Federal Court rejects Gold Coast payday lender’s appeal against short-term lending ban

A judgment has been issued in the case of a Gold Coast payday lender that appealed against an order from the corporate regulator banning a “predatory” short-term lending model.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

GOLD Coast payday lender Cigno has lost its Federal Court appeal against an order from the corporate regulator banning a “predatory” short-term lending model.

Justice Angus Stewart in the Federal Court in NSW today issued his judgment following a judicial review application by Cigno, which sought to overturn a Product Intervention Order (PIO) lodged by the Australian Securities and Investments Commission in September last year.

Cigno’s appeal claimed the PIO was invalid.

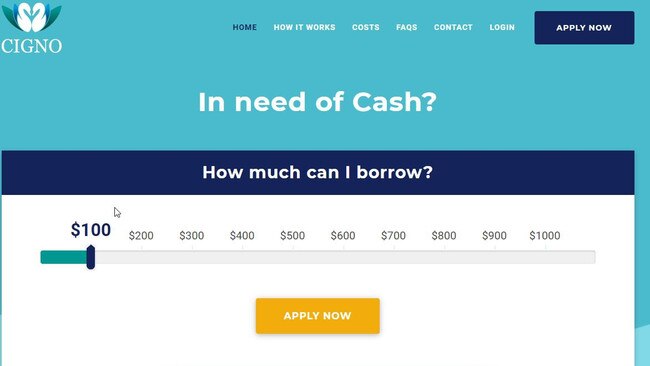

The order banned a model or class of financial products that lead to “predatory” lending in the short-term credit industry. ASIC claimed “significant consumer detriment” via charges that were 10 times the original amount borrowed.

The model works through one party acting as short-term credit provider while another charges other additional fees as broker, thus getting around obligations under the National Consumer Credit Protection Act 2009 preventing lenders charging more than 24 per cent annual interest.

Justice Stewart said ASIC was entitled to consider the “detriment caused indirectly by the financial product” when making the PIO.

“In my view ASIC’s delegate identified the relevant class of financial products as being short term credit or short-term credit provided in particular circumstances, namely as part of the short term lending model,” he said.

“ … s 1023D (3) provides for the exercise of the product intervention order power on the basis not only of detriment that has actually occurred, but also detriment that ‘will or is likely to’ occur as a result of a class of financial products. Thus, there need be no existing product, let alone more than one, for the power to be able to be exercised.”

ASIC Commissioner Sean Hughes said ASIC will continue to act to protect consumers especially where it saw “evidence of significant harm”.

The PIO remains in force and costs were awarded to ASIC.