Gold Coast payday lender in corporate regulator’s crosshairs again

A Gold Coast payday lender is again in the crosshairs of the corporate regulator for high-interest loans resulting in repayments close to 500 per cent of the amount borrowed. SUBSCRIBE TO READ MORE.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

A GOLD Coast payday lender is again in the crosshairs of the corporate regulator for high-interest loans resulting in repayments close to 500 per cent of the amount borrowed.

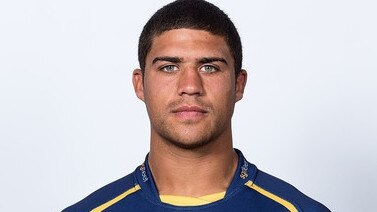

Last year the Australian Securities and Investments Commission issued a Product Intervention Order against Southport-based Cigno, which counts former ACT Brumbies player Mark Swanepoel as sole director, for what it called a short-term credit lending model that caused “significant consumer detriment”.

KIWI FAMILY’S STOUSH WITH GOLD COAST BOOKING AGENCY

Cigno circumvented obligations under the National Consumer Credit Protection Act 2009 limiting the amount of interest that can be charged by using an associated company – Gold-Silver Standard Finance Pty Ltd – to act as the short-term credit provider.

It then charged significant upfront fees including for default through associated company under a separate Cigno contract.

As a result some clients who defaulted on their loans were charged close to 1000 per cent interest.

Last year Cigno appealed to the Federal Court in NSW to overturn the PIO but failed to get the order reversed.

On Thursday ASIC issued a consultation paper seeking a second PIO to ban another model used by Cigno and associated company BHF Solutions, linked to Brenton Harrison, that it says also harms consumers.

ASIC is obliged to issue consultation papers seeking comment from interested parties prior to exercising its powers under Corporations Act.

The new model is called continuing credit and ASIC is seeking to impose a cap on costs relating to the credit contracts. Under this model, which contemplates multiple advances, BHFS provides the loans charging a fixed fee and Cigno enters into a services agreement charging additional fees, including for “fast tracking” loans.

ASIC said the loans were advertised as ‘Loans for Unemployed People’ and ‘Centrelink Loans’ among other descriptions.

It said the loans were issued without a credit licence, did not give clients access to an external dispute resolution body such as the Australian Financial Complaints Authority, and had high fees payable on default.

MORE BUSINESS NEWS

Gold Coast development: Star Group reveals future of $2B Broadbeach masterplan

Coast gymnastics club’s incredible story of survival

The regulator gives the example of a client who engaged Cigno for a $250 loan under a continuing credit contract.

The client was charged almost $1000 in fees, including $215 in upfront fees and $685 in default fees.

ASIC said that the customer was only able to make $309 in repayments and as of December still owed Cigno and BHFS more than $900. The total repayments added up to 490 per cent of the original loan amount.

ASIC commissioner Sean Hughes said it is seeing cases of significant harm from continuing credit contracts.

“The product intervention power equips ASIC with the ability to take action where we find significant consumer detriment. Protecting vulnerable consumers remains a high priority for ASIC,” he said.

Cigno has been contacted for comment.

Submissions to ASIC on its latest proposal are due by August 6.