Gold Coast businesses that have opened and closed during COVID in 2020

Last year was one of the hardest on businesses who had to weather an “unprecedented” pandemic. Unfortunately, some didn’t survive, and surprisingly, others saw it as a new opportunity. SEE THE FULL LIST

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

LAST year was one of the hardest on businesses who had to weather an “unprecedented” pandemic.

COVID-19 restrictions caused the hospitality, retail and tourism industries to grind to a halt while the country’s leaders tried to “flatten the curve”.

For months most states and territories were in lockdown and some experienced a “second wave” of the deadly virus.

Queensland closed its borders on March 26, the first time in 101 years, allowing only essential workers to enter the state.

On March 30, the Federal Government announced the introduction of JobKeeper. The payment is a wage subsidy paid by the government to businesses significantly impacted by the coronavirus.

It helped to keep businesses afloat until restrictions eased and all levels of government started concentrating on stimulating the economy. Unfortunately, not all businesses survived.

Despite this, many courageous Gold Coast and Tweed residents took the plunge and opened the doors to a new business.

Below the Gold Coast Bulletin lists Gold Coast businesses that have opened, and closed, in 2020.

OPENED BUSINESSES

Indirectory

WHEN trade shows were cancelled around the world due to coronavirus, Gold Coast entrepreneur Emma Patterson decided it was the right time to launch her “low-risk” software solution.

Trade shows normally provide an opportunity for product brands to connect with retail buyers looking for the latest stock. However, in February thousands of these shows were cancelled worldwide – leading to a massive void in the market for networking tools.

Enter Ms Patterson, who in late 2017 pitched an app “like Tinder, but for connecting product brands with stores” at a Global Startup Weekend Competition hosted by GC Hub, which she won.

Burleigh Drinks Company

BY now it is a familiar tale.

A business sees its revenue crumble after coronavirus-related restrictions take an axe to its customer base and the company is forced to pivot to survive.

In the aftermath, a new business/side venture is born and that provides an alternate revenue stream to keep the operation viable.

All the above is true for Burleigh-based bulk juice supplier Queensland Fruit Processors owned by Michael Paull and Doug Bario.

The key difference according to Mr Paull is that a retail arm of the business called Burleigh Drinks Company was always on the cards.

Empire Nightclub & Cocktail Lounge

FOR one Gold Coast entrepreneur, the COVID-19 restrictions have meant a longer wait to realise a lifelong dream of opening a club in Surfers Paradise.

Matty Turner, the 23-year-old founder of Bikini Barber Babes, secured a liquor licence for a his new rhythm and blues (RnB) venue Empire Night Club & Cocktail Lounge. It will be located in the front section of the former Shooters club on Orchid Ave.

Arcade Gold Coast

THE Glitter Strip’s newest nightspot expects to draw bumper crowds bolstered by tourists flocking north after its looming opening was advertised interstate.

Arcade opened its doors on Surfers Paradise party strip Orchid Ave on December 6, despite initial plans to hold out until lingering COVID-19 dancing restrictions were lifted.

Owner-operator Mark James, former organiser of Future Music and Summerfield Dayze festivals, said the venue with a “lounge retro vibe” offering a “sophisticated” take on Coast clubbing.

Stoken

A TOP cardiologist and his neighbour have created a sophisticated gin they promise will get your heart started.

Stoken gin is described by creators Dr John Meulet and Gold Coast Airport general manager Brett Curtis as unconventional, refreshing and “absolutely Australian”.

The Kingscliff locals started their gin journey by default about two years ago after initially wanting to create their own tequila.

Nectar Juice House

CRAVING a freshly squeezed juice and quality sanga during a road trip has led two sisters on a whirlwind journey into opening a business just weeks after the initial idea.

Three weeks after that conversation the sisters are madly renovating a Cabarita Beach shopfront to open their brainchild, Nectar Juice House.

The Cavill Hotel

THOSE behind a revamp of former Surfers Paradise nightclub Melbas hope it’ll draw a new crowd.

The institution shut in late 2019 due to COVID-19 but has been reinvented as The Cavill Hotel.

Hallmark Group, with Surfers Paradise venues Finn McCool’s, Retros, Asylum and The Lost Kingdom, has taken over the Cavill Ave lease where Melbas has been since 1981.

CLOSED BUSINESSES

Global Travel & Cruise – Tweed Heads

A TWEED Heads travel agency was likely the latest victim of COVID-19 – falling into liquidation owing $155,000.

The directors of D P & C Ryan Pty Ltd, which traded as Global Travel & Cruise and was part of the Helloworld Travel group, made the decision to undertake a creditors’ voluntary winding up of the company on July 15.

The directors were Rebecca and Jason Collins of Nerang and Dallas and Cecile Ryan of Bogangar. The travel agency’s office was located on level two of Mantra Twin Towns in Tweed Heads.

Blockchain Finance Pty Ltd

ASITHA Koralage and Johnathan Regan are directors and shareholders of Bundall’s Blockchain Finance Pty Ltd.

According its website, taken down for maintenance after Bulletin queries, the business offers a wide range of services.

They include investment and guidance to blockchain start-ups, software to identify cryptocurrency trading and investment opportunities and due diligence on Initial Coin Offers.

On September 18 the directors voted to voluntarily wind it up, appointing Mark Pearce and Michael Dullaway of Pearce & Heers as liquidators.

HOW NBN HAS COST THESE COAST BUSINESSES THOUSANDS

i2S

YATALA-based road works group Intelligent Infrastructure Solutions fell into voluntary administration with the chairman at the time blaming COVID-19.

Administrators Matthew Joiner and Bruno Secatore, of Cor Cordis, were appointed to i2S, which was headed up by chairman Clayton Glenister, in June.

Mr Glenister, who is managing partner of MBA Lawyers, said it was forced to pull its crews from four work sites in Victoria and NSW because it could not guarantee the health and safety of its employees during the COVID-19 pandemic.

Mr Glenister said these were cases where its workers had to work in confined spaces with no social distancing.

“It was completely impractical.”

He said this imposed a “massive” financial cost to the company, which has 40 employees.

Salt & Co

A GOLD Coast company linked to a chain of gourmet butchers was placed into liquidation owing more than $34,000 with the business blaming the Robina Town Centre operator for the failure.

Salt & Co Meats Pty Ltd was placed into liquidation on May 11 following Supreme Court action by creditor, Tamworth-based Warmoll Foods to wind up the company over an $8000 unpaid debt.

The sole director of Salt & Co Meats was Palm Beach resident Samantha Williamson and the principal place of business was listed as Westfield Coomera.

Salt & Co, which supplied dry aged meat and Wagyu beef to the public and high-end restaurants, had a number of stores in addition to Coomera including one at Pacific Fair as well as another under construction at Pavilions in Palm Beach.

Wiltshire Lawyers Pty Ltd

A LARGE Gold Coast family law practice touted as a “leading force” in the industry has fell into voluntary liquidation in March.

The Australian Securities and Investments Commission published a notice on March 16 that liquidator Domenic Calabretta, of Mackay Goodwin, had been appointed to Wiltshire Lawyers Pty Ltd, which traded as ATF Wiltshire Lawyers Trust.

Director Andrew Wiltshire passed a resolution at a meeting to voluntarily wind up the company.

The resolution read: “That as the company is unable to pay its debts as and when they fall due, the company be wound up voluntarily and that Domenic Calabretta be appointed liquidator for the purposes of such winding up.”

THE SHOCKING SHARK ATTACKS THAT ROCKED THE COAST

Citi Private Capital

THE Gold Coast company behind an alleged loan scam has gone bust.

Citi Private Capital was placed into voluntary administration on September 30 following a motion from sole director Jarred Scott.

The company forms part of allegations by Queensland Police that Anton Mentz – formerly known as Marius Ackerman – used it to defraud borrowers of tens of thousands of dollars.

Mentz is alleged to have taken large upfront fees from borrowers looking for commercial loans and then made no attempt to obtain the finance.

Tallship Island Adventures

IN THEIR heyday Gold Coast tourism identities Bruce and Margaret Nicholls ferried holidaymakers and corporate partygoers to the couple’s South Stradbroke resort aboard a luxury sailing yacht called Sir Henry Morgan.

By September, the three-mast vessel was abandoned and lying in a Brisbane boat yard waiting to be broken up while the Nicholls’ business Tallship Island Adventures was controlled by liquidators.

The family-run company, launched in 2004 and based next to Marina Mirage, offered day trips to the couple’s McClarens Landing Resort as well as parasailing, whale watching and private parties for large companies.

Mr Nicholls was also on the board of the Gold Coast Tourism Corporation for several years.

These days the resort, which was once a hub for both booming parties and laid back drinks, is abandoned with vandals trashing the buildings on the site.

Jersey Mike’s

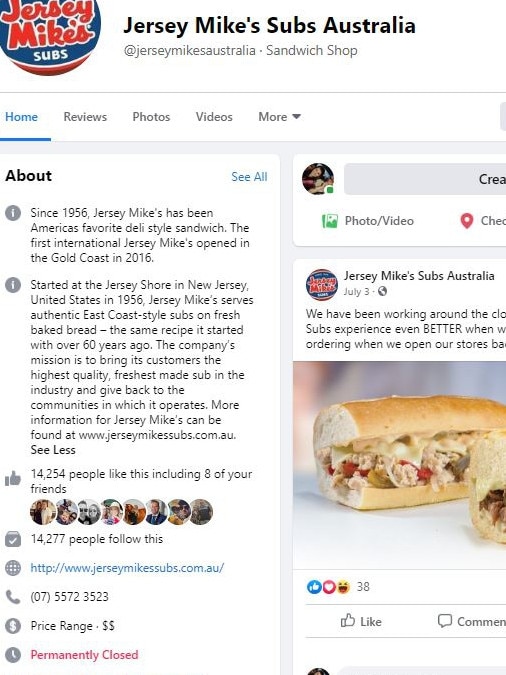

AN attempt by US submarine sandwich chain Jersey Mike’s to push into the highly competitive Australian fast-food sector appears to have fizzled with both its Gold Coast stores closing their doors.

Jersey Mike’s, founded in New Jersey in 1956, sells deli-style submarine sandwiches.

In 2016 it chose the Gold Coast and South Brisbane for its first international expansion.

The first shop was set up in 2016 at the Q Super Centre in Mermaid Waters following $400,000 in fit-out costs and was closely followed by another outlet at the Benowa Village Shopping Centre with an additional shop in Browns Plains south of Brisbane.

The chain was hard hit by coronavirus-related restrictions on in-store dining imposed on businesses in March and had to temporarily close its stores.

Those closures appear to have become permanent and Jersey Mike’s Australia’s Facebook page lists its operation as “permanently closed”.

The Q Super Centre store is for lease while the Benowa shop has been shut for months.

The website lists no outlets in Australia with a message on the front page stating: “We are working on an opening date”.