Failed Gold Coast builder Pivotal Homes did not hold enough assets to perform $52m of work

The liquidator of a failed Gold Coast builder has found the company did not hold enough assets to perform the amount of work it was undertaking. Meanwhile, the director has made a claim of his own. DETAILS:

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The liquidator of failed Gold Coast builder Pivotal Homes has found the company did not hold enough assets to perform the amount of work it was undertaking.

As a result, director Michael Irwin may personally have to find up to $550,000 to tip into the liquidation fund.

Meanwhile, Mr Iwin has emerged as the second largest unsecured creditor of the company, claiming he’s owed $417,670.

Pivotal’s licence history shows it had a maximum revenue limit of $30m but logged 211 residential construction jobs worth $56.7m in 2020-21.

It logged 105 jobs worth $30.5m in the current financial year.

Liquidator Chris Cook found Pivotal had lodged two deeds of covenant, worth $350,000 and $550,000 in order to meet financial requirements of its building licence.

Deeds of covenant are provided by a third party, usually a director, as an assurance to support the company when it doesn’t meet the asset requirements for its licence category.

The deed amount can then be claimed by the company in the event of a liquidation.

The liquidator found the first deed, for $350,000, was provided to the Queensland Building and Construction Commission in October 2019.

The report said Pivotal had applied to increase its revenue category in October 2021 and, to support the application, a new deed for $550,000 was provided in April this year.

In May, the same month Pivotal went into liquidation, the company requested the application to upgrade its licence be withdrawn.

Mr Cook’s report said he was seeking legal advice on which of the deeds would apply and would demand immediate payment as soon as possible.

While the director estimated about $3.6m was owed to unsecured creditors, that amount had climbed to $5.39m in the liquidator’s report.

The amount does not include money to be claimed from the company by the QBCC in relation to its Home Warranty Scheme, a figure which is likely to be significant.

Mr Cook’s report said non-priority creditors could receive an interim dividend of between 53.68c and 98.33c per dollar they were owed “in the near future”.

Pivotal employees who have lodged a valid claim will be the first to be paid, with deposits to drop in their accounts on July 11.

The liquidator found about $320,000 was owed to staff in priority entitlements.

A further $410,000 owed to them is not considered a priority to be paid from the liquidation.

The report said Mr Irwin had advised of $771,167 held by the company in a Westpac account, which has since been transferred into the liquidation account.

Upon further examination, the liquidator found three more accounts holding a further $418,708, meaning the company’s known cash at bank was closer to $1.2m.

According to his report, the company had paid $2.9m to sales agents in exchange for finding new Pivotal clients.

Sold out $140m Palm Beach tower Alegria canned, deposits returned after construction costs skyrocket

Shortly before going into liquidation, Pivotal cancelled the contracts for the agents and demanded the money be returned.

The liquidator hoped to recoup most of the funds, but conceded costly legal action may be required to do so.

The liquidator has estimated the costs of administering the liquidation between $300,000 and $550,000.

He found the company’s motor vehicles had been valued at $218,000, and it would cost $2800 to sell them, providing an estimated return of $215,200.

A Ferrari, listed as a company asset in its depreciation schedule, had been sold with proceeds being paid to the company, the liquidator said.

“We are still in the process of investigating this position, to confirm that the Ferrari

was sold at fair market value,” the report said.

“An update into our investigations will be disclosed in our next report to creditors.”

The liquidator found much of the $179,000 worth of office equipment disclosed by Mr Irwin was leased and would have to be returned, leaving equipment worth $12,120.

He said it would cost $7249 to sell the equipment, making a net return of $4871.

The liquidator’s report shed more light on a ransomware attack, which has been described as the “last straw” that pushed Pivotal into liquidation.

The report said hackers gained access to the company’s network on May 10, two weeks before the liquidation.

The report said a backup system in place to protect the company from data loss had failed and the liquidator is considering whether there may be grounds to claim on insurance.

“The Company’s IT service provide advised that on restoration of the servers from backup, it was discovered that back up for various data files had not been completing correctly,” it said.

“As a result, the Company lost all of the data. The Company then started recreating all accounts manually to enable payment of outstanding invoices.

“The enormity of recreating the account as a result of lost data was the last straw for the Company to wind up the Company.”

How collapsed builder did $52m of work on $30m licence

June 6, 2022: Queensland’s building watchdog will not say whether Pivotal Homes raised any financial red flags in the lead up to its $3.6 million collapse.

Pivotal’s licence was cancelled the day after it went into liquidation, with Queensland Building and Construction Commission records showing it had not been subject to any previous suspension or cancellation.

The company’s licence history shows it had a maximum revenue limit of $30m but logged 211 residential construction jobs worth $56.7m in 2020-21 and 105 jobs worth $30.5m in the current financial year.

Despite the apparent disparity, the QBCC said the amount of work recorded on the licence was not an indication of how much revenue the builder had earned.

“Construction Notification values are not indicative of actual revenue earned during a financial year, as a construction contract may take more than 12 months to complete, or may cross from one financial year to the next,” a spokesman said.

“Licensees are required to comply with minimum financial requirements, including the requirement to lodge financial reporting with the QBCC annually.

“The minimum financial requirements for licensing do not permit a licensee to increase maximum revenue by more than 10 per cent in a financial year without prior approval from the QBCC.”

The QBCC declined to answer questions about Pivotal’s capacity to meet its minimum financial requirements in the months leading up to the liquidation, or if the company had applied to increase its maximum revenue limit.

“Due to privacy laws, the QBCC is only able to confirm financial information that appears on a licensee’s public record,” the spokesman said.

Speaking after the liquidation, Pivotal managing director Michael Irwin said pandemic and weather impacts, combined with rising supply and subcontractor costs had left the company’s fixed price home build contracts unviable.

“Data loss” due to a ransomware attack has also been partly blamed for Pivotal’s failure.

When it went into liquidation it had 103 houses under construction, in various stages from slab pours to turnkey, and 177 homes waiting on council approval.

Clients of failed Gold Coast builder Pivotal Homes have been urged to lodge a claim under the QBCC’s insurance scheme.

Failed builder’s records lost in data hack: Liquidators

June 3: Liquidators of Gold Coast builder Pivotal Homes say the company was subject to a devastating ransomware attack in the weeks before it collapsed.

The hack means Pivotal’s financial information will have to be painstakingly pieced together using paper records.

Meanwhile, it has emerged a Ferrari, bought for $440,000 in 2018 and listed as a company asset, was sold a few months ago.

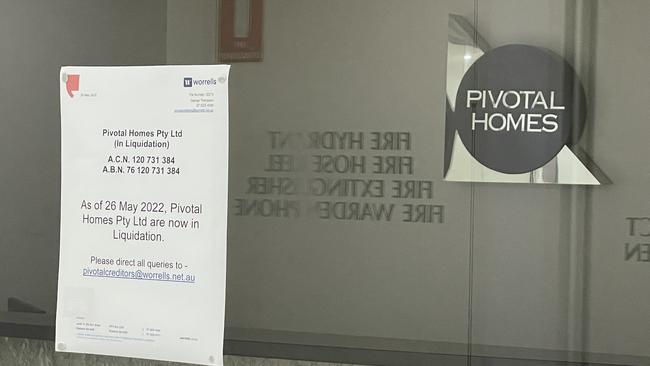

Pivotal Homes went into administration on May 26, leaving the future uncertain for more than 200 new home builds and 16 staff.

MUM CALLS ON HOME BUYERS HIT BY PIVOTAL COLLAPSE TO SPEAK UP

A report from director Michael Irwin estimated it had debts of more than $3.6m, but said “lost data” meant there were “no accurate records” of exactly how much was owed to subbies and suppliers.

Liquidator Chris Cook said the attack was “legitimate” and had corrupted the company’s files covering the past six months.

Mr Cook said the lost files had meant staff of Pivotal had been attempting to settle accounts manually in recent weeks, with the increased labour a likely contributor to the company’s failure.

“It was probably a case of it being the final straw,” he said.

“It was making it enormously difficult, there was an enormous amount of labour involved in working out the payments.”

Mr Cook could not say whether the attack had been reported to authorities.

The Bulletin has contacted the Queensland Police Service and Australian Cyber Security Centre for a response.

Mr Cook said liquidators had been told the sports car had been sold “three or four months ago”, with proceeds returned to the company for the benefit of creditors.

“I’ll be investigating that,” he said.

Despite the unusual data setback, the liquidator said early indications were there would be sufficient funds in the company to ensure employee wages and entitlements were all met and he anticipated other unsecured creditors would also receive at least part of what they were owed.

‘No accurate records’ of building giant’s debts after shock collapse

June 2: Failed Gold Coast builder Pivotal Homes has debts of more than $3.6m, according to its director, but “lost data” means there are “no accurate records” of exactly how much is owed to subbies and suppliers.

A report on company activities and property, completed by Pivotal director Michael Irwin, also lists a Ferrari sports car, bought for $440,000 in 2018 and sporting the licence plate “MI”, as a company asset.

The report blamed “lost data” as “the part-cause of the insolvency” and estimated subcontractors were owed $500,000, while suppliers were owed $2.5m over two months.

“Attempts are currently being made to re-create this information which, in time, may provide a more accurate listing, per creditor,” Mr Irwin wrote.

Pivotal Homes went into administration on May 26, leaving the future uncertain for more than 200 new home builds and 16 staff.

Mr Irwin last week said rising costs, lockdowns, floods, Covid infections and constant rain had caused the collapse of his company, obliterating the viability of its fixed-price contracts.

The report said the company also owed $171,026 in tax.

Staff are owed about two weeks’ wages, totalling $80,000, as well as $376,133 in annual and long service leave entitlements.

Employees are considered protected creditors, so will be paid first out of any proceeds of the liquidation.

The director’s report does not take into account claims from creditors lodged since the administration began.

According to his report, the company had also lost data on how much money it was owed, but Mr Irwin provided a “good faith”, “rounded estimate” of $2m.

The company’s assets include eight vehicles worth $245,000 and other assets totalling $179,000, including computers, office furniture, a “bronze bull statue” bought for $1300 and autographed Les Sherrington memorabilia bought for $500.

The report also listed a contingent assets of a $3m marketing fee refund.

Have you been impacted by the collapse of Pivotal Homes? Get in touch by emailing kathleen.skene@news.com.au