Closing Bell: Aussie dollar climbs and ASX pares back gains on inflation data

Both the Australian dollar and the ASX have made gains following today’s inflation read, which has all but locked-in an interest rate cut for the RBA’s May meeting.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX pares back early gains to settle up 0.69pc

Inflation marginally exceeds forecast (0.9pc vs 0.8pc)

Australian dollar climbs to around US$0.6395

The ASX had a bit of a wobble after today’s inflation data came in marginally higher than expected, tipping up 0.9% instead of 0.8% for a steady annual rate of 2.4%.

More importantly, trimmed core inflation – the Reserve Bank’s preferred inflation metric – nudged under the RBA’s 2-3% target for the first time in three years, settling at 2.9%.

The numbers have convinced markets a 25-basis-point interest rate reduction is all but guaranteed for the RBA’s May meeting, with predictions of another four cuts on the cards throughout the rest of the year.

While the RBA has been hawkish on rate cuts since Michele Bullock took the helm, deflationary pressures from the ongoing international trade war are no doubt on their minds.

"We view an RBA rate cut of 25bp in May as a near certainty, given the downside risks to global and domestic growth stemming from global trade policy uncertainty and the inflation outcomes over the past two quarters," ANZ senior economist Adelaide Timbrell wrote in a note.

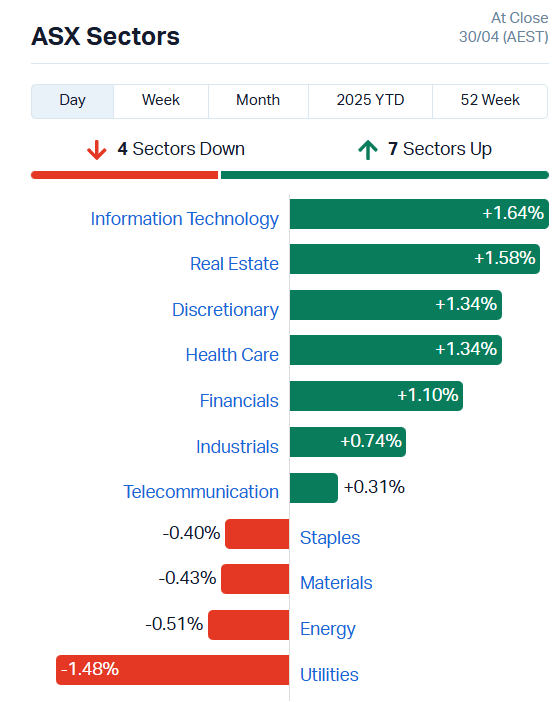

Turning back to the market, the ASX has lifted 0.69% during today’s trading, supported by strength in the Info Tech, Real Estate, Discretionary and Health Care sectors.

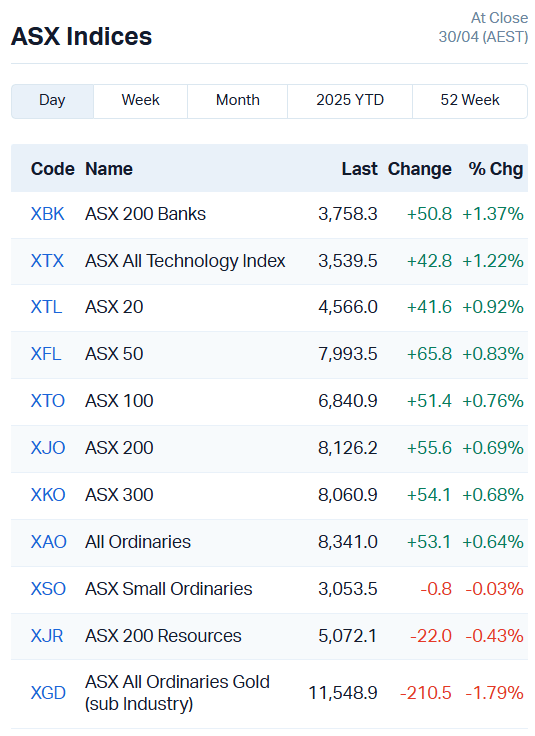

The ASX 200 Banks index also rose 1.37%, alongside a 1.22% uptick by the All Technology.

Commonwealth Bank (ASX:CBA) gained 2.22%, standing out from more modest gains by other major banks. They were joined by Suncorp (ASX:SUN), up 2.27% and Insurance Australia (ASX:IAG), up 1.36%.

Over in the tech sector, Life360 (ASX:360) gained 2.67% and Megaport (ASX:MP1) 3.44%. Big caps WiseTech (ASX:WTC), Xero (ASX:XRO), Technology One (ASX:TNE) and NextDC (ASX:NXT) all lifted between 1.05% and 2.45%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| MOM | Moab Minerals Ltd | 0.0015 | 50% | 245980 | $1,733,666 |

| JLL | Jindalee Lithium Ltd | 0.58 | 41% | 696836 | $30,172,658 |

| SKK | Stakk Limited | 0.007 | 40% | 305663 | $10,375,398 |

| ERA | Energy Resources | 0.002 | 33% | 4901144 | $608,094,361 |

| WOA | Wide Open Agricultur | 0.0355 | 31% | 34887241 | $14,409,538 |

| ALM | Alma Metals Ltd | 0.005 | 25% | 4005600 | $6,345,381 |

| CYQ | Cycliq Group Ltd | 0.0025 | 25% | 249999 | $921,033 |

| ERL | Empire Resources | 0.005 | 25% | 500000 | $5,935,653 |

| OVT | Ovanti Limited | 0.005 | 25% | 4147687 | $10,806,191 |

| WHK | Whitehawk Limited | 0.016 | 23% | 7400433 | $9,354,933 |

| OSX | Osteopore Limited | 0.018 | 20% | 4460326 | $2,283,284 |

| BMR | Ballymore Resources | 0.12 | 20% | 182966 | $17,673,059 |

| 1AI | Algorae Pharma | 0.006 | 20% | 1455146 | $8,436,974 |

| AZL | Arizona Lithium Ltd | 0.006 | 20% | 5190549 | $22,809,073 |

| LMG | Latrobe Magnesium | 0.012 | 20% | 10632106 | $25,485,374 |

| PV1 | Provaris Energy Ltd | 0.012 | 20% | 758334 | $6,980,013 |

| SMM | Somerset Minerals | 0.012 | 20% | 6678247 | $3,271,122 |

| TMX | Terrain Minerals | 0.003 | 20% | 1000000 | $5,008,892 |

| REM | Remsensetechnologies | 0.062 | 19% | 1383821 | $8,696,167 |

| SVG | Savannah Goldfields | 0.025 | 19% | 1120359 | $18,263,918 |

| NUC | Nuchev Limited | 0.19 | 19% | 7784 | $23,414,288 |

| ECS | ECS Botanics Holding | 0.013 | 18% | 3350172 | $14,256,545 |

| NMT | Neometals Ltd | 0.075 | 17% | 1936292 | $49,243,205 |

| AKN | Auking Mining Ltd | 0.007 | 17% | 500000 | $3,448,673 |

| CRR | Critical Resources | 0.0035 | 17% | 2019002 | $7,842,664 |

Making news…

Wide Open Agriculture (ASX:WOA) has signed a deal with Univar Solutions China, naming it the exclusive distributor of its lupin protein products across mainland China. Univar’s no small player, it’s the second-biggest ingredient distributor in the world, pulling in over $11 billion in sales last year. Under the deal, Univar has agreed to buy at least 50 tonnes of lupin protein over 12 months (after a 6-month prep phase), with pricing to be sorted between the two.

Arizona Lithium (ASX:AZL) is powering ahead with its Prairie Project in Canada, locking in approvals to kick off brine production and raising $1.3 million to fund its first facility. It’s also reworking plans at Big Sandy alongside key shareholder NTEC. With DLE tech in hand and the lithium market tipped to bounce back, AZL reckons it’s in prime position to make a splash.

Strong exploration potential and the formal acquisition of the Coppermine project have delighted Somerset Minerals (ASX:SMM) investors. The company has drummed up 15 anomalous copper zones on the project tenure, with at least five coinciding with other indicators of mineralisation, including positive historical drilling, surface exploration and geophysical results.

A cash flow positive quarter achieving net cash of $420k and customer cash receipts of $1.403m boosted RemSense Technologies (ASX:REM) shares after the company released its quarterly report. Major customer Woodside Energy also renewed its virtualplant subscription during the quarter, alongside Newmont Mining. REM says it's discussing a global rollout across all Newmont Mining operations with the major gold production company.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ICU | Investor Centre Ltd | 0.001 | -50% | 103990 | $609,023 |

| IVT | Inventis Limited | 0.01 | -38% | 51005 | $1,222,790 |

| EEL | Enrg Elements Ltd | 0.001 | -33% | 6454216 | $4,880,668 |

| WEL | Winchester Energy | 0.001 | -33% | 100000 | $2,044,528 |

| 3DP | Pointerra Limited | 0.06 | -28% | 9513299 | $66,821,374 |

| NC6 | Nanollose Limited | 0.034 | -28% | 2056610 | $10,950,168 |

| 1TT | Thrive Tribe Tech | 0.0015 | -25% | 3112589 | $4,063,446 |

| 88E | 88 Energy Ltd | 0.0015 | -25% | 1976288 | $57,867,624 |

| CT1 | Constellation Tech | 0.0015 | -25% | 1000000 | $2,949,467 |

| GMN | Gold Mountain Ltd | 0.0015 | -25% | 433530 | $9,591,960 |

| M2R | Miramar | 0.003 | -25% | 7372978 | $3,987,293 |

| RFA | Rare Foods Australia | 0.006 | -25% | 362307 | $2,175,866 |

| TFL | Tasfoods Ltd | 0.003 | -25% | 60261 | $1,748,382 |

| MAP | Microbalifesciences | 0.17 | -24% | 763535 | $100,766,695 |

| GSM | Golden State Mining | 0.007 | -22% | 426513 | $2,514,336 |

| TMS | Tennant Minerals Ltd | 0.007 | -22% | 3058097 | $8,603,014 |

| ODE | Odessa Minerals Ltd | 0.0055 | -21% | 1838502 | $11,196,728 |

| VAR | Variscan Mines Ltd | 0.0055 | -21% | 3877994 | $5,480,004 |

| ASR | Asra Minerals Ltd | 0.002 | -20% | 7556077 | $6,765,117 |

| BLZ | Blaze Minerals Ltd | 0.002 | -20% | 700000 | $3,917,370 |

| C7A | Clara Resources | 0.004 | -20% | 6962 | $2,558,021 |

| HLX | Helix Resources | 0.002 | -20% | 160999 | $8,410,484 |

| MGU | Magnum Mining & Exp | 0.004 | -20% | 139999 | $4,046,807 |

| MMR | Mec Resources | 0.004 | -20% | 2558333 | $9,248,829 |

| PHL | Propell Holdings Ltd | 0.008 | -20% | 125431 | $2,783,381 |

IN CASE YOU MISSED IT

Hot Chili (ASX:HCH) has taken a step toward obtaining priority status for both its Costa Fuego copper-gold project and Huasco water project in Chile, after securing registration with the Office for Sustainable Project Management of the Chilean Ministry of Economy. Both projects fulfilled key requirements to be considered in the government’s list of strategic investment projects to be expedited through a streamlined approval process.

In an effort to focus resources on the flagship Yarramba uranium project, Koba Resources (ASX:KOB) has entered into agreements to offload 100% of its interest in the Harrier uranium project in Newfoundland and Labrador to Azincourt Energy Corp in return for C$50,000 and 30m Azincourt shares.

Silver Mines (ASX:SVL) submitted an application with the Department of Planning, Housing and Infrastructure to determine whether a transmission line to power the Bowdens Silver project forms part of a single proposed development in an ongoing effort to reinstate development consent for the project. The development application itself remains alive, with the final decision to be made by the consent authority, the NSW Independent Planning Commission.

Refurbishment of the Casposo toll milling track is on schedule, supporting a binding agreement between Challenger Gold (ASX:CEL) and the plant operator to process a minimum of 450,000t of material from the Hualilan gold project over three years. CEL is looking to capitalise on current high gold prices.

Trading Halts

AdAlta (ASX:1AD) – evaluate financing opportunities

Advance Metals (ASX:AVM) – cap raise

Arika Resources (ASX:ARI) – cap raise

Clime Investment Management (ASX:CIW) – distribution deal with a US based fund manager

Dreadnought Resources (ASX:DRE) – farm-in and joint venture agreement

Equinox Resources (ASX:EQN) – cap raise

Opyl (ASX:OPL) – cap raise

Red Mountain Mining (ASX:RMX) – cap raise

At Stockhead, we tell it like it is. While Hot Chili, Koba Resources, Silver Mines and Challenger Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: Aussie dollar climbs and ASX pares back gains on inflation data