Billabong shareholders vote in favour of $210 million sale to Quiksilver owners Boardriders Inc

THE result of a shareholder vote on the sale of Burleigh surf icon Billabong has been revealed. Here’s what the future holds for the Gold Coast’s best-known company.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

ICONIC Gold Coast company Billabong is set to go offshore by the end of April after shareholders overwhelmingly voted to sell to the California-based owners of Quiksilver.

The vote of 95.45 per cent in favour of the sale was confirmed minutes ago, two hours after voting closed, in a statement from Billabong to the ASX.

If the process goes to schedule, Billabong will trade on the ASX for the last time on April 9.

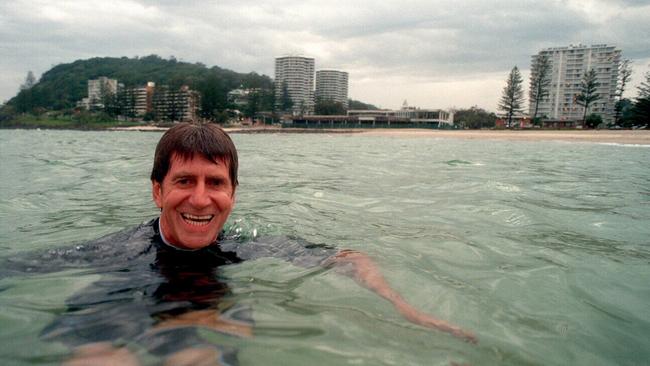

Gordon Merchant, the Gold Coast surfer who founded the icon from his Burleigh kitchen in 1973, opted not to attend the meeting, instead escaping the drama for overseas and listening in by phone.

Mr Merchant, 75, who holds 12 per cent of the company’s shares, voted to sell the company he built from nothing.

In their statement to the ASX, Billabong said 85.87 per cent of eligible shareholders had cast a vote.

Speaking after the announcement was made, chairman Ian Pollard acknowledged Mr Merchant, “whose passion for Billabong is unmatched”.

“Gordon has seen all the highs and lows during the last 45 years and is one of the very few Australian business figures who has actually built a global brand from the ground up,” he said.

CEO Neil Fiske thanked the global Billabong team of 4000 people for staying focused during the “inherently distracting” process.

“Today is about moving forward into an exciting new chapter,” he said.

“In many ways, this is an expansion of our strategy.”

Mr Fiske said he was confident the newly-formed combined company would “retain brand authenticity”.

Shareholders were offered an 11th-hour incentive to vote in favour of the Burleigh company’s sale — an increase in their cut from $1 per share to $1.05 per share.

The deal between Boardriders Inc and Billabong was struck minutes before the vote meeting was due to begin.

Key shareholders who flagged their intention to block the sale last week instead voted in favour of it.

Most shareholders left the Burleigh-based surf icon’s headquarters as their votes were counted — but a few stayed to mull the future of the company which has always been more than a financial investment to them.

Sipping coffees in the HQ foyer were two Gold Coast mates — one voted in favour of the sale, and one against.

One shareholder who has “done a lot of money” in Billabong is 81-year-old Martin Davis, who voted in favour of the sale. He lives near Mr Merchant at Tugun and was hoping to wish him well.

His friend, who didn’t want his name published because he was “embarrassed the whole situation had got so bad” voted against the $210 million sale.

“It’s a sad day,” he said.

“They do so much for the sporting community here, for the surfers and kids — maybe that will continue if it’s sold but who knows.”

Mr Davis, a former Richmond Tigers player, said the company sealed its fate in 2009-10.

“They bought all those stores in Canada and never recovered from that,” he said.

“They expanded at the height of the GFC, Gordon was kicked of the board for two or three years and they have never recovered.”

“It’s very sad for a lot of us Gold Coasters who have stood by Gordon.”

Before the vote, Chairman Ian Pollard said Billabong was not viable on its current trajectory and “will need to sell significant assets and change its strategy” if the sale did not go through.

Of proxy votes lodged before the meeting, 4.56 per cent were against the sale and 78.8 per cent were in favour.

Billabong was worth well north of $3 billion at the crest of its global wave back in May 2007, while the Boardriders’ bid, which lobbed last December, values the Gold Coast company at just $198 million.

Six months ago, the stock was wallowing at half the offer price.

About 40 shareholders and facilitators gathered for the scheme meeting, which was delayed by half an hour due to the increased offer price.

Boardriders Inc is majority owned by hedge fund manager Oaktree Capital, which already holds 19 per cent of Billabong shares and is a major lender to the company.

Directors of Billabong recommended shareholders vote in favour of the proposal.