ANZ admits it relies on brokers’ data for loan applications but ignores its own

ANZ puts more faith in expenses data filed by mortgage brokers than “contradictory” information from its own bank accounts when it assesses loan applications, the banking royal commission has heard.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

ANZ puts more faith in expenses data filed by mortgage brokers than “contradictory” information from its own bank accounts when it assesses loan applications, the banking royal commission has heard.

The bank chooses not to scrutinise its customers’ bank statements to assess their expenses when they apply for loans through brokers, the commission heard yesterday.

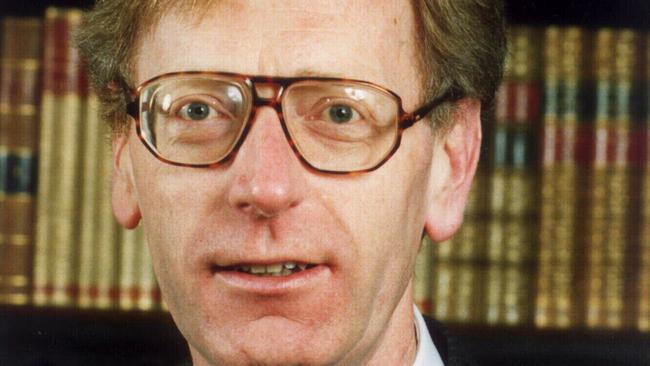

Counsel assisting the commission Rowena Orr, QC, asked ANZ home loans general manager William Ranken if the bank were in breach of the credit code as a result.

BANKING ROYAL COMMISSION INUNDATED BY PUBLIC SUBMISSIONS

NAB THE FIRST OF BIG FOUR TO GET GRILLED AT ROYAL COMMISSION

BUMPER GUIDE TO MELBOURNE FOOD AND WINE FESTIVAL

MELBOURNE INTERNATIONAL COMEDY FESTIVAL: COMPLETE GUIDE

ANZ had a “legal obligation under the National Credit Act” to “assess whether the customer has the ability to service commitments”, she noted.

But Mr Ranken rejected the suggestion ANZ had broken the rules, saying internal records of such expenses were “hard” to analyse.

The bank had other processes, including the use of the household expenditure measurement — or HEM — to assess expenses, he said.

That measurement makes use of statistical benchmarks and is used by all lenders but is widely seen as outdated and has already been criticised at the commission.

Ms Orr said: “You’ve got bank accounts to show that the expenses are different to what is recorded in the documents submitted by the broker — you say you do nothing about that.”

Mr Ranken said: “Our processes are, we do nothing.”

The ANZ executive said it would be “highly complex and costly” to contrast internal information with details provided by brokers.

“We’re talking about the manual review of paper-based statements, and to use those to verify (a) customer’s statement of position would be very highly complex and very time consuming, very costly and ultimately not very helpful,” Mr Ranken said.

Ms Orr presented a report prepared for ANZ last April by accounting titan KPMG that recommended using bank statements to check expenses.

“Bank statements could be reviewed for general account conduct to identify any obvious inconsistencies between the customer’s stated expenses and the transaction history,” KPMG told ANZ.

he commission also heard that between October 2016 and September 2017, 58 per cent of ANZ mortgages came through mortgage brokers. These were valued at $67 billion. Commissioner Ken Hayne asked Mr Ranken in what way brokers were provided incentives to care about the accuracy of customer spending claims.

“Why is it in the interest of the broker for the customer to face the truth of their expenses,” he said. “There is nothing in it for them, is there?”

Ms Orr also referred to the case, originally presented on Friday, of Robert Regan — a 72-year-old aged pensioner who a year ago received a $50,000 ANZ loan secured against his house.

She referred the commission to internal ANZ documents showing the bank, in considering his loan, said that if he struggled, Mr Regan could “downsize” and sell his home to pay off the debt.

“Nobody asked Mr Regan if he would be happy to sell his home, did they?” she asked.

Mr Ranken responded: “No”.

Mr Hayne asked Mr Ranken, just before he left the stand, if he stood by ANZ’s decision to offer Mr Regan a loan.

“In hindsight, it is hard to make that clear delineation,” Mr Regan said. “With the same information available to us, the same decision would be made.”