Mortgagee to auction Matt Robinson’s million-dollar unit but he’s got a new loan, more plans

THE property developer husband of a prominent lobbyist has had his million-dollar unit repossessed, and still owes $814,000 to the mortgagee. But it hasn’t stopped the pair getting a new mortgage and planning a new development.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

THE property developer husband of lobbyist Simone Holzapfel has had his million-dollar unit repossessed and owes $814,000 to the mortgagee.

Another lender has launched action to repossess another of their properties, one of the companies is in external administration and others are in financial strife.

But it hasn’t stopped Ms Holzapfel and her husband Matt Robinson from getting a new mortgage and planning another development.

Mr Robinson is hoping to put 50 homes on a 4.6ha block despite the application not complying with five council codes, the presence of endangered remnant vegetation and the prospect of their own adjoining homesite being repossessed by a mortgagee.

Several companies linked to Ms Holzapfel and her husband have not paid their bills, with a lender set to auction Mr Robinson’s Currumbin apartment on Saturday.

Supreme Court documents show Mr Robinson and his company “It Grows on Trees” defaulted on a mortgage of the two-bedroom ground-floor unit which property records say he bought from former Gold Coast Titans coach John Cartwright for $950,000 in 2015.

The court granted a warrant on January 31 for Permanent Mortgages (No 2) to take possession of the oceanview unit in the Rocks Resort and also ordered Mr Robinson to pay $814,000 including the borrowings, interest and costs.

GET FULL DIGITAL ACCESS FOR 50C A DAY

Another mortgagee has taken the pair to court in their effort to take possession of the 126ha Gleneagle property near Beaudesert where the couple was married.

Varsity Lakes-based Weldev Capital applied to take possession of the acreage for an alleged mortgage default in April and it was listed online “for sale by mortgagee”.

However Ms Holzapfel, her company Amalfi Invest and Mr Robinson, have launched a counterclaim which is yet to be finalised.

The couple haven’t let the setbacks stop them from securing a $5 million new mortgage to bail out another of their companies, Horseshoe Properties, which is in external administration and is behind another development, Huonbrook Estate, at Terranora in northern New South Wales.

In response to 10 detailed questions yesterday, Mr Robinson said the new lender was aware of his financial situation.

“All was and has been totally disclosed,” he said via text messages.

“I have been very open with people and yes, they are across the issues.

“There is a cause and they acknowledge it.”

Mr Robinson has previously said their problems started when a major contractor at the Huonbrook development made an error which “cost millions”.

He said he planned to pursue that matter through the courts.

“MY FINANCIAL PROBLEMS ARE BULLETIN’S FAULT”: HOLZAPFEL

A 4.9ha triangular wedge adjoining the couple’s farmhouse property at Gleneagle west of the Gold Coast, reconfigured and registered in the name of one of Mr Robinson’s companies Bromelton Paddock, has corridors for future railways on two sides and the Mount Lindesay highway on the other.

The Bromelton company has applied to develop 50 homes and a park on the wedge of land, directly in front of their other property.

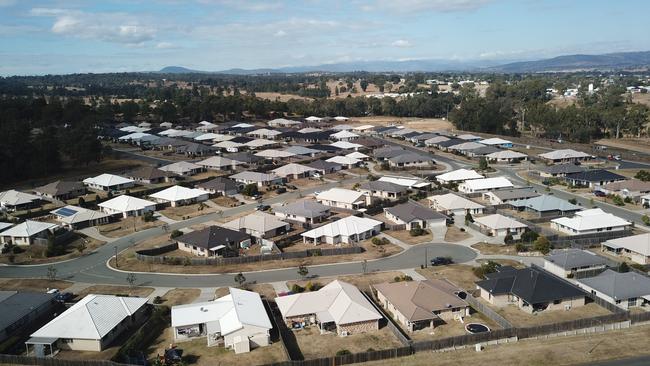

The property is at the centre of a booming house-and-land market, with new housing estates sprouting across the highway from the site and also to its north and south.

The council is dealing with eight applications for new housing projects in the area as greenfield development land on the Gold Coast and in Brisbane’s south dwindles.

Bromelton Paddock first applied to create the 50-lot subdivision, with a median lot size of 653 sqm, in April, but failed to include the $35,000 application fee, so the application was not accepted until May.

HOLZAPFEL NOT REGISTERED FOR LEDA LOBBYING IN NSW

After the fee and other documents were supplied, the council found the application lacking key information — including a missed state government referral related to the railway corridor and issues with the proposal’s roads and traffic; layout; open space; stormwater management; and code assessment.

The council flagged multiple aspects of five applicable codes the application did not comply with.

State Government biodiversity mapping also shows an area of endangered remnant vegetation on the property.

Asked how he planned to address the issues, Mr Robinson’s text said: “No referral problems at all on DA”.

“Normal procedure,” he wrote.

“Bromelton Paddock has successfully delivered a completed subdivision ahead of time and on budget last year.

“As usually is the case, when there’s no unjust damage causing delivery of the subdivision to be stopped.”

Through various entities, Mr Robinson holds 60 of 120 shares in Bromelton Paddock, with 36 ultimately held by Sydney man James Byrne, 59.

The remaining shares are held by a Charlotte Varland, whose holding is listed with a Swedish address and no date of birth.

Mr Robinson did not address questions about who Ms Varland was or how she could be contacted.

He did not answer questions about whether he intended to pay the $814,000 owed to the mortgagee of the Currumbin property, what that judgment meant for his other developments, how he planned to address endangered vegetation or the other council concerns.

Several companies linked to Ms Holzapfel and her husband are suffering financial difficulties, with one company in external administration.

That company, Horseshoe Properties, owns the site of a multi-million development at Terranora, which is being developed by another of the family’s companies, Robinson Prospect.

Ms Holzapfel is a shareholder in Horseshoe Properties and manager of Robinson Prospect.

Court documents showed Horseshoe Properties owes $27,000 to a Nerang environmental consultancy and $22,000 to Tweed Shire Council for unpaid rates.

Ms Holzapfel’s PR and lobbying company Shac Communications also had “some creditors that have got bills that are being paid”, she revealed earlier this month.

GET FULL DIGITAL ACCESS FOR 50C A DAY

Ms Holzapfel did not respond to the Bulletin’s questions yesterday.

Her company Amalfi Invest, owner of the Gleneagle property, is subject to strike-off action by ASIC.