Logan calls for state inquiry into insurance premium price gouging after stricter flood mapping

Landowners south of Brisbane are waging a war with the nation’s insurance giants over alleged price gouging, after dozens were faced with massive spikes in premiums.

Landowners south of Brisbane are waging a war with the nation’s insurance giants over alleged price gouging, after dozens were faced with massive spikes in premiums after the local council tightened its flood mapping.

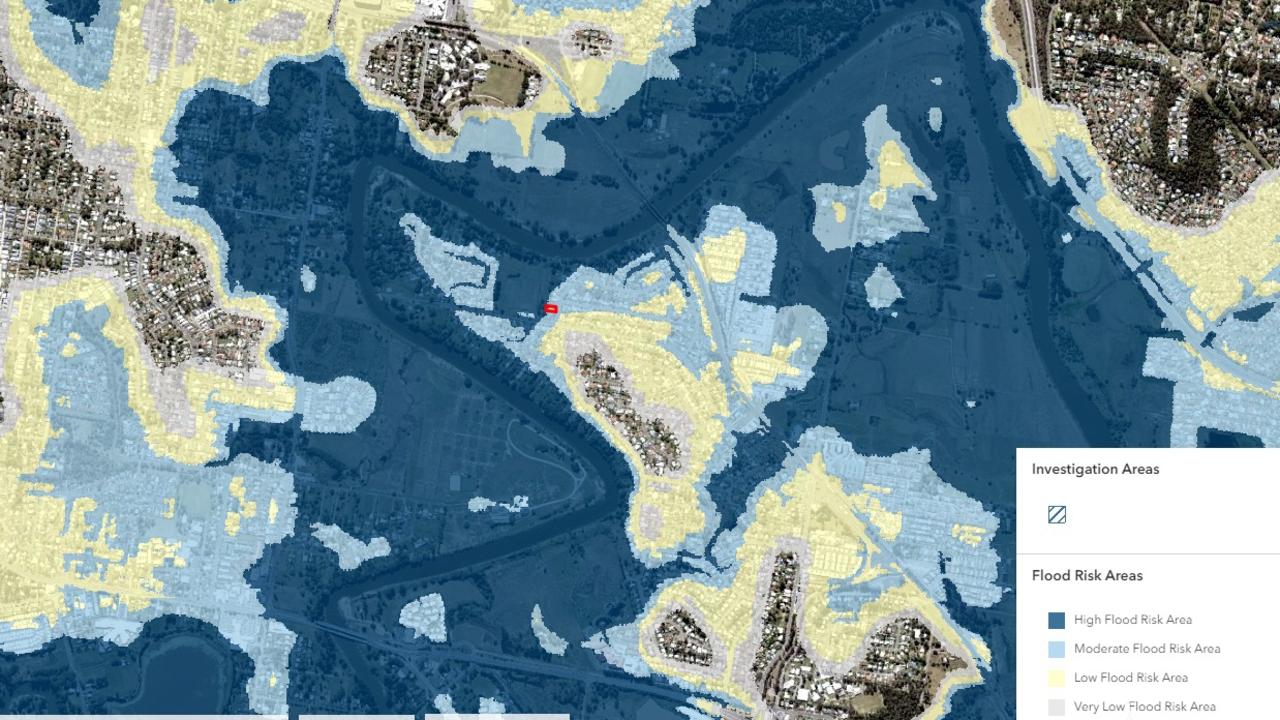

Logan City Council approved its new, more stringent, flood mapping in October, resulting in more properties being classified as “at risk of flooding” in any year.

The new mapping has prompted calls for state intervention to address what many landowners claim is unjust and exorbitant insurance hikes.

Bethania landowner Gail MacPherson was shocked to find she faced a 400 per cent rise in her RACQ property insurance with annual payments skyrocketing from $1300 a year to a nosebleeding $6500.

The former Brisbane City councillor moved in 2015 to her 750 sqm property, which is separated from the Logan River by a large soccer field and park.

“It is unacceptable that landowners have to pay premiums for events that may happen sometime in the next 200 years or may not even happen at all,” she said.

“I only became aware that the flood mapping had changed when I received my home insurance bill for $6500 and could not believe it.

“My property, like more than 90 per cent of this suburb, is now classified as a moderate flood risk — even though the majority of houses here have never flooded.

“Before I bought in Bethania, I did all of my homework and really checked out the flood maps, which showed about 2 per cent of my back yard was at risk of a 1 in 100-year flood.

“This block did not flood during the historic 1974 flood and since then, there has never been any flooding on my property.

“Even the 2022 flood, which swamped the Logan catchment, did not affect this block and there was no inundation in the 2017 flood either – so I am amazed that I am now being treated as if the property is a flood risk.”

Ms MacPherson, who has had a policy with insurer RACQ for 30 years and had never made a claim, complained about the 400 per cent cost increase but was told there would be no decrease in premiums.

She has since signed a cheaper policy with another insurer but it does not cover the event of her house flooding.

RACQ said premium increases were industry-wide and it “did not wish to charge high premiums to anybody”.

The insurer urged customers to call to discuss options that may be available to lower premiums, including answering additional questions to help risk assessment.

“We have a responsibility to set premiums based on the policyholder’s likelihood to lodge a claim and how large that claim may be in the future,” RACQ said in a statement.

“We believe this is the fair thing to do so other members aren’t paying higher premiums to subsidise those in high-risk areas.

“We always look for ways to minimise the impact on our members and acknowledge that no model is perfect.

“We understand members may be experiencing vulnerability or hardship and may require specialised assistance or care.”

Ms MacPherson was one of more than 50 residents to lodge complaints about the new flood maps, prompting Logan City Council this month to call for a review of its maps and flood policy.

Councillor Scott Bannon said one of his constituents had a premium rise from $3500 a year to $35,000.

Mayoral candidate Jon Raven called for a review of the new mapping and a state inquiry into the insurance industry, saying the “gouging” was creating stress in the community with the insurance industry trying to blame the council.

He said the insurance hikes could possibly put hundreds of pensioners “out on the street”.

“These pensioners own the home but not the land and if they don’t have insurance they get kicked out of that property,” he said.

“The insurance industry is trying to make it local government’s fault … when they’re the ones making million-dollar profits.”

Mayor Darren Power also urged the Local Government Association of Queensland to call for the inquiry which he hoped would look at insurance price gouging claims for properties affected by low-risk flood mapping.

Logan will also raise concerns with the Insurance Council of Australia about the “significant increases” in premiums for properties covered by the mapping which may have an “extremely low risk of flooding”.

In a statement, the council defended its new risk-based flood mapping saying it was complying with State Planning Policy, which required councils to identify and map all possible flood risk and consider the impacts of climate change.

But resident groups, including the Logan Ratepayers’ Association and online forum Logan Voters, have raised alarm bells over council approvals for developments which have been allowed to proceed in mapped flood zones.

Logan resident Angela Leo said residents were considering a class action against the new maps and called on the governments to buy back properties that were now on flood zones.

“Council is in charge of the development approval process and should be considering the long-term implications of run-off from new housing and commercial estates,” she said.

“It is up to the council to take actions to mitigate flooding – isn’t that one of the roles of council to do future planning?

“It definitely sounds like potential for a class action law suit.”

A Department of Housing, Local Government and Planning spokesman said the federal government was responsible for regulating general insurance while councils were responsible for zoning land and mapping natural hazards, such as flooding, through their planning schemes.

“Given the potential impacts of flooding across Queensland, local governments have developed comprehensive approaches to planning for flooding in their planning schemes, and they already have the power to refuse development applications where flood risk cannot be appropriately managed,” the state spokesman said.

“Local governments also have the power to condition development applications to require appropriate flood mitigation measures.”

Flood mitigation in Logan has also included the state government acquiring properties which were at high risk of flooding with 12 houses already demolished or removed since 2022.

There have been 30 contracts settled under the Queensland Reconstruction Authority Voluntary Home Buy-Back program with 45 offers presented and 32 accepted.

More Coverage

Originally published as Logan calls for state inquiry into insurance premium price gouging after stricter flood mapping