Prominent lobbyist Simone Holzapfel and husband took out $1.75m loan to put towards $1.2m debt

EXPLOSIVE court documents allege a prominent Gold Coast lobbyist and her husband took out a $1.75 million loan against their property to pay off a $1.2 million debt. See the full details of the shocking allegations.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

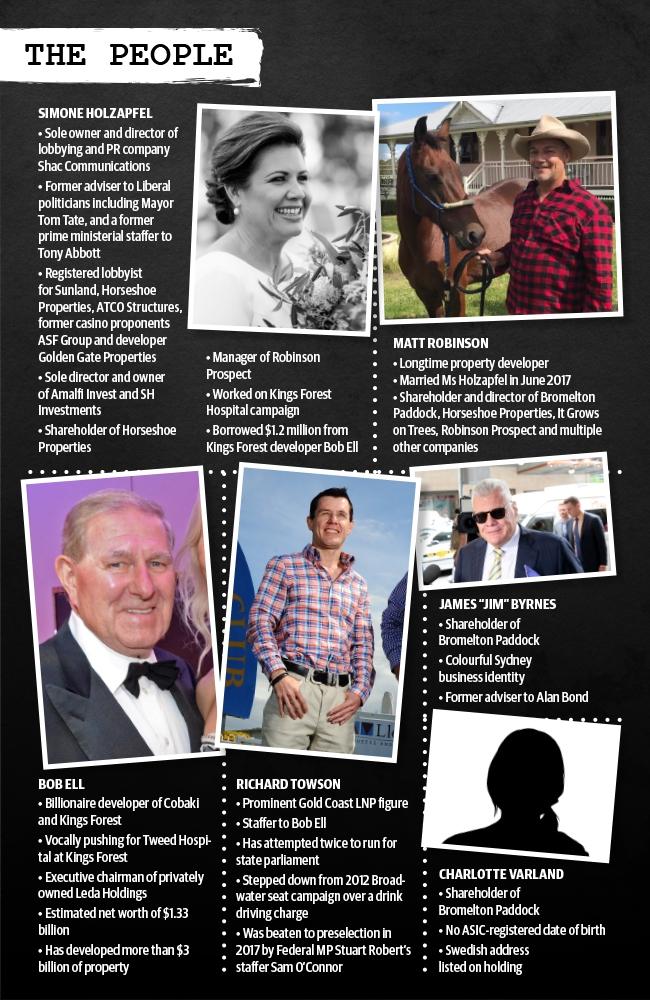

PROMINENT lobbyist Simone Holzapfel and her husband Matt Robinson took out a $1.75 million loan against their property and put it towards a $1.2 million debt to billionaire developer Bob Ell.

Evidence tendered to the Supreme Court as part of a mortgagee repossession also shows a mortgage to a third company was registered two days later over the same rural acreage where the couple were married at Gleneagle, near Beaudesert.

Ms Holzapfel is a prominent Liberal lobbyist and political donor who has worked as an adviser to Mayor Tom Tate and former prime minister Tony Abbott.

Varsity Lakes-based lender Weldev Capital claims it is owed more than $1.5 million and is seeking possession of the couple’s 126ha Gleneagle property, claiming they defaulted on the mortgage agreement in five ways. The couple is defending the claim.

The mortgage resulted in Mr Ell being paid $1,191,493.71 of the $1,205,000 million debt owed by Ms Holzapfel and her company.

Mr Robinson, Ms Holzapfel and her company Amalfi Invest have rejected the lender’s claims and have said the funds they owe are “farm debt” because she is running a cattle business and should be protected from enforcement action.

The mortgagee attempted to repossess the property in March, culminating in a confrontation between a security guard and an unknown man at the property, leading to accusations of trespass and property damage.

BOB ELL: ‘WHY ARE YOU PIKING ON SIMONE’

Under the loan agreement, Ms Holzapfel, Mr Robinson and Amalfi guaranteed another loan from Weldev to Mr Robinson’s company Bromelton Paddock, which owns three lots adjoining the couple’s Gleneagle property, including one where a 50-home development is planned.

Another of Mr Robinson’s properties, a million-dollar apartment at Currumbin, is listed for auction by a different mortgagee this morning, after he was ordered to pay $814,000.

Creditors are also circling their company Horseshoe Properties, which owns the site of the Huonbrook Estate development at Terranora and is in external administration.

Ms Holzapfel’s high-profile lobbying and PR company Shac Communications is also under financial strain and has shed staff.

Meanwhile, Ms Holzapfel has strongly denied lobbying for Mr Ell in his push for the NSW Government to build a new $534 million Tweed Hospital at his Leda Holdings development, Kings Forest.

Ms Holzapfel is a registered lobbyist for casino proponent ASF Group and developers Golden Gate Properties and Sunland.

Ms Holzapfel and the fellow respondents are being represented by Holding Redlich lawyer Ron Eames, who is a director on the board of Sunland.

PROMINENT LOBBYIST’S COMPANIES FACING FINANCIAL DIFFICULTIES

“MY FINANCIAL PROBLEMS ARE BULLETIN’S FAULT”: HOLZAPFEL

HOUSE OF CARDS

WELDEV Capital claims it is owed $1,515,461, including principal of $1,381,250, interest of $110,500 and an establishment fee of $23,711.

The loan agreement filed in court said the borrowers agreed the fees would be taken out of a $1.38 million advance, along with $172,656 in prepaid interest for the first month of the loan.

The parties in the case disagree on which rate of interest — either 12.5 or 18 per cent — should be applied.

Amalfi executed the mortgage on January 16 but according to the court documents, Ms Holzapfel emailed through her broker on the same day, asking for the terms to be varied as the deductions meant there would not be enough to cover the debt to Mr Ell’s company.

In an email, Ms Holzapfel asked for the loan to be settled with a reduction in the prepaid interest, with the balance of interest to be paid by the end of March.

According to the court documents, she also offered for Amalfi Invest to “pay certain amounts” that Mr Robinson’s company Bromleton Paddock owed Weldev in another loan.

Ms Holzapfel’s mortgage broker Travis Rayner followed the email with a call to the lender the same day.

HOLZAPFEL NOT REGISTERED FOR LEDA LOBBYING IN NSW

According to Weldev’s submission, its company secretary Adam Webb instead proposed a variation that would see Amalfi’s establishment fee and $34,531 in interest deferred until February 22.

Under Mr Webb’s alleged proposal, $25,194 in fees and interest owed to Weldev by Bromelton Paddock would also be deferred until that date, the submission said.

It said he also proposed Amalfi pay $106,250 by March 1 to reduce the loan-value ratio (LVR) below 60 per cent and agreed Weldev would pay out $1.191 million directly to the existing mortgagee, Leda.

The payment went to Leda on January 18, after correspondence with Ms Holzapfel, Leda’s lawyers and Mr Ell’s staffer Richard Towson.

The couple’s court defence denies the existence of a varied loan agreement, claiming Mr Webb did not specify the terms of a new agreement during the phone call, and that the discussion did not result in Amalfi agreeing to pay the $106,250 LVR reduction.

The defence said none of the respondents was party to the telephone call and that Mr Rayner did not have authority to agree to new terms on their behalf.

MULTIPLE VALUATIONS

THE initial finance application, signed by Ms Holzapfel, listed the value of the property at $2.5 million and said the $1.75 million loan represented 70 per cent of the property’s value, known as the loan-value ratio.

The application, lodged on November 7, 2017, included a valuation of $2.125 million for the property completed by Taylor Byrne the previous day.

Weldev had its own valuation done by JPM Valuers and Property Consultants on April 9 and that came back at $1.925 million, which gave an LVR of 72 per cent.

In their defence, the respondents said the JPM valuation was improper and submitted a third valuation of $3 million, completed on February 22, 2018 by CBRE, giving an LVR of 46 per cent.

Weldev rejected that assertion because the loan agreement specified the mortgagee had to nominate the valuer and that it had not nominated CBRE.

Weldev also rejected the borrowers’ claim the JPM valuation was improper and submitted that even if the varied loan agreement was not applied, the borrowers were in default because they had not reduced the LVR below 60 per cent as originally agreed. It submitted the “three months” referred to in the loan agreement ended on March 1.

In their counterclaim, the respondents said the three months should be counted from the loan advance date on January 18 and that they should have had until April 18 to get the debt ratio down to 60 per cent.

They said that voided the default notice, which was made March 5.

In response to the counterclaim, Weldev admitted the allegation the default notice was invalid “for the purpose of the proceeding”.

THE PENTHOUSE

MS Holzapfel’s postal address on some of the court documents from the mortgagee was the $2.7 million Trilogy penthouse in the up-market Surfers Paradise enclave of Budds Beach. The four-bedroom, five bathroom skyhome has a rooftop pool and has previously been advertised for rent at $1800 a week and “fit for an emperor”.

It is owned by former QBE Insurance chief executive Frank O’Halloran and his wife Rosemary.

Once court proceedings were under way, law firm Holding Redlich’s address became the respondents’ address for service of documents.

Ms Holzapfel had not responded to the Bulletin’s questions yesterday. Weldev Capital declined to comment on the case.

HOSHOE PROPERTIES OWES $27K TO NERANG ENVIRONMENTAL CONSULTANCY

TALLARA PASTORAL CORPORATION

SIMONE Holzapfel is a cattle farmer and haymaker, and the loan should thus be treated as “farm debt” and protected from automatic enforcement action, according to her Supreme Court defence.

In its statement of claim, Weldev referred to the finance application that described the secured property as a “residence’’ also used for “property investments/land bank”.

In the loan acknowledgment, the stated purpose of the loan was for “refinance of property”.

The application, which the respondents say was filled out by their mortgage broker, gave Ms Holzapfel’s occupation as “communications, lobbyist and political strategy advisory”.

Weldev submitted that Ms Holzapfel, in her affidavit on April 29, said the land had been used by one of her companies, SH Investments No 1, to operate a cattle grazing exercise since January 24.

Weldev claimed the alleged misrepresentation of the land use was a default of the loan.

In their defence, the respondents said the authorised purpose for the loan under the agreement was “business purposes”.

Company records show Ms Holzapfel registered a business name, Tallara Pastoral Corporation, attached to SH Investments, and registered a website — tallara.com.au — in January 2017.

GET FULL DIGITAL ACCESS FOR 50C A DAY

LOCKED OUT

EVIDENCE tendered by a security guard said he supervised the changing of locks and posted repossession notices on the Gleneagle property on March 19.

The guard said when he returned on March 22, a new lock had been placed on the front gate, and he destroyed it to access the property.

When he approached the house, a man told him he was trespassing and asked him to leave.

The respondents claimed in their defence that no notice was delivered and in their counterclaim described the mortgagee’s attempts to repossess the land as “unlawful”.

Weldev said that was untrue as the notice had been fixed to the property’s front door and that the notice had also been served through the respondents’ solicitors.

The respondents claimed the locksmith and security guard had trespassed and caused $12,500 in damage to the doors, windows and front gate, sparking $19,187 in related legal costs and that the entire exercise was a breach of the Farm Business Debt Management Act.

Weldev’s submission denies the trespass and breach claims and that the damage was caused by their agents.

ANOTHER MORTGAGE, MORE LOANS

A TITLE search showed another mortgage, to Sydney-based Lehne Investments, was registered two days after the Weldev mortgage. The Bulletin has been unable to contact Lehne Investments.

The default notice also alleges a breach of a separate loan with Weldev by Mr Robinson’s company Bromelton Paddock, which owns land adjoining the main property and has a current development application for a 50-home estate at Gleneagle.

In their counterclaim, Ms Holzapfel, Mr Robinson and Amalfi denied obtaining a second mortgage constituted a default of the mortgage to Weldev and said the alleged Bromelton breaches were not sufficiently detailed by the mortgagee.

Among their counterclaims to Weldev’s action, the respondents said the process for deducting establishment fees from the loan advance breached the agreement and nullified Weldev’s claim of default through non-payment of that fee.