyone over the age of 60 who is preparing to strap on the sandals and socks is to start aggressively building up three to five years of “Retirement Mojo” — a cash buffer of living expenses.

(If you think you’ll get a pension or part-pension, that’ll reduce the amount you’ll need to save to reach your buffer.)

Better yet, put it on autopilot — contact your super fund and request that all future super contributions go to a cash and fixed-interest investment option. Why would you do this?

Well, my old finance professor called it “sequencing risk” — which is a fancy way of saying a market crash in the final years leading up to your retirement has a significant impact on the future income you can generate from your nest egg.

I learned this first hand in 2008 when I saw many retirees watch in horror as their super got smashed.

What did they do? They sold out at the market bottom — and locked in their losses.

Think of last Monday as a test run, John.

When the real crash comes, you want to be able to say yourself: “That’s Day 1 — it’s a good thing I have 1825 days (five years) of living expenses set aside to ride this sucker out.”

That way you won’t end up having to rely on the Sunrise Cash Cow!

ACCEPT THE BLAME

NICK ASKS: I have managed to rack up a large sum ($15,000) in parking and speeding fines.

Not being able to come up with the money, I tried to pay fortnightly, but the “hardship” rate was unreasonable; and when it caused food to be taken off my table, I refused to pay.

I have not driven for three years now and the sum has magically jumped to $25,000.

I am helpless to argue for a justified repayment plan or a fair total and the lack of licence is destroying my career potential. I feel robbed by the WA police!

BAREFOOT REPLIES: Fair suck of the sav, cobber! The only person robbing your career is the hoon who racked up 15 grand in fines, and then couldn’t cough up the dough (even on reduced “hardship” terms).

Also, there was no magic involved with your fines jumping $10,000. If you Google “what happens if I stick my thumb in my mouth and don’t pay my fines for three years?”, you can clearly see the escalating fiscal repercussions of your decision. So there are two pieces of advice I’d give you:

Call the National Debt Line on 1800 007 007 and see what your options are — there may be a chance for you to do community work to pay off the debts if you have no other means.

And, most importantly, sit down and make a life-changing decision. Are you going to play the victim for the rest of your life, or are you going to take responsibility for your actions and make something of yourself?

Or let me put it another way, sport. If you keep avoiding the problem, there’s every chance you’ll wind up with a free pair of striped pyjamas, enjoying an extended sleepover with a bunch of other thumbsuckers.

AWKWARD TALKS

ANNA ASKS: My grandmother passed away in 2013 and left me, along with her other four grandchildren, $50,000.

Unfortunately, my parents put the money into their mortgage offset account without discussion, as they thought I was too young to be in charge of the money (I was 22, but I have always been very responsible and a great saver — unlike them). Five years on and I want my money!

The question is, should they be paying me the interest they made off my inheritance?

BAREFOOT REPLIES: What a pickle. If I were you, I’d do three things: First, arm yourself with the facts by reading your grandmother’s will. Were your parents required by the will to hold the money in trust for you until a certain age?

Whatever the answer, I highly doubt you’ll want to bring legal action against your parents — that would make Christmas lunch awkward, right?

Second, as financial guru Noel Gallagher advises, “don’t look back in anger”.

Look on the bright side: at least your parentals haven’t blown your inheritance on Bitcoin. The money is still there.

And using an offset account is actually a tax-effective strategy for parking short-term money — well, so long as it’s your offset account and you’re not being treated like a 28-year-old kidult.

Finally, by all means you should cut the apron strings and get control of your money — but first have a plan for it.

I’d like you to set up your three “Barefoot Buckets” and, assuming you’ve paid off your debts, start saving for a house deposit.

Then take this plan to your parents. Explain that you have a responsible financial plan that honours your grandmother’s legacy — and then hit them up for $58,000 (which includes $8000 in interest you’ve forgone over the past five years).

That’s more than enough stuffing for the turkey for this year’s Christmas lunch. Good luck!

The Barefoot Investor holds an Australian Financial Services Licence (302081). This is general advice only. It should not replace individual, independent, personal financial advice.