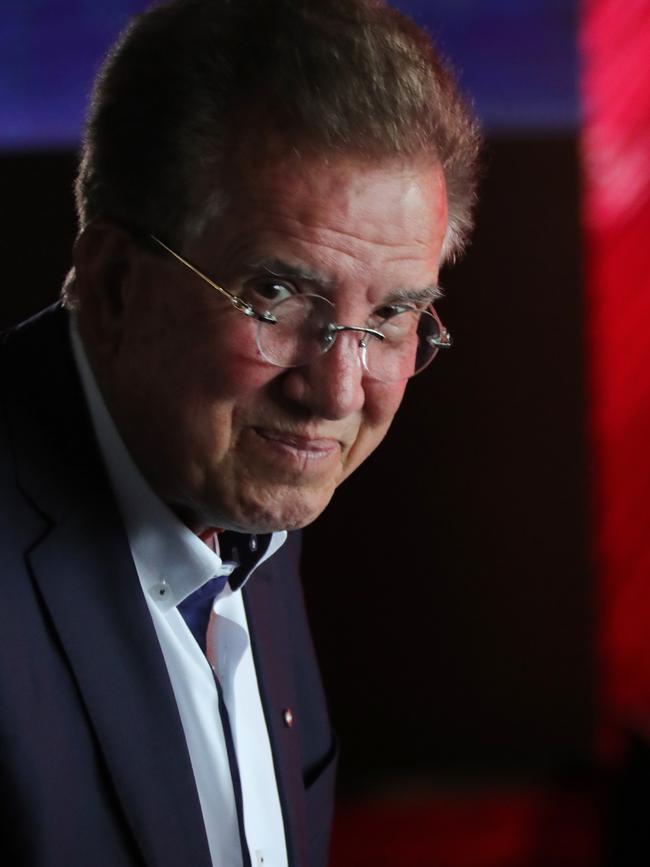

Gold Coast developer Jim Raptis buys $16m property at Mermaid Beach amid ATO asset freeze

Developer Jim Raptis, in the middle of a $110 million arm wrestle with the Tax Office, is paying $16 million for a Mermaid Beach site that comes with a KFC outlet. DETAILS>>

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

DEVELOPER Jim Raptis – in the middle of a $110 million arm wrestle with the Australian Tax Office – is paying $16 million for a Mermaid Beach site that comes with a KFC outlet.

He signed up for the former movie theatre property in August, weeks before the Federal Court froze $80 million in Raptis family assets.

The KFC site purchase has gone unconditional but a settlement date has not been revealed.

Mr Raptis confirmed he’d purchased the property, but declined to detail his plans for it.

“We plan on putting in plans for the first quarter of next year,” he said.

“We have concepts in our mind but nothing on paper of what it will be like.”

Roland Evans, principal of Canford Estate Agents, marketed the highway-front property and announced in August that it was sold.

Mr Evans declined to comment on the sale.

Prolific tower builder Mr Raptis, outside his listed Raptis Group, has new projects under way at Main Beach and Broadbeach.

The new Raptis property, at 2506 Gold Coast Highway, spans 6525 sqm and has frontages to Crescent Ave and Gaven Crescent.

It includes the Gold Coast’s first major cinema centre and was, until earlier this year, the long-term home of a Sizzler restaurant.

Tenants are KFC, a medical centre and a snooker hall, with an Optus mobile-phone mast also providing income.

Seller Greg Van Zeeland, a Brisbane investor, bought the property from receivers for $5.9 million in 2011.

Birch Carroll and Coyle owned the then 1.5ha holding, home to a five-screen cinema centre, from 1981.

The property was sold to investor Harry Pamamull for $4 million in 2001, with the cinema chain vacating it the following year.

It was on-sold to developer Larry Matthews for $6.8 million in 2005 and he developed a 70-unit project, Zone, on the western side of Gaven Crescent.

Receivers took control of the balance of the property when the Matthews business ran into turbulent waters during the GFC.

The ATO said on October 1 that it was chasing almost $110 million allegedly owed in taxes and penalties by Mr Raptis, members of his family and other entities they allege are linked to him.

The Raptis asset freeze, which also is linked to wife Helen and son Evan, takes in the Mr Raptis’s Paradise Waters home and will last until a case management hearing in February.

A Raptis spokesman last month said the developer was co-operating with the ATO and that there were ‘productive discussions’ with the tax body to clarify and resolve matters.