Gold Coast payday lenders Cigno Pty Ltd and Gold-Silver Standard Finance Pty Ltd in regulator’s crosshairs for payday loans

Payday lenders are in the corporate regulator’s crosshairs for loans charging 1000 per cent interest to low-income customers.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

SOUTHPORT-based payday lenders are in the corporate regulator’s crosshairs for loans charging 1000 per cent interest to low-income customers.

ASIC yesterday announced it has released a consultation paper proposing the first use of its new product intervention power where it is seeking to address what it calls “significant consumer detriment in the short-term credit industry”.

The new powers, granted by the Federal Government in April, require ASIC to consult with affected and interested parties before intervening.

Cigno Pty Ltd and Gold-Silver Standard Finance Pty Ltd are the first targets identified by ASIC.

SUBSCRIBE TO THE BULLETIN FOR $1 A WEEK FOR THE FIRST 12 WEEKS

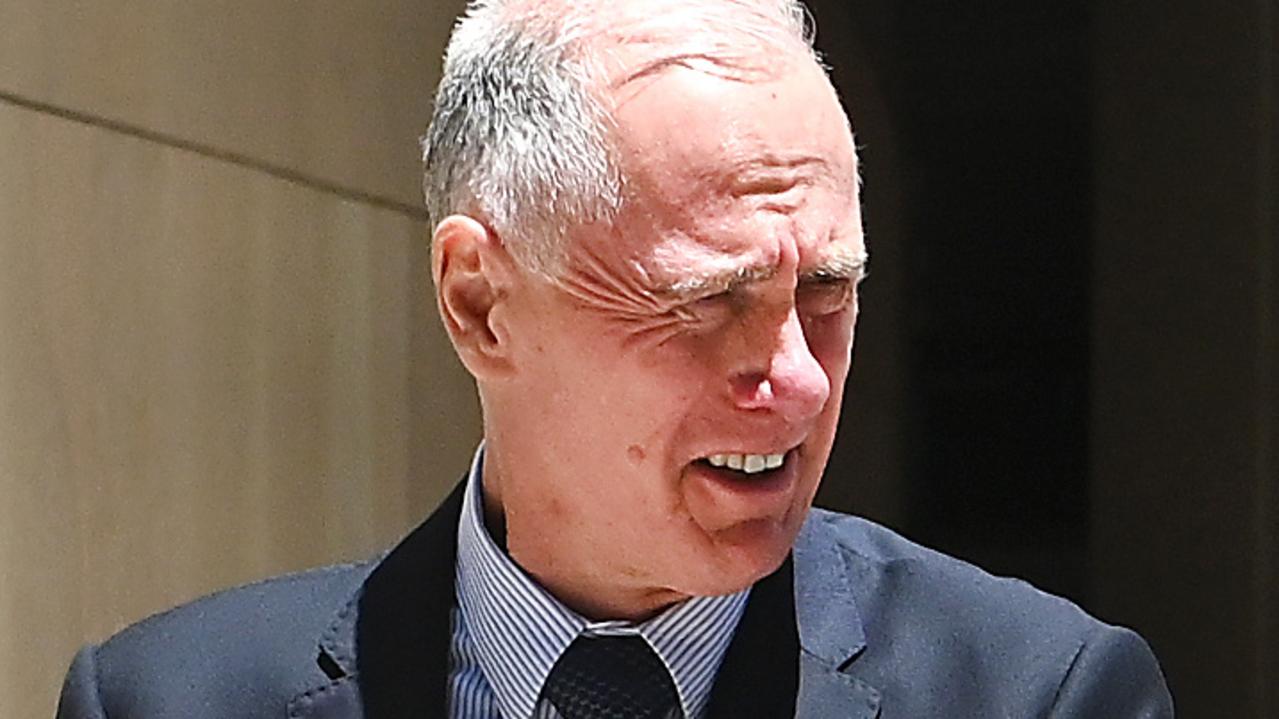

Cigno’s sole director is Mark Swanepoel, while the latter company counts Jan Swanepoel as the only director and shareholder. Both companies share an address on level one of 34a Nerang St.

A case study from ASIC in its consultation paper describes the situation of a Cigno client who borrowed $120. The total amount to be repaid was $263.60 by four fortnightly payments of about $66.

However, ASIC says the client could not afford the repayments and “immediately defaulted”.

She was charged dishonour fees and weekly account-keeping fees resulting in her being liable to repay $1189 on the original amount of $120. This was 990 per cent more than she borrowed.

The Bulletin visited Cigno’s offices where an employee said a representative would be in touch. The Bulletin also called the mobile number listed on Cigno’s website but it was switched off.

MAN BEHIND DIAMOND LOAN SCAM BANNED FOR THREE YEARS

ASIC Commissioner Sean Hughes said “significant” harm has been done to vulnerable people through the use of the short-term lending model.

“Consumers and their representatives have brought many instances of the impacts of this type of lending model to us,” he said.

“Given we only recently received this additional power, then it is both timely and vital that we consult on our use of this tool to protect consumers from significant harm which arise from this type of product.

“Before we exercise our powers, we must consult with affected and interested parties. This is an opportunity for us to receive comments and further information, including details of any other firms providing similar products, before we make a decision.”

ASIC is seeking public submissions by July 30.

Submissions should be sent to: product.regulation@asic.gov.au.

The regulator said it expects to make a decision on action it will take by August.

Options flagged in its proposal include the use of the product intervention power to prohibit specific short-term lending models, which is ASIC’s preferred option, encouraging the use of alternative products or actions through warning messages and no change to the status quo.

Payday lenders such as Cigno and Gold-Silver Standard Finance are not subject to the National Credit Code and National Credit Act if they meet certain conditions. They include extending credit for less than 62 days.

This means lenders such as Cigno and Gold-Silver Standard Finance can operate without a credit licence.