Gold Coast crime: 15 outrageous scams to be detailed before courts

Greed makes some people do crazy things - leaving others to pick up the pieces. Here are some outrageous scams revealed in Gold Coast courts.

Police & Courts

Don't miss out on the headlines from Police & Courts. Followed categories will be added to My News.

GREED makes some people do crazy things. Some Gold Coasters took the quest for wealth too far – and suffered the consequences in court. Here are some of the city’s most prolific fraudsters and scammers.

Billabong bungle

EX-BILLABONG boss Matthew Perrin made headlines for all the wrong reasons when it emerged he had forged loan documents.

Perrin, 47, was sentenced to eight years jail after a jury convicted him of forging his ex-wife Nicole Bricknell’s signature in order to pocket a $13.5 million loan secured against his wife’s Cronin Island home on the Gold Coast, which he used to invest in a speculative and ultimately disastrous Chinese supermarket business.

In a Court of Appeal decision delivered in September 2017, Perrin’s parole eligibility date was listed as being this year.

But the former businessman hit the headlines again last June when he was released on parole early.

Strip scammer

A BOOKKEEPER forced a Surfers Paradise strip club into liquidation after she stole about $1 million and then tried to claim she was unfairly sacked, a court was told.

Tina Harris, 54, will remain behind bars until at least June 2023 after admitting in the Southport District Court in October last year to a five-year scam.

She pleaded guilty to one count of fraud and was sentenced by Judge David Kent to eight years prison.

Harris was trusted by Players Group owner Paul Janice Petrie to act as bookkeeper and pay the company’s wages and bills between July 2008 and July 2013.

Players Group consisted of a number of Gold Coast companies including Players Showgirls and charity Good Times Queensland.

Crown prosecutor Judith Geary said instead, Harris transferred money into her own accounts, to other family members and friends.

The court was told the strip club Players Showgirls went into liquidation in 2012 because of the theft.

He sentenced her to eight years in prison with parole eligibility on June 24, 2023.

Super raid

A RETIRED engineer siphoned more than $500,000 from his partner’s superannuation account by pretending to be her over the phone.

John Borovac, 68, fraudulently obtained withdrawals from QSuper between August 2015 and June 2017 to feed his alcoholism and gambling addiction.

Crown prosecutor Emily Coley said the woman’s account was “completely depleted”. The couple had been together for more than 25 years.

The Carrara man pleaded guilty in the Southport District Court in November last year to two counts of fraud and one count each of attempted fraud, forgery and uttering, personation in general and uttering a forged document.

Judge Jennifer Rosengren sentenced Borovac to four years in jail, suspended after eight months.

Casino chip cheat

A HIGH-END retail worker was busted on CCTV camera trying to bluff the Star Casino out of almost $20,000.

Winnie Huang was part of a high-stakes scam that involved hiding betting chips on the card table and only alerting the dealer to the bet when the hand won.

The single mum placed a $10,000 plaque in the betting area behind the card shoe and out of the dealer’s sight while gambling at the Star Casino at Broadbeach on June 7, 2017.

When the hand lost, Huang, 28, left the chip on the table instead of surrendering it to the dealer. She played a number of hands with the plaque hidden on the table.

Her deceit totalled up to $19,500.

She pleaded guilty in September 2019 to fraud.

Magistrate Joan White sentenced her to 12 months jail, to be wholly suspended for two years.

Real estate agent gone bad

A FORMER real estate agent and serial fraudster conned a mate into giving him $63,000 so he could be a guarantor on a home loan.

Chen had told his friend he needed the money in his bank account to prove he had the assets to act as guarantor. The 47-year-old pleaded guilty in the Southport District Court in September last year to fraud over $30,000. It was the third time Chen had been convicted on fraud charges since 2014.

Judge Paul Smith sentenced Chen to three and a half years in prison, with parole eligibility of November 22.

Public servant’s Centrelink fraud

A GOLD Coast mother of three was ordered to pay back the $12,000 she swindled from taxpayers while working at two government agencies.

Sandra Dorne Colbert, 46, received welfare payments for 13 months while working part-time at the Australian Taxation Office and later Centrelink.

She was employed at Centrelink to advise others how to declare payments correctly.

She failed to declare to Centrelink that she was employed and later did not update any change in circumstances after transferring roles.

In January this year she pleaded guilty to obtaining financial advantage for one’s self, 14 counts of making a false document and 14 counts of using forged documents.

Colbert was sentenced to nine months’ prison, with immediate release, and was ordered to serve a two-year $800 good behaviour bond.

From Russia with love

A WEALTHY Russian mum was getting Centrelink family benefits while she secretly transferred $750,000 from offshore accounts to avoid being taxed.

Nadezda Bek transferred $8000-9500 from Russian credit cards to two Australian accounts more than 70 times between July 2014 and February last year.

Under federal law any cash amount more than $10,000 transferred into Australia from a foreign country is reportable and taxable. Taking steps to deliberately avoid the reporting threshold is an offence.

Bek grinned as she left the Southport District Court in May last year, avoiding spending any time in prison.

Judge Catherine Muir sentenced Bek to four months in prison with immediate release on a 12-month, $1000 good behaviour bond.

The 35-year-old pleaded guilty to one count of conducting transactions to avoid reporting requirements relating to threshold transactions.

Beauty betrayer

A GOLD Coast beautician scammed the credit card details from a client while she had her eyes closed for eyelash extensions.

Casey Jade Leather then went on spending spree, splashing out $6600 over six days in June on an Apple Watch, Xbox, Samsung sound bar, MIMCO handbags and wallets, Ugg boots, clothes and kids play sets.

Leather pleaded guilty in the Southport Magistrates Court in September last year to 19 fraud charges and one count of possessing dangerous drugs.

A woman was having her eyelashes done and unable to open her eyes when Leather stole the cards.

After taking down the details, Leather then returned to the cards to the woman’s wallet.

Magistrate Jane Bentley sentenced Leather to six months in prison, to be wholly suspended for 12 months.

She ordered Leather pay $3808 in restitution.

Boiler room cocaine

A SILVER-TONGUED salesman used $1.7 million of other people’s savings to support his cocaine habit, lavish holidays and nights out in Surfers Paradise.

Stephen William Chant, 49, s pent months convincing more than 40 people across southeast Queensland to part with their cash as the leader of a sophisticated boiler room scheme.

All of that money is gone.

Chant had fled to New Zealand to avoid facing the consequences.

He was sentenced in the Southport District Court in June last year to five years in prison, to be suspended after he had served two years. He has been behind bars for 18 months.

Chant pleaded guilty to two counts of fraud and one count of money laundering.

Chant used businesses Freedom Connect and Leading Edge Strategic Group to convince people he could get 20 per cent returns on their investments.

They got none and lost all their money.

The schemes were run between February 22 and October 28, 2011 and September 23, 2013 and March 15, 2016.

Website fake out

A GRAPHIC designer created fake websites and online testimonies for a bogus computer software company to scam $2.16 million out of victims across Australia.

Pierre Joseph Aghajani was contracted by a Gold Coast-based company and knew what he was doing was illegal, a court was told.

The 31-year-old was sentenced in the Southport Magistrates Court in May last year after he pleaded guilty to producing fraudulent online material.

The boiler room-type scam, which featured a call centre based in Surfers Paradise trading under Financial Endeavours, sold investment software packages targeting customers through cold calls. More than 200 dissatisfied clients complained to police between January 1, 2014 and August 16, 2015.

The syndicate’s former receptionist Chloe Rose Podger, 28, and customer service officer, Thomas Philipp Pfaff, 53, were also sentenced in May after pleading guilty to producing fraudulent material.

Magistrate Kay Philipson sentenced Pfaff to two-and-a-half years in jail, wholly suspended for five years.

Podger was sentenced to 18 months in jail, wholly suspended for three years.

Aghajani was sentenced to 12 months in jail, wholly suspended for two years.

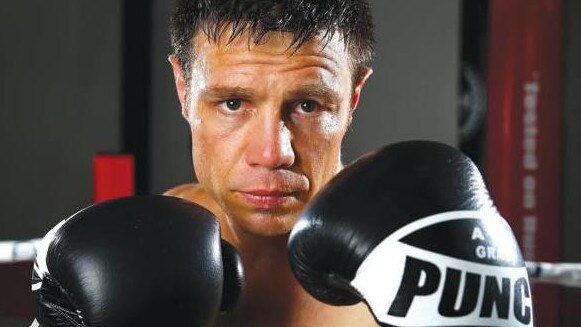

Urine trouble for boxer

TROUBLED former boxing champion Michael Katsidis asked two mates to provide clean urine samples in a “harebrained” scheme to clear his name of driving while on ice, a court was told.

Only one mate, Benjamin Kalcina, a former high-level rugby league player, agreed to pretend to be Katsidis for the urine sample.

The ploy did not work, with Kalcina’s sample testing positive for cannabis.

The failed plot was described as “foolhardy”, “destined for failure” and “not going to go anywhere” by Katsidis’s own lawyer.

Katsidis, 38, pleaded guilty in the Southport District Court in March last year to two counts of attempting to pervert the course of justice and one count of obtaining identification information.

Kalcina, 35, pleaded guilty to attempted fraud, forgery and uttering a forged document.

Katsidis was sentenced to 18 months prison with immediate release on parole while Kalcina was sentenced to four months in jail which was wholly suspended for an operational period of one year.

Outside court Kalcina said: “Just sometimes you help your mates out.”

Fat fear

AS a 60-year-old woman convicted of ripping off taxpayers to the tune of $250,000 awaited her fate in court, she told her family she feared getting fat in prison.

A jury in February last year convicted Gold Coast woman Laura Aprile on six counts of using a forged document and three counts of obtaining financial advantage, after a five-day trial.

The offending related to three business activity statement (BAS) periods in which Aprile lodged false information as business expenses and purchases that never took place.

She swindled taxpayers out of more than $246,000.

In the Southport District Court, Aprile was sentenced to a total of four years in prison, with a parole eligibility date after she serves 18 months.

She was also ordered to pay the money back.

Sitting in the dock, Aprile spoke to family about the prospect of going to prison and was heard to tell them: “I’m going to get fat”.

Ultimate bad employee

A SERIAL fraudster was on parole when she stole more than $710,000 to buy a Range Rover, boat, jet ski, clothes and travel for her family.

Arabella Violet Anderson’s behaviour was so reprehensible that Judge Katherine McGinness ordered future employers be warned about her criminal history.

Anderson made 75 unauthorised transactions from her employer Wraith Capital Group to her own account between March 2015 and June 2016.

The 44-year-old was sentenced to eight years prison, with parole eligibility in July next year, after pleading guilty in Southport District Court in January last year to fraud.

It was just five weeks after Anderson started at Wraith Capital Group that she started taking the cash.

Faking being a cop

A GOLD Coast man who pretended to be an undercover police officer to coerce an escort into performing a sex act had also previously beaten sex workers.

Daine Robert Johnson, 37, was sentenced to two years prison in November 2018 with immediate release on parole after pleading guilty to fraud and assuming designation or description of a police officer.

He told the woman if she performed a sex act she would not be charged.

The woman forced to perform the sex act described it as a “sheepish, timid and horrible” experience.

Party poopers

A MOTHER-daughter duo of serial fraudsters who scammed more than $107,000 through fake loan applications and a dodgy party planning business were each sentenced to four years jail.

The mother in the two-person scam team Cassandra Thomas, 51, walked from the Southport watchhouse in June 2017 after spending 480 days behind bars.

Her daughter Courtney Elice Glover, 28, remained until the end of September having only spent 260 days in pre-sentence custody.

The pair pleaded guilty in Southport District Court to multiple counts of fraud, attempted fraud and obtaining someone else’s identification details.

The duo’s crime spree spread from the Gold Coast to Innisfail and began in 2013 before they fled to Victoria while on bail in 2015.

Judge Michael Rackemann suspended the pair’s jail terms for five years once they had both completed at least 12 months.