How to survive a recession: Expert tips for your finances

We are now officially in the midst of a recession for the first time in almost 30 years. Here’s how to ride out the tough months ahead.

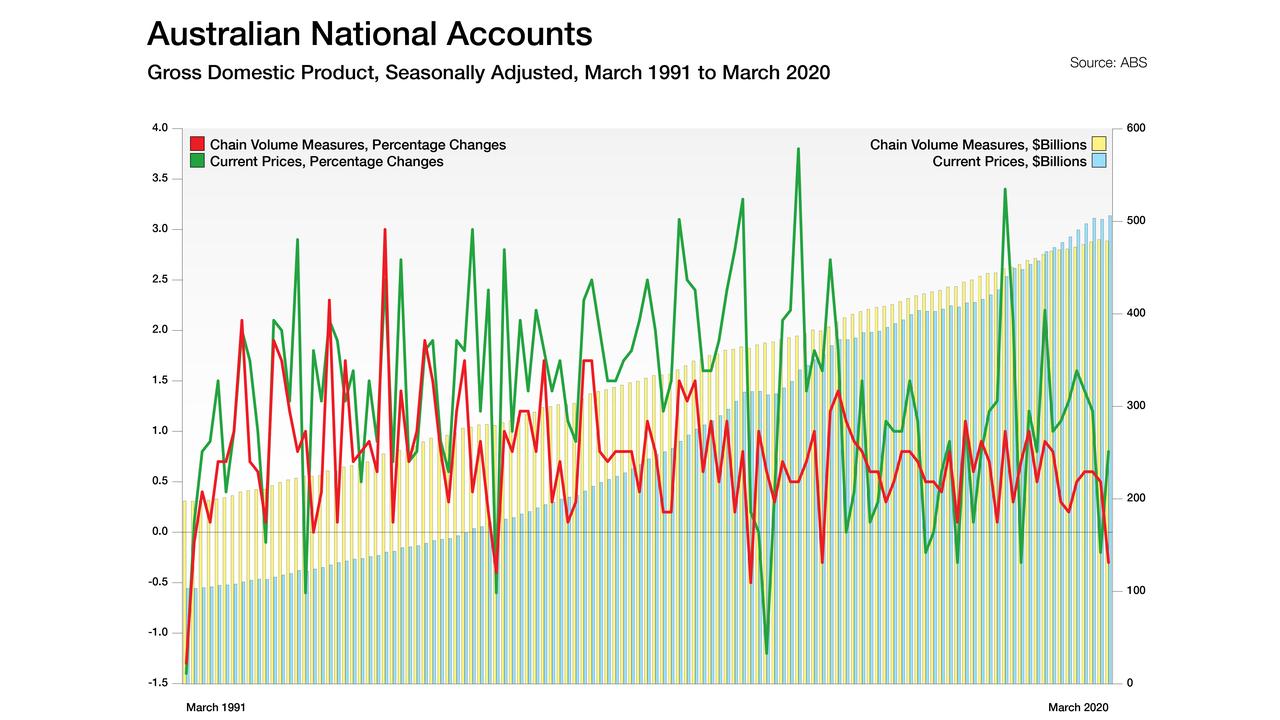

Australia’s decades-long run of prosperity has come to an end, with the nation entering an official recession for the first time since the 1990s.

The grim news was confirmed by the June national accounts data released on September 2, which revealed the economy had contracted by 7 per cent through the quarter.

It’s the most drastic fall the nation has experienced since records began in 1959, and a second straight contraction, meaning we are now in the middle of a coronavirus-fuelled recession – and the worst contraction since WWII.

The economic disaster is even more severe than the expected by economists and even the RBA, with the coronavirus crisis shrinking the economy by 6.3 per cent for the year to June and with real GDP falling by 0.3 per cent in the March quarter.

RELATED: ‘Rich get richer’: ScoMo’s scheme backfires

RELATED: Big losers of ScoMo’s home reno handout

FEELING THE PINCH

They are worrying statistics, and it’s no surprise that households are feeling the strain, with a recent Finder survey revealing more than one in three Aussies don’t feel financially prepared in the current climate.

The overwhelming majority are worried about a lack of savings, with job security and the plunging Australian dollar also causing concern.

Almost a quarter of us have had to defer bills or payments due to the coronavirus crisis, while we’ve upped our savings by 30 per cent compared to the beginning of 2020.

Finder’s money expert Bessie Hassan said families were tightening their belts as almost all of us had been impacted in some way since the crisis began.

“Regardless of your current situation, it’s important to safeguard your financial position however possible – every bit counts,” Ms Hassan said.

RECESSION-PROOF YOUR MONEY

Ms Hassan said many Australians had asked for a rent freeze and applied for benefits such as JobSeeker and JobKeeper – but she warned these measures “won’t last forever”.

Therefore, it’s essential to transfer any spare cash into a buffer account that you can rely on once the Government assistance ends, or your landlord begins charging rent again.

“Make sure you prioritise your buffer account. It’s tempting to go to the pub or eat out now that restrictions are lifting, but recessions can last for a while – you don’t know what might happen down the track,” she said.

That sentiment was echoed by Dominic Beattie, editor of online financial resource Savings.com.au, who told news.com.au people should build up an emergency savings fund that would cover three to six months’ worth of bills if you experience sudden hardship.

And if you do have savings stashed away, make sure you are getting a competitive interest rate.

“Both AMP and Macquarie Bank are offering 2.26 per cent per annum and Rabobank is also offering up to 2.25 per cent per annum,” Ms Hassan said.

HOUSING COSTS

Both Ms Hassan and Mr Beattie said as housing was one of the biggest expenses most of us faced, now was the time to look into your options.

“If your lease is due to expire soon, consider moving to a cheaper property. Rental prices have fallen significantly during the pandemic, and you can save a small fortune by relocating. Consider moving into a sharehouse to split the rent even further,” Ms Hassan said.

“If you’re a homeowner, refinancing to a lower interest rate can save you thousands of dollars over the life of your loan by lowering your monthly or fortnightly repayments.

“If you’ve been paying above the minimum repayment amount, you may also have the option to access redraw. This can help to free up cashflow if you’re falling behind on your bills.”

Mr Beattie went a step further, and said Aussies shouldn’t be afraid to downsize, or sell their home and rent temporarily.

“People in a really tough scenario who may have just lost their job might be finding it hard to keep up with their home loan repayments. You don’t want to be defaulting on your loan at the moment,” he said.

“A lot of lenders have been quite lenient in allowing people to defer during the pandemic but if your bank isn’t allowing that, you might find you have to sell your house and downsize to a smaller property, as your repayments might be lower.

“And an alternative could be to sell your home and rent for a while – obviously that’s extreme and not to be done lightly, and you should consider all options before such a drastic measure, but you don’t want to be going bankrupt or defaulting as that will leave a black mark on your credit report for many years to come.”

CREDIT CARD TRAP

When our savings are stretched, it’s tempting to fall back on your credit card to get by – but Mr Beattie said that was a trap to avoid, especially during a recession.

“People in tight spots often feel the need to rely on their credit card – it can seem like your best friend – but you can get too used to it and suddenly your bill is getting bigger and bigger and it is harder and harder to pay off,” he said.

“Credit card interest rates are still almost at record levels despite the RBA’s rate cuts – it’s not out of the ordinary to be charged 20 per cent on some credit cards … so it’s very easy to spiral out of control.”

And he said it was also the perfect time to come up with a household budget and learn how to keep track of your spending and your overall wealth, including debts and savings, superannuation and share balance.

STAY POSITIVE

It’s easy to get caught up in the doom and gloom, but Mr Beattie said there was light at the end of the tunnel as all recessions are temporary.

“Recessions don’t last forever and things will get brighter – it might seem tough now, but be prepared and things will get better,” he said.