Australia recession: Capex spending reveals grim economic outlook

Australia is in a recession – but how bad will it get? This graph gives us a glimpse into what our future holds, and it’s not pretty.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

What does the future hold for us?

That’s the big question Australians are asking, and to answer it, we need to know what business will be doing. They’re the ones who create the jobs that pay our bills. If they are confident about the future, we can be too.

So what will business be doing?

To answer that question, the Australian Bureau of Statistics releases the capital expenditure survey four times a year. It’s an important piece of data I always look forward to.

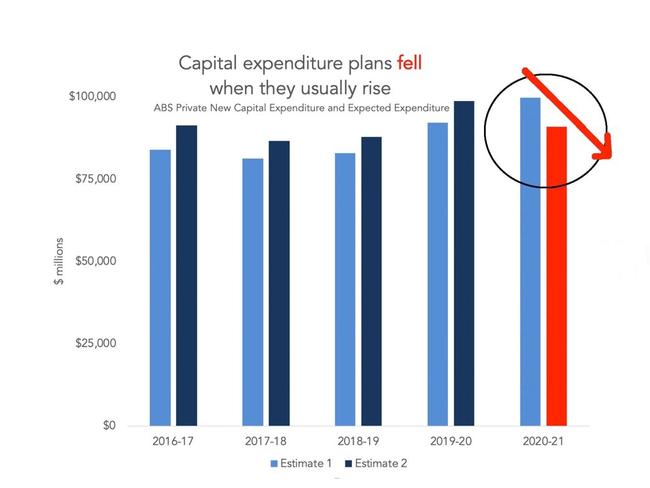

When the latest release came out, it sent a chill through the economy. Planned capital expenditure slumped between the first time they asked business to estimate next year’s spending and the second estimate.

RELATED: Australia recession: Graph that rings economists’ alarm bells

RELATED: How to survive a recession: Expert tips for your finances

Capital expenditure is all the hard things businesses buy. Trucks, sheds, machines, office blocks, and computer hardware. Imagine a Bunnings. Capital expenditure doesn’t measure the hammers and drills they sell, it measures the cost to build the big green building and the carpark outside, to buy the cash registers, etc.

Capital expenditure is important because it shows businesses have the confidence to grow and get bigger. It correlates with spending and with jobs: if they put up a new Bunnings in your suburb that’s capital expenditure, and it indicates new people will be hired, and that new spending is likely to happen.

Capital expenditure is planned in advance, and that makes it a very useful piece of economic data. It tells us about the future. Most economic data can only speak about the past. But information about future capital expenditure plans hints at how fast we can get out of our current slump.

In the capex report there are three big numbers to pay attention to:

- How much business actually spent in the three months from January to March. That was down 1.6 per cent on the previous three month period.

- How much business expects to spend on capital this financial year, which has about 30 days to go. They now expect to spend 3.8 per cent less than they did when the ABS surveyed them late last year.

- How much they plan to spend next year. This one is the key, because the ABS asks them to update their expectations and usually this number grows strongly from the first estimate to the second estimate. This time it fell. Capital expenditure plans for 2020-21 are down by 8.8 per cent.

That’s a lot of new business opportunities being left on the shelf, and a lot of jobs that were going to be created that now will not be. The fall is especially strong in non-mining investment, a category that includes retail, accommodation, cafes, etc.

One important caveat: the expected capital expenditure doesn’t cover education, and with many fewer international students, the education sector is in big trouble. So the reality could be even worse.

HOW TO SAVE 2019-20 FROM BEING A TOTAL DISASTER

Businesses are nervous about the future, and that nervousness can become a self-fulfilling prophecy. If they all hold back on their expansion plans, then the weak economy they all feared becomes manifest.

To try to spark a bit of confidence, a circuit breaker is needed.

The Reserve Bank has already cut interest rates as low as they can go, so we can’t expect anything more from them. The remaining impetus, if there is going to be impetus, has to come from the Treasurer.

The Reserve Bank Governor told a Senate Committee last week that the smartest approach was to borrow and spend.

“We have got to keep the fiscal stimulus going until the recovery is assured,” Governor Lowe said. Fiscal stimulus refers to government spending. It can be used to keep the economy flowing when private businesses and households are nervously cutting spending.

He referred to the moment when the JobKeeper and JobSeeker programs are due to end as a “critical point.” That is currently scheduled for September.

“I’ve seen … when fiscal stimulus is removed too quickly and the economy has suffered,” Governor Lowe warned.

The Governor also pointed out that the government can borrow money at an interest rate of 0.25 per cent, so borrowing is very cheap. That money could be used to build useful infrastructure, he suggested.

If we want to get businesses the confidence to spend their own money on growing and going back to hiring people, they need to believe the economy will be healthy. The best way to create that belief at the moment is for the government to step into the gap at this time.

Jason Murphy is an economist | @jasemurphy . He is the author of the book Incentivology .

Originally published as Australia recession: Capex spending reveals grim economic outlook