Retail Food Group has devastated the franchising industry through an ‘unjust’ business model that bled franchisees dry in the name of shareholder profit, a damning parliamentary report has found.

The Gold Coast food franchisor is fingered as the chief culprit in an industry-wide inquiry by the Parliamentary Joint Committee on Corporations and Financial Services, which released its report yesterday.

RFG REVEAL HUGE $111.1M NET LOSS

The committee has recommended a wide-ranging and significant overhaul of the sector to address systematic abuses of the system that have seen franchisees lose their homes, assets and livelihoods.

Past and present management from RFG came in for the most scathing criticism, with the committee recommending a three-pronged investigation into the company and its current and former executives to look for insider trading, short selling, market disclosure and tax avoidance.

THOUSANDS OF DOLLARS OF DEBT DUE TO RFG FOR COAST FAMILY

Among other findings/recommendations were:

●RFG’s business model remained high risk because of continued reliance on acquiring brands, opening new outlets, exploitative fee gouging and increased costs to franchisees while services were cut at the same time

●The company operated an unjust business model where shareholders and senior executives profited at the expense of franchisees

●Evidence that after franchisees walked away, their businesses were reacquired by RFG and sold on without full disclosure to the buyer

●RFG has damaged an industry that has historically been seen as a safe option for new business owners

FORMER RFG EXECS NOW THE COMPANY’S LANDLORDS

‘FRANCHISE SUCCESS STORY’:

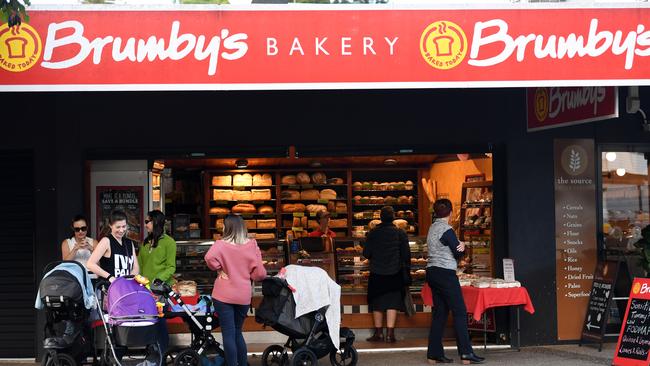

The Southport-based company listed on the ASX in 2006 and grew quickly, adding 2000 outlets between 2007 and 2014. In 2007 it acquired 600 Brumby’s Bakeries outlets, in 2012 110 Pizza Capers outlets and 119 Crust Pizza outlets and 800 Gloria Jean’s Coffees shops in 2014.

Between 2014-15 and 2016-17 the number of stores opening and closing was around 200 for both figures.

However, closures soared in 2017-18 while just eight new stores were opened.

The share price began to fall in the first half of 2017 after an increase in short-selling of RFG shares.

The stock fell further after UBS reports downgraded its target price based on the introduction of new accounting standards.

At the end of 2017, RFG’s share price plummeted following media reports about mistreatment of franchisees. It unveiled a $306.7 million full-year loss for FY18. Its stock never recovered and has traded as low as 18c.

RFG SHARES HIT LOW OF 28 CENTS AFTER GROUP LOSES 5-YEAR LEGAL BATTLE

‘CASH IS KING’:

One-sixth of franchisee submissions to the inquiry related to RFG. Concerns raised included: poor disclosure of the financial viability of franchisees; franchisees being compelled to buy from suppliers who gave secret commissions to RFG; ownership changes that effected product quality and imposed costs on franchisees; lack of accountability for marketing fees and the churning and burning of outlets. In addition unviable franchisees ended up destroying the franchisees’ assets because they were unable to escape “harsh termination conditions”. Former RFG credit controller Elke Meyer gave evidence she had warned executives that the business model was unsustainable.

SUBSCRIBE TO THE GOLD COAST BULLETIN — JUST $1 FOR THE FIRST 28 DAYS

“When a company’s staff and franchisees are consistently disgruntled, stressed, and

volatile; and your staff retention rate is incredibly low so you constantly have inexperienced staff dealing with issues the franchisees have; it appeared doomed to fail in my opinion,” she told the committee.

“The motto was ‘Cash is King’ … it was creating a false economy as it was not sustainable long term if the franchisees and staff were constantly unhappy and struggling.”

She also said she spoke to many franchisees who believed RFG lied to them about the profitability of the stores they were purchasing.

FORMER RFG EXEC SUING COMPANY FOR $1.62 MILLION

‘CHURNING AND BURNING’:

The report notes that the listing on the stock exchange may have been partly responsible for the franchisees struggling to be profitable.

“In order to satisfy shareholders, the focus shifts from long-term sustainability to short-term profitability,” the report reads.

“In short, there is a risk that listed or private equity may try to extract too much value

from the franchise system, namely shifting profit from the franchisees to the shareholders.”

The committee also takes aim at the so-called “churning and burning” of franchisees, referring to the repeated sale of a failed franchise to a new franchisee and the continual opening of new outlets to profit from upfront fees.

OTHER NEWS:

Surf Life Saving Queensland accused of sexism

Coast workers lose millions in super rip-off

Weather warning: Prepare to spend Saturday indoors

However, it said, the committee came up against repeated roadblocks when it tried to refute or verify allegations. RFG refused to provide requested data on four occasions.

The committee said this either meant RFG had potentially misled parliament, or that management were “incompetent”.

“Given such high rates of outlet turnover, the committee finds it incomprehensible that

nobody in an organisation the size of RFG undertook sufficient due diligence to

ascertain whether certain outlets were being churned. If that was the case, it points to

negligence on the part of the board and senior executives,” the committee said.

The report also looks into the actions, or lack thereof, of the regulators, including the ACCC.

“The committee is surprised that none of the relevant regulators appear to have undertaken any investigation that has led to court action, or, at the very least, public acknowledgment of misconduct.” It said the ACCC, ATO and ASIC had not conducted thorough examinations.

It said RFG’s business model remained “high risk”, with cases of fee gouging apparently continuing to occur. While this may have been within the bounds of the code of conduct, this was more troubling because “it speaks to the extent to which an outfit such as RFG is able to engage in harmful but legal behaviour”.

NO NEW RFG STORES IN SIX MONTHS AFTER SCANDAL BROKE

‘NEW POWERS’:

The committee calls for more powers for the ACCC to take action where there are indications of churning and burning. It says the ACCC should be given powers to intervene and prevent the marketing and sale of franchises where a franchisor shows a track record of churning and/or burning. ACCC commissioner Mick Keogh said he was heartened the committee had adopted its recommendations regarding what it saw as the inadequacy of the franchising code. “Reform to the code is important and then the ability to enforce it and the resources necessary to do that would be the other important element of progress in this area,” he said.

Mr Keogh said a lack of penalties around the code was an issue. “Implementation of penalties around the code is quite important.” He said new powers around the churning and burning issue were complex to address. “We recognise in all our franchise sector work that when we take action against a franchisor we can also cause consideration harm to franchisees at the same time.”

SUBSCRIBE TO THE GOLD COAST BULLETIN — JUST $1 FOR THE FIRST 28 DAYS

He confirmed there is an investigation into RFG underway, but declined to give details. “Quite a number of complaints have been raised with us, but unfortunately we can’t go into any more detail on that,” he said. The report also recommends a three-party investigation by the ACCC, ATO and ASIC into RFG and its current and former executives and companies and trusts they own. This includes a long list of areas such as the Australian Consumer Law, the Franchising Code of Conduct, insider trading, short selling, market disclosure obligations, compliance with directors’ duties, audit quality, valuation of assets (including goodwill), and tax avoidance.

Other recommendations, not specifically aimed at RFG, but the wider sector, include an

inter-agency Franchising Taskforce to look at the feasibility and implementation of the recommendations, protections for whistleblowers, and amendments to the franchising code to provide prospective franchisees with a clearer picture of financials prior to purchase.

It also proposes fines for breaches of the code.

Add your comment to this story

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout

Sharks unveil huge new stadium, $500m mega development

Southport Sharks has unveiled plans for a near-21,000-seat stadium and three residential towers in a massive redevelopment that could reshape the Gold Coast's sporting landscape.

Revealed: All Coast’s options for solving gridlock nightmare

The Gold Coast's population will surge by 350,000 in two decades, but the city's transport blueprint remains in limbo after light rail's dramatic cancellation. FIND OUT MORE