Gold Coast property: Knight Frank report shows price growth among best in world

New data has shown Gold Coast property prices are continuing to shoot up, with the city now rated one of the most attractive places for luxury homes worldwide. FULL DETAILS >>>

Gold Coast

Don't miss out on the headlines from Gold Coast. Followed categories will be added to My News.

GOLD COAST property prices are continuing to soar, with a new report revealing the city has one of the hottest house markets on the planet.

New statistics show average values rose 2.6 per cent in February alone – outpacing a national average of 2.1% – while a report focused on luxury property listed the Gold Coast as one of the top cities worldwide.

It comes as rental vacancies on the Gold Coast reach record lows, creating fears of a housing crisis.

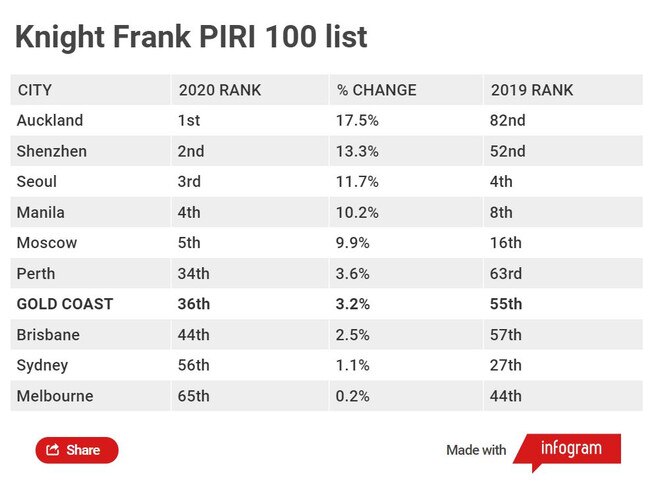

The Coast finished 36th globally in the list compiled by Knight Frank for their ‘Wealth Report’ – up from 55th in the previous year’s index.

FULL DIGITAL ACCESS: JUST $1 FOR FIRST 28 DAYS

The report, which tracks the movement of luxury residential prices across the world’s top 100 residential markets, found prices for high-end properties on the Coast were up 3.2 per cent in 2020, well ahead of the global average of 1.9 per cent.

It was also significantly higher than neighbouring Brisbane, which recorded growth of 2.5 per cent.

The only Australian city to record a higher rise in prices than the Gold Coast was Perth, where prices rose 3.6 per cent.

HIDDEN GEMS OF COAST PROPERTY: TOP AGENTS REVEAL THEIR TIPS

Knight Frank’s head of residential, Shayne Harris, said the COVID-19 pandemic had encouraged wealthy property buyers to invest in lifestyle destinations such as the Gold Coast.

“The pandemic has forced many to retreat in the comfort of their home for the best part of 2020, so it’s not surprising prime property is becoming increasingly more attractive in destinations known for their lifestyles such as Perth, the Gold Coast and Brisbane,” Mr Harris said.

“On average, 22 per cent of the wealth of Australian ultra-high-net-worth individuals (someone with a net worth of more than $US30m, including their primary residence) is directly allocated to property for their principal and second homes, where they and their families spend time, while on average 24 per cent is directly allocated to a property investment portfolio.”

Knight Frank’s Head of Residential Research Australia Michelle Ciesielski said she expected prices of luxury property on the Gold Coast to continue rising strongly this year.

“Knight Frank’s ‘The Wealth Report’ forecasts that luxury residential property prices in Perth, the Gold Coast and Sydney will rise by three per cent over 2021, while Brisbane will see growth of two per cent and Melbourne prices are expected to grow slightly more modestly at one per cent,” Ms Ciesielski said.

“Last year, demand for prime property was mostly domestic in nature, apart from those expats on the move back to Australia.

“With the ultra-wealthy population in Australia increasing over the past year, much of this will be redirected back into expanding property portfolios over the coming year.

“ … Lifestyle, wellness and wellbeing will shape most prime property buying decisions across all markets in Australia, with many seeking green space and luxury amenities.”

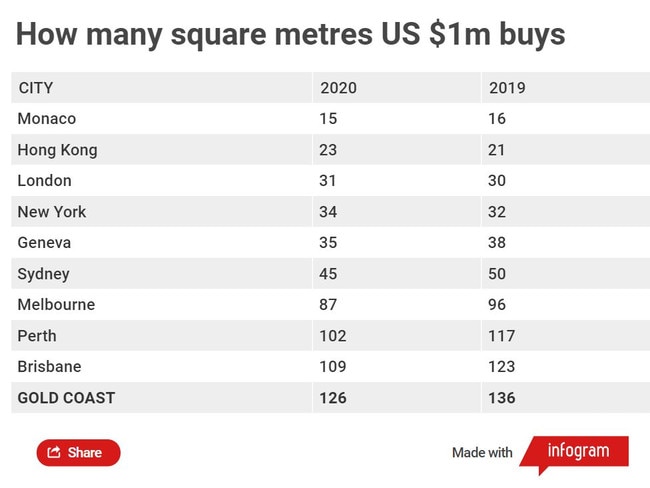

Ms Ciesielski said the Gold Coast was boosted by the fact that investors’ money goes further on the Gold Coast than any other Australian city.

“The amount of money goes furthest on the Gold Coast, where you can buy 126 square metres luxury internal floor space (per US $1 million), but it will buy you the least in Sydney, where you can get 45 square metres,” Ms Ciesielski said.