Closing Bell: Hot run ends for ASX as trade war impacts emerge

Between US debt being downgraded to AA1 by Moody’s and a slowdown in China’s economy, the ASX has broken an eight-day winning streak to fall 0.58pc.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

US government debt was downgraded from AAA to AA1

Iron ore falls as data out of China shows weakening growth

Gold climbs 0.62pc to US$3223/oz

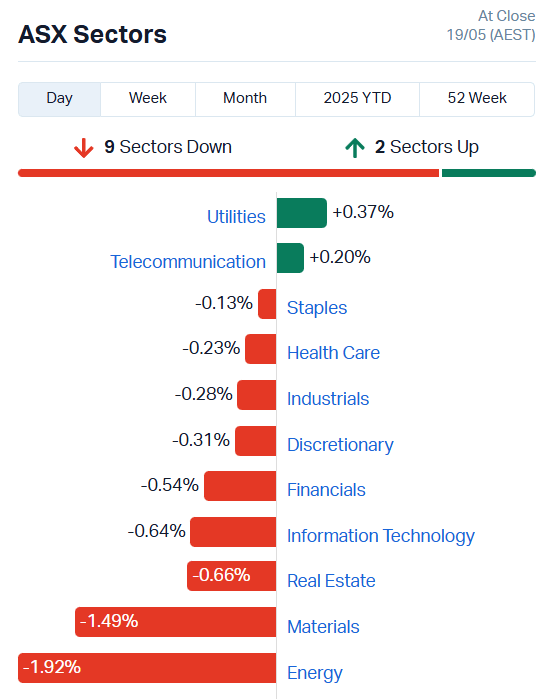

After eight days of gains the ASX has finally stumbled, ending the day down 0.58%.

It’s unlikely to be a particularly cheery day in the US or Europe this evening, either, with S&P500 futures down more than 1% and UK FTSE100 futures down 0.44%.

Now that the relief from the US-China trade war ceasefire has worn off, structural indications of the tariff’s effects are beginning to make themselves known.

Moody’s downgrades US debt

Moody’s downgraded the US government debt rating from AAA to AA1, drawing the strength of the US dollar into doubt and driving treasury yields higher by three basis points.

“Over the next decade, we expect larger deficits as entitlement spending rises while government revenue remains broadly flat,” Moody’s said in its press release.

“In turn, persistent, large fiscal deficits will drive the government’s debt and interest burden higher. The US’s fiscal performance is likely to deteriorate relative to its own past and compared with other highly rated sovereigns.”

Adding to the ASX’s woes, China isn’t faring particularly well, either.

The latest economic data out of Beijing shows weakening retail sales in April, as well as a 10.3% drop in property investment – not a good sign for the struggling Chinese steel industry, or our own iron ore sector.

In fact, iron ore has fallen 0.56% today, slipping below the US$100 per tonne mark to sit at US$99.50.

That cut the legs out from under the resources sector, with Materials falling more than 1.5%.

As always, the market giveth and the market taketh away.

With the increasingly gloomy sentiment came a rotation back into gold, which has lifted 0.62% today to touch US$3223 per ounce.

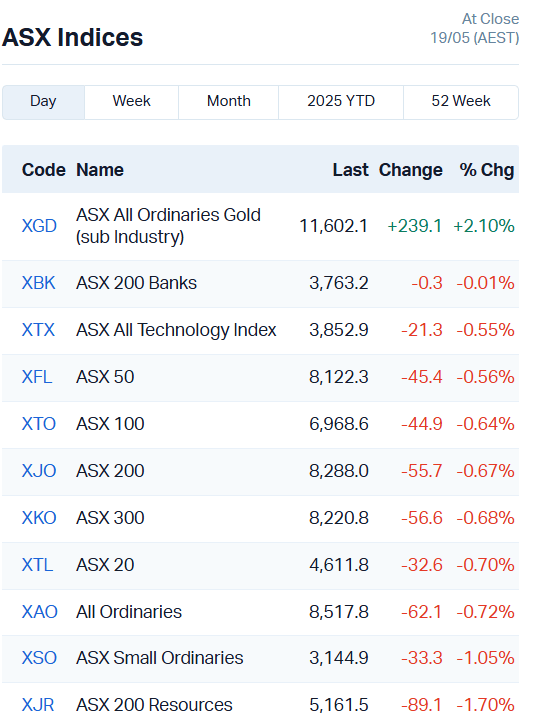

That gave the ASX All Ords Gold Index some love, driving it up 2% to make it the only index in the green on the ASX.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RDN | Raiden Resources Ltd | 0.0065 | 63% | 72630135 | $13,803,566 |

| XAM | Xanadu Mines Ltd | 0.078 | 53% | 60640475 | $97,522,075 |

| BP8 | Bph Global Ltd | 0.003 | 50% | 977859 | $2,101,969 |

| EDE | Eden Inv Ltd | 0.0015 | 50% | 86750 | $4,109,881 |

| PIL | Peppermint Inv Ltd | 0.003 | 50% | 854216 | $4,475,279 |

| TKL | Traka Resources | 0.0015 | 50% | 845452 | $2,125,790 |

| NSX | NSX Limited | 0.032 | 45% | 2387863 | $11,075,006 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 100246 | $7,254,899 |

| SIS | Simble Solutions | 0.004 | 33% | 514408 | $2,628,991 |

| ADY | Admiralty Resources. | 0.005 | 25% | 1099 | $10,517,918 |

| ASR | Asra Minerals Ltd | 0.0025 | 25% | 66666 | $5,412,094 |

| CUL | Cullen Resources | 0.005 | 25% | 100786 | $2,773,607 |

| LML | Lincoln Minerals | 0.005 | 25% | 385471 | $8,410,279 |

| OLI | Oliver'S Real Food | 0.005 | 25% | 469592 | $2,162,928 |

| RLL | Rapid Lithium Ltd | 0.0025 | 25% | 968621 | $2,489,889 |

| ROG | Red Sky Energy. | 0.005 | 25% | 4434158 | $21,688,909 |

| LDR | Lode Resources | 0.16 | 23% | 3365164 | $21,031,939 |

| FRS | Forrestaniaresources | 0.075 | 21% | 3540810 | $18,599,992 |

| OD6 | Od6Metalsltd | 0.03 | 20% | 361746 | $4,011,699 |

| MSG | Mcs Services Limited | 0.006 | 20% | 86096 | $990,498 |

| HOR | Horseshoe Metals Ltd | 0.021 | 17% | 919448 | $12,060,120 |

| AUK | Aumake Limited | 0.0035 | 17% | 5000 | $9,070,076 |

| BLU | Blue Energy Limited | 0.007 | 17% | 623839 | $11,105,842 |

| CTQ | Careteq Limited | 0.014 | 17% | 640299 | $2,845,425 |

| E79 | E79Goldmineslimited | 0.027 | 17% | 539768 | $3,643,491 |

Making news…

Raiden Resources (ASX:RDN) has hit gold in all eight holes from its Phase 2 drilling at the Vuzel project in Bulgaria, confirming a shallow, potentially large gold system. Top results included 24.8m at 1.96g/t from surface, with a high-grade zone of 13.3m at 3.4g/t.

Another hole returned 56m at 1.09g/t, including 8.3m at nearly 5g/t. The flat, near-surface nature of the gold means cheaper, faster follow-up drilling, said Raiden. The explorer is now testing 1.5km of a 4km target zone, with more assays pending and rigs still turning.

Stock exchange operator NSX (ASX:NSX) is set to be fully acquired by Canada’s CNSX, owner of the Canadian Securities Exchange, in a $0.035-a-share deal. CNSX already owns a slice of NSX and now wants the lot, offering a 59% premium to Friday’s close. The NSX board is backing the deal, saying it’ll bring financial muscle, tech upgrades and a stronger shot at shaking up Aussie capital markets.

And, Xanadu Mines (ASX:XAM) has entered into a bid deal with Bastion Mining, which is offering 8 cents a share, a 56% premium to Xanadu’s last close.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EEL | Enrg Elements Ltd | 0.001 | -50% | 10161 | $6,507,557 |

| HMD | Heramed Limited | 0.012 | -37% | 15269817 | $16,636,452 |

| AOA | Ausmon Resorces | 0.001 | -33% | 140669 | $1,966,820 |

| VPR | Voltgroupltd | 0.001 | -33% | 890010 | $16,074,312 |

| CDEDC | Codeifai Limited | 0.007 | -30% | 179 | $3,170,314 |

| VAR | Variscan Mines Ltd | 0.005 | -29% | 223042 | $5,480,004 |

| CTO | Citigold Corp Ltd | 0.003 | -25% | 51069 | $12,000,000 |

| MMR | Mec Resources | 0.003 | -25% | 11263310 | $7,399,063 |

| RLC | Reedy Lagoon Corp. | 0.0015 | -25% | 147000 | $1,553,413 |

| ATX | Amplia Therapeutics | 0.05 | -23% | 7928267 | $25,216,923 |

| AZL | Arizona Lithium Ltd | 0.007 | -22% | 34414461 | $41,056,331 |

| HPR | High Peak Royalties | 0.047 | -22% | 30500 | $12,483,583 |

| ERL | Empire Resources | 0.004 | -20% | 382724 | $7,419,566 |

| HLX | Helix Resources | 0.002 | -20% | 125000 | $8,410,484 |

| TEM | Tempest Minerals | 0.004 | -20% | 2503404 | $3,672,649 |

| TYX | Tyranna Res Ltd | 0.004 | -20% | 1409999 | $16,442,127 |

| HCT | Holista CollTech Ltd | 0.045 | -20% | 1134435 | $16,002,936 |

| ZMM | Zimi Ltd | 0.009 | -18% | 1033 | $4,702,982 |

| T92 | Terrauraniumlimited | 0.025 | -17% | 574360 | $3,057,462 |

| AQX | Alice Queen Ltd | 0.005 | -17% | 4645921 | $6,881,340 |

| EM2 | Eagle Mountain | 0.005 | -17% | 142889 | $6,810,224 |

| EMU | EMU NL | 0.02 | -17% | 234588 | $5,069,963 |

| JAV | Javelin Minerals Ltd | 0.0025 | -17% | 1124158 | $18,138,447 |

| MEM | Memphasys Ltd | 0.005 | -17% | 678910 | $11,901,589 |

| AMO | Ambertech Limited | 0.14 | -15% | 326164 | $15,741,789 |

IN CASE YOU MISSED IT

Impact Minerals (ASX:IPT) has raised the final $635,000 for a renounceable rights issue, under a shortfall offer. The funds will support a drilling program at the Arkun project, which will test the Caligula nickel-copper-platinum group element anomaly.

With $180,000 from the WA government’s Exploration Incentive Scheme partially funding the drilling program, IPT is keen to get drills turning at Arkun.

Alice Queen (ASX:AQX) has pocketed just under one million dollars in its latest raising effort to advance its Fijian gold exploration.

Anson Resources (ASX:ASN) locks in a first of its kind royalty rate for Green River lithium.

Many Peaks Minerals (ASX:MPK) has kickstarted a 3500 metre drilling campaign at its Odienné gold project in Côte d’lvoire.

Trading Halts

Arrow Minerals (ASX:AMD) – media reports in Guinea regarding mineral exploration tenements

EQ Resources (ASX:EQR) – cap raise

Estrella Resources (ASX:ESR) – agreement with mining services firm, PT Raka Energi Mandiri

Iltani Resources (ASX:ILT) – cap raise

Island Pharmaceuticals (ASX:ILA) – cap raise

Kingston Resources (ASX:KSN) – proposed transaction on Misima Gold Project

Koba Resources (ASX:KOB) – cap raise

Mayne Pharma (ASX:MYX) – proposed acquisition by Cosette

Nimy Resources (ASX:NIM) – cap raise

Oceana Lithium (ASX:OCN) – cap raise

OFX Group (ASX:OFX) – ASX query on its full year financial results

Peak Minerals (ASX:PUA) – exploration results from its Minta Rutile Project

Talga Resources (ASX:TLG) – cap raise

Volt Resources (ASX:VRC) – media reports in Guinea regarding mineral exploration tenements

At Stockhead, we tell it like it is. While Impact Minerals, Alice Queen, Anson Many Peak Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: Hot run ends for ASX as trade war impacts emerge