Winners and losers in sale of Gold Coast’s Billabong to California’s Boardriders Inc for $208 million

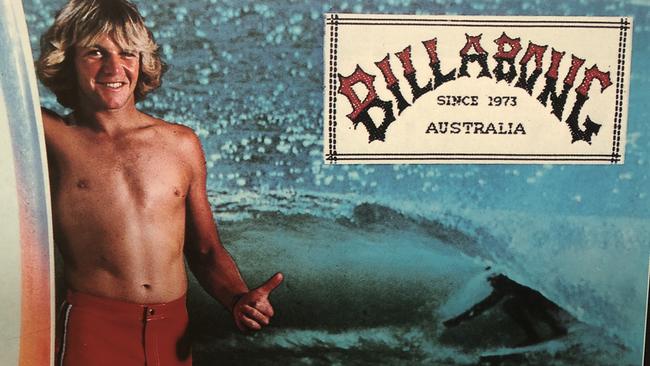

GOLD Coast surfware company Billabong has been an icon for more than 40 years but its shareholders have voted to sell it overseas. So what does that mean for its future here on the Gold Coast.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

AFTER 45 years as a Gold Coast surfing icon, Billabong will go offshore after shareholders voted to sell to the California-based owners of Quiksilver.

The vote of 95.45 per cent in favour of the sale to Boardriders Inc came after two hours of vote counting and eight years of steady decline which has seen the company once valued at $3 billion sold for $208 million.

Chairman Ian Pollard, who now has a month left in his role, and CEO Neil Fiske, who could not say how long he’d be around, last night planned to have a quiet dinner with board members and others involved in the process.

Before that, they had to get through the task of telling the company’s worldwide staff that the deal had been done.

Shareholders who bought recently, for example last May when shares were trading at a sad 48.7c, could have doubled their dosh in the deal — however these lucky punters are few and far between.

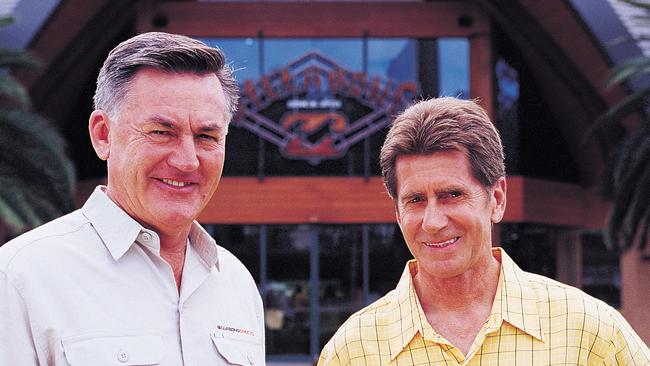

Most shareholders, most notably founder Gordon Merchant, have worn a loss in value of more than $2 billion since the company’s peak a decade ago.

Boardriders Inc is majority owned by hedge fund manager Oaktree Capital, which already held 19 per cent of Billabong shares and is a major lender to the company.

Shareholders were offered an 11th-hour incentive to vote in favour of the Burleigh company’s sale — an increase in their cut from $1 per share to $1.05 per share.

BILLABONG’S LONG ROAD TO REDEMPTION

The increased offer was made struck minutes before the vote meeting was due to begin after speculation key shareholders planned to vote down the sale. Instead they voted in favour of it.

Before the vote, Chairman Ian Pollard said Billabong was not viable on its current trajectory and “will need to sell significant assets and change its strategy” if the sale did not go through.

Of proxy votes lodged before the meeting, 4.56 per cent were against the sale and 78.8 per cent were in favour.

MERCHANT ‘CONFIDENT’ IN COMPANY

Quizzed on what the sale could mean to his global staff of 4000 people, including those in the Gold Coast headquarters, Mr Fiske could only say his strategy had been to “build global brands and global platforms”.

He was at pains to head off any speculation the sale could spell the eventual end of any of the company’s brands, which include Billabong itself, RVCA and Element.

“The brands will remain paramount, the authenticity, their character, their soulfulness is our biggest asset,” he said.

“I think they’re going to be elevated and invested behind in the new organisation and it’s going to open up new possibilities for brands and the company.

“This was our best option, our best strategic alternative. We looked at it long and hard, it was a rigorous process and this is a great outcome.”

Mr Fiske would not speculate on his future, but said he felt “honoured to have been part of” Billabong and that he’d managed to transform the company despite “headwinds” since he started in the role five years ago.

“My focus is running the business and getting this transaction done,” he said.

“From where the business was five years ago to where it is now — it’s quite different. It’s global, it’s streamlined, it’s simplified and I think it’s positioned to thrive under the construct of this combined entity.”

Boardriders chief executive Dave Tanner said the deal offered the best value for shareholders, employees, vendors and customers.

“We are pleased to see that the Billabong shareholders recognised this value, and have approved the proposed acquisition,” Mr Tanner said. “We have now cleared a significant milestone, and we are one step closer to creating the world’s leading action sports company.”

Shareholders who attended the scheme meeting yesterday left the Burleigh-based surf icon’s headquarters as their votes were counted — but a few stayed to mull the future of the company which has always been more than a financial investment to them.

Sipping coffees in the HQ foyer were two Gold Coast mates — one voted in favour of the sale, and one against.

One shareholder who had “done a lot of money” in Billabong is 81-year-old Martin Davis, who voted in favour of the sale. He lives near Mr Merchant at Tugun and was hoping to wish him well.

His friend, who didn’t want his name published because he was “embarrassed the whole situation had got so bad” voted against the $208 million sale.

“It’s a sad day,” he said.

“They do so much for the sporting community here, for the surfers and kids — maybe that will continue if it’s sold but who knows.”

Mr Davis, a former Richmond Tigers player, said the company sealed its fate in 2009-10.

“They bought all those stores in Canada and never recovered from that,” he said.

“They expanded at the height of the GFC, Gordon was kicked of the board for two or tree years and they have never recovered.”

“It’s very sad for a lot of us Gold Coasters who have stood by Gordon.”

The company will now present the results of the vote to the Federal Court on April 6, so it can proceed with the takeover, which would be finalised by April 24.