MORE than a dozen multimillion-dollar property barons own land equal to six times the size of Surfers Paradise.

For the first time, a Gold Coast Bulletin report into the Coast’s biggest landholders reveals 16 companies own 9108ha of land and development sites on the Gold Coast and northern NSW.

The holdings are equivalent to 6.82 per cent of the city’s 133,372ha land.

The top three landholders, comprising Songcheng, Leda Group, and Perron Group, owned 7965.9ha, which is the size of Ormeau and Yatala (7220ha).

Three landowners, comprising Leda Group, Perron Group, and Japan-linked Polaris, have plans for more than 17,000 lots and/or homes in northern NSW, Worongary and Coomera.

Ray White Special Projects (Queeensland) associate director Dax Roep said based on the current run rate of land sales, there would be 10 years’ worth of supply if the above projects were released to the market.

“Based on that number of 17,222, between those estates, it would appear that there is sufficient supply for more than 10 years,” he said.

“However, I’d stress that the bulk of this is within Leda’s two estates, which are both located south of the border, and will not satisfy the needs of buyers who will need to be on the northern end of the Gold Coast for employment or personal reasons.

“Taking out these two estates, the supply falls back to well under five years. This is not to say there aren’t other infill and smaller estates that will help add to the total available.”

Songcheng Performance Development is the biggest landholder with 6162ha under its control — the size of Mudgeeraba and Bonogin (6680ha).

SCROLL DOWN FOR AN IN-DEPTH LOOK AT EACH OF THE COAST’S BIGGEST LANDOWNERS

At number two on the list is one of the city’s most successful property kings, Bob Ell.

The billionaire, who earned his stripes in the cutthroat Sydney property market, has huge land holdings in northern NSW.

Tipped to be valued at more than $1 billion, his two parcels at Cobaki and Kings Forest are earmarked for 10,000 new properties.

Plans for the Cobaki estate appear to be moving forward.

GET A NEW SET OF HEADPHONES WITH YOUR DIGITAL SUBSCRIPTION

Last month the developer lodged an application to Tweed Shire Council to move stockpiles of material to the site to be crushed, screened and blended to be made into road base.

According to the development application, this material would then be used for the road network on the proposed estate.

Gold Coast businessman Clive Palmer also makes the top 16 — his 75.9ha slice of Merrimac could be considered a gamechanger for the suburb.

He bought the land in 2013 for $7.9 million, and in 2015, lodged plans with Gold Coast City Council to build eight 30-storey towers on the Robina-Merrimac floodplain.

The plans recently went out for public consultation.

Plans for the $1 billion Pacific View Estate at Worongary, on the western side of the M1 Motorway, are underway.

Western Australia’s Perron Group, founded by billionaire Stan Perron, owns the 342ha parcel off Hinkler Drive that was held by reclusive millionaire Bob Anthes, who died in 2004.

While prices for blocks have not yet been released, work is underway upgrading the area’s water and sewer system, and there are plans for a railway station and school on the site, which is expected to hold 3500 homes.

It is anticipated this community will ease the land shortage on the Gold Coast over the next 10 years.

However, the plans for the 3722-dwelling Polaris Coomera Woods project appear to have struck a roadblock.

The plans are on hold while the Federal Government investigates the risk to the koala population.

THE BIGGEST LANDOWNERS REVEALED

Songcheng Performance Development

(run by chairman Qiao Ling Huang, who owns 19 per cent of the company)

Value of landholdings (undeveloped): $1.055 billion plus

● Norwell Valley farmland: 6117ha

● 114-129 Nerang Broadbeach Rd, Nerang: 45ha

Chinese theme park operator Songcheng has very different plans for its two Gold Coast sites.

On the Nerang site it wants to build a $600 million theme park on a property that was once farmland.

It bought the site in 2016 for $55m from fellow Chinese company Wanda.

A year ago it submitted a detailed development application to the Gold Coast City Council to build Australian Legends World.

Songcheng is also working on a $1 billion-plus deal to buy 6117ha of farmland from cane farmers in the Norwell Valley.

It would be the biggest land sale in Australia if it is finalised. The project would involve building an entire city over 25 years.

Leda Group

(Bob Ell)

Value of landholdings (undeveloped): $1 billion (approx.)

● Cobaki, NSW: 605.4ha

● Kings Forest, NSW: 856.5ha

One of the Gold Coast’s most successful property barons, Bob Ell is sitting on huge parcels of land in northern NSW.

The founder and executive chairman of the Leda Holdings development group has long divided his time between Sydney and the Gold Coast.

Since founding Leda in 1976, Mr Ell has completed a host of retail, commercial, industrial and residential developments and investments.

The Cobaki land is high, largely flat and overlooks the ocean — it is earmarked for a 5500-lot masterplanned community.

He bought this holding in 1994. Another 4500 properties are set to be built at Kings Forest.

Perron Group

(founded by Stan Perron)

Value of landholdings (undeveloped): $120-150 million

● Pacific View Estate, Worongary: 342ha

The Worongary estate is planned by Western Australia’s Perron Group for a 342ha parcel off Hinkler Drive that was held by reclusive millionaire Bob Anthes, who died in 2004.

The $1 billion masterplanned community, known as Pacific View Estate, was approved after it was called in by the State Government in 2015.

Upon completion Pacific View will be home to 12,000 residents, with the massive greenfield site between Nerang and Mudgeeraba set to ease pressure on housing.

Work is underway upgrading the area’s water and sewer system, commitments have been made for a new railway station and assessments are starting on the need for a new school. Prices for blocks have not yet been released.

The Perron Group was founded by billionaire Stan Perron in 1989.

Mr Perron also holds a stake in the owner of Gold Coast Airport.

Queensland Airports Ltd

Value of land (undeveloped): $69 million (estimate)

● Adjacent to Tugun overpass on western side of M1 Motorway: 39ha (Western Enterprise Precinct)

Gold Coast Airport is run by Queensland Airports Limited, which has major shareholders including The Private Capital Group Pty Ltd, linked to Charmaine Twomey, as trustee for The Infrastructure Fund, Perron Investments Pty Ltd, linked to billionaire Stan Perron, and QAL Investments, linked to Andrew Agnew and Jonathan Addison, as trustee for QAL Investments Trust.

Gold Coast Airport, run by Queensland Airports Limited, owns multiple land parcels surrounding its site on the Queensland and NSW border.

It has been earmarked for a future expansion. The city gateway has recently undergone $86 million worth of expansion work to its taxiway and aircraft apron with the terminal next in line to be enlarged in a bid to better cope with demand.

According to the masterplan, 39ha, which comprises the Western Enterprise Precinct at the western extremity of the airport site in the Tweed Shire, is undeveloped land which has been earmarked for future airport development.

This could include non-aviation uses such as a mix of light or general industry including bulky goods.

The airport is leased by QAL from the Commonwealth with a 50-year term and 49-year option.

Polaris Coomera Pty Ltd

Value of landholdings (undeveloped): $63.5 million

● Lot 1 Foxwell Rd and 49 Cunningham Dr, Coomera: 202.3ha

Japan-linked developer Polaris, linked to Japan-born Motoaki Omura and Kaeko Omura, recently launched plans for a 51ha business park between the M1 and the under-construction Westfield Shopping Centre.

The first stage of the project will be a 36ha site while the second stage will be 18ha.

Parcels of land will be offered from 0.23ha to 1.6ha.

Polaris is still in discussions with the council on the timing for starting works on the site. Upon completion, the estate will sit just 800m from the Westfield site and the Coomera train station.

The balance of the Polaris land is set aside for residential development, which requires environmental approvals from the Federal Government before it can proceed.

Aquis

(Tony Fung)

Value of landholdings (undeveloped): $60.5 million (includes acquisition and amalgamation costs)

● Cypress Ave, Surfers Paradise: 1.05ha (owned with Chinese companies CCCC International Holding and Tandellen)

● 3488 Main Beach Parade, Surfers Paradise: 1682sq m

Aquis Group boss Tony Fung is heavily invested in the Gold Coast.

He is a former sponsor of the Gold Coast Titans and current sponsor of the Gold Coast Turf Club.

Aquis currently has its massive central Surfers Paradise site on the market.

At 1.05ha, the site takes up a full city block, has frontages to both Surfers Paradise Blvd and Ferny Ave, and is owned by Aquis group and Chinese companies CCCC International Holding and Tandellen.

Mr Fung has earmarked the former Pacific Point site in Main Beach for a $440 million six-star hotel project.

It has been advertised for sale, but this was recently denied by the Fung camp. Aquis Farm, at Canungra, is one of the Gold Coast’s largest integrated racing and breeding operations.

Stockland

(led by managing director Mark Steinert)

Value of landholdings (undeveloped): $52.3 million

Major landholdings include:

● 2 and 44 Marina Quays Blvd, Hope Island: 1.63ha and 1.66ha

● Foxwell Island, Hope Island: 10.11ha

● Oakey Creek Rd, Coomera: 106.27ha

Stockland was the city’s biggest landowner in the wake of the 1980s property boom.

In the past few decades, Stockland has created residential communities featuring house and land packages at Ormeau Ridge, Ormeau Hills; Highland Reserve, Upper Coomera; Riverstone Crossing, Maudsland; and The Observatory, Reedy Creek.

The latest development is the 750-home Foreshore Coomera, which is the last of Stockland’s house-and-land developments on the Gold Coast. Its remaining land is set aside for medium-density development.

Queensland Investment Corporation

Value of landholdings (undeveloped): $43.77 million

● 103-129 Foxwell Rd: 44.97ha (owned with Scentre Management Ltd)

● 2 Millaroo Drive, Helensvale: 4.74ha (owned with Scentre Management Ltd and RE1 Ltd — trustee of Westfield Retail Trust)

● 11 and 50 Town Centre Dr, Helensvale: 22ha (approx.) (owned with Scentre Management Ltd and RE1 Ltd)

Queensland Investment Corporation is a State Government-owned investment company.

It is a major landowner in Coomera and Helensvale and has undertaken a number of acquisitions with Westfield shopping centre operator Scentre. QIC owns land on the southern side of Foxwell Rd near the Coomera Town Centre with Scentre, but has not unveiled plans for the site.

It has put a 4.7ha site at 2 Millaroo Drive, Helensvale, to the market recently.

The area is zoned fringe business precinct and mixed-use with a 32m height limit.

Garuda GC Corporation

— an arm of China’s Huixin Real Estate Group

Value of landholdings (undeveloped): $33.86 million (sale price)

● Marine Pde and Nerang St, Southport: 1.61ha

Garuda bought the old Star of the Sea site overlooking the Broadwater at the end of 2013 for $27.26 million.

It then added two properties at the northeastern end of Nerang St for a total cost of $6.6 million, expanding its holding from 1.4ha to 1.6ha.

The company is planning a resort and lifestyle precinct to feature high-rises, shopping and dining amenities alongside education facilities and resort accommodation and apartments.

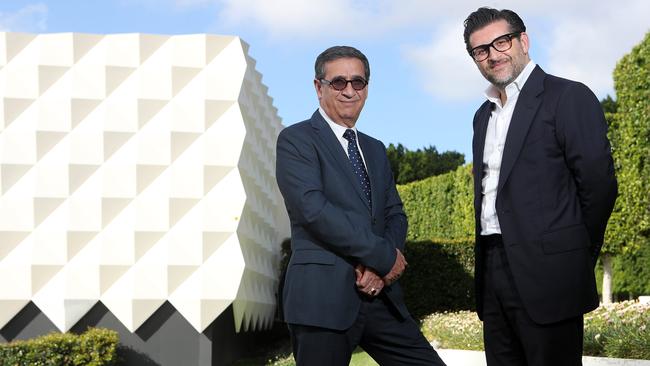

Sunland Group

(run by executive chairman Soheil Abedian and managing director Sahba Abedian who are also significant shareholders in the company)

Value of landholdings (undeveloped): $25.149 million (sale price)

● 272 Hedges Ave, Mermaid Beach: 3053sq m

● 3 Frank St and 1 Marine Pde, Labrador: 6059sq m

Listed developer Sunland Group launched several new residential and retail projects over the past year.

Gold Coast projects slated to settle after 2021 include the $1.4 billion One Marine Parade project at the old Frank St KFC site; $366 million Greenmount Residences; $204 million, 44-floor tower at 272 Hedges Avenue; $152 million Magnoli Apartments and The Lakes Residences at Mermaid Waters.

Soheil Abedian is one of Queensland’s wealthiest property developers, well-known on the Gold Coast for creating the country’s first fashion-branded hotel Palazzo Versace and one of the tallest towers on the Glitter Strip — the Q1.

Morris Property Group (Barry Morris)

Value of landholdings (undeveloped): $14.85 million (based on sale price)

● 2739 Gold Coast Highway, Broadbeach: 627sq m

● 16-18 Chelsea Ave, Broadbeach: 1214sq m (Opus site)

● 12 Elizabeth Ave, Broadbeach: 1032sq m (Koko site)

● 1969-1971 Gold Coast Highway, Burleigh Heads: 2023sq m

Headed up by astute Canberra developer Barry Morris, Morris Property Group is responsible for a string of towers that have popped up recently or are under construction.

They include the recently completed Boardwalk at Burleigh Heads, Qube at Broadbeach and Otto at Mermaid Beach (under construction).

Almost all the undeveloped sites are earmarked for towers, with projects in the presales stage.

Banyan Tree Group

(run by Singaporean journalist Ho Kwon Ping)

Value of landholdings (undeveloped): $12.083 million (based on sale price)

● 154 and 158-162 The Esplanade and 3343 Gold Coast Highway, Surfers Paradise: 4413sq m

The Singaporean hotel giant amalgamated a 4413sq m beachfront site in Surfers Paradise, starting with the purchase of 971sq m parcel in 2014, for $12.083 million.

It outlaid plans for 47 and 39-storey towers on the site in 2016, before listing the property as a development opportunity, either jointly, or solo, for another developer.

Rix Developments

(Norm Rix)

Value of landholdings (undeveloped): $5.225 million (based on sale price)

● Lot 23, lot 22 and lot 14, Amity Rd, Coomera: 18.52ha

Veteran developer Norm Rix, who has been buying and selling property on the Gold Coast for close to six decades, is undertaking a 207-lot development on Amity Rd, Coomera.

The land was acquired by an entity associated with Mr Rix between 2015 and 2017.

Mr Rix is also behind the Pimpama City shopping centre, which is slated to open in September.

Clive Palmer

Value of land (undeveloped): $5 million (government valuation)

● 153 Gooding Dr, Merrimac: 75.9ha

Gold Coast millionaire Clive Palmer owns multiple properties across Queensland, including mansions and golf courses.

Property records show the large Merrimac block of land was transferred from Clive Palmer’s company Queensland Nickel into his own name for $7.9 million in 2013.

Mr Palmer is being chased by creditors for millions in unpaid funds following its collapse.

He recently splashed out $4.4 million on two properties at The Sovereign Islands.

The Palmer family’s spend on The Sovereign Islands has topped more than $20 million during the past decade with many of the properties listed as being owned by Mr Palmer’s wife, son, daughter and nephew.

Ormed Investments Pty Ltd

Value of land (undeveloped): $500,000 (sale price)

● 121 Goldmine Rd, Ormeau: 203.18ha

Suman Makan-linked Ormed Investments is planning a massive solar farm on a 200ha site on Goldmine Rd.

The project, which has recently been scaled back, would produce 38 megawatts of power as opposed to the original 100 megawatts.

Ormed ultimately hopes to create a residential development on the site at the end of the farm’s 25-year life cycle.

The Makan family also owns the Ormeau Town Centre site, which it put up for sale last year.

Hamelech Basodeh Pty Ltd (Kornhauser family)

Value of landholdings: $3.75 million

● 108 Green Meadows Rd, Pimpama: 407.26ha

The Kornhauser family has owned the Greenridge site at Pimpama since the 1980s.

It is seeking a change to the city plan to build 1200 houses on 80ha of the Pimpama parcel.

The remainder of the site would be donated as land for koala conservation.

The property is owned by Hamelech Basodeh Pty Ltd, linked to Nicole Kornhauser, who is the wife of Eliezer Kornhauser.

Mr Kornhauser is one of the three surviving children of Eddie Kornhauser, who died in 2006, leaving a fortune of more than $400 million behind.

Add your comment to this story

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout

More than a theme park: Dreamworld’s dramatic expansion plan

Tourism giant Dreamworld wants to fast track a massive expansion of the theme park, with an incredible array of features including hotels and residential towers. FIND OUT MORE

My rise and fall: $65m brewery co-founder to ‘feeling like a loser’

Three years ago Black Hops craft brewery co-founder Dan Norris had a big stake in his own $65m brand and a $3.1m dream home - now he’s not involved, broke and “ashamed”. SEE THE VIDEO