Business as usual for Jim Raptis, whose assets have been frozen for a year in $110m tax probe

It’s been a year since the assets of indomitable developer Jim Raptis were frozen over an alleged $110m tax debt, so how has his life changed? In two words: not much. HERE’S WHY:

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

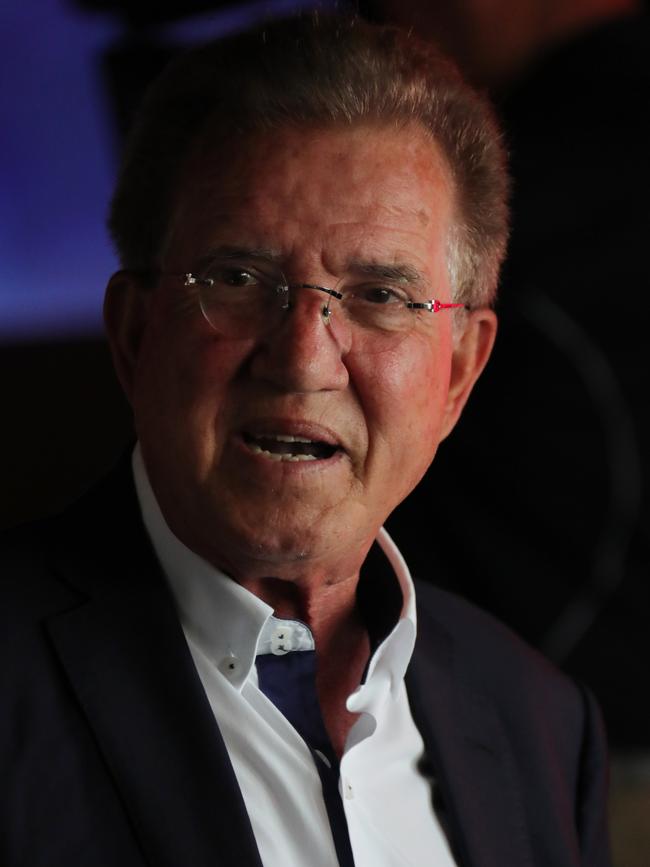

It’s been a year since the assets of indomitable Gold Coast developer Jim Raptis were frozen over an alleged $110m tax debt, so how has his life changed?

To summarise in two words: not much.

Within a hefty Federal Court order made on October 1, 2021, four words explain how the teflon businessman continues to live virtually unaffected by a series of events that would cripple almost anyone else.

They’re written in bold capitals: EXCEPTIONS TO THIS ORDER.

Mr Raptis himself bristles at the words “freezing orders” and, despite the documents themselves using the term, insists they have not impacted his ability to work.

It’s hard to argue otherwise.

While exceptions to freezing orders are not uncommon, some may seem more exceptional than others to the average tradie or retiree.

One such exception allows Mr Raptis, 76, to spend up to $10,000 a week on “ordinary living expenses” – a $520,000 allowance for the year.

He can spend what he likes on “reasonable legal expenses” on top.

The case

The asset freeze came as the ATO seeks $109.7m from Mr Raptis, members of his family and other entities they allege are linked to him.

Since the orders were made last October, the Federal Court case has been adjourned seven times.

It is next due before the court for case management on December 14, meaning it will likely stretch into a third year.

Despite multiple inquiries with numerous specific and general questions, the ATO media office has repeatedly declined to provide the Gold Coast Bulletin with any answers, citing confidentiality.

Its bombshell 2021 action made national headlines as the known assets of Mr Raptis and his family were laid bare, from his luxury mansion and vehicles, down to the contents of his bank accounts.

According to documents lodged with the Federal Court, ATO investigations revealed apparent “tax avoidance arrangements” by Mr Raptis, members of his immediate family and companies.

The office alleged Mr Raptis had a long-time association with criminal accountant Vanda Gould, who was convicted for providing offshore tax avoidance services for Australians.

According to the court documents, “significant sums of money had been transferred out of Australia by Raptis group entities to offshore entities in which Mr Raptis had admitted a beneficial interest or which were associated with Mr Gould”.

At the time, Mr Raptis said he was in “productive discussions” with the ATO and hoped for a resolution of what he called “historical matters”.

Two months after the court orders were made, a spokesman for Raptis again said the group was “in productive negotiations with the ATO”.

“A new timetable was agreed upon last month to give time to reach an agreement,” he said in December 2021.

“We anticipate reaching that agreement, early next year.”

Almost a year later, a statement from the company this week conveys similar optimism, saying it had “been working constructively with the ATO”.

“We and the ATO have mutually agreed to extend discussions over the last 12 months,” the statement said.

“The matters are complex in nature and we’ve been pleased that the ATO has been

accommodating in hearing alternative views.

“Discussions remain amicable and focused on reaching an agreement.”

Business as usual

The order allows Mr Raptis to continue buying, selling and developing “in the ordinary and proper course” of his business.

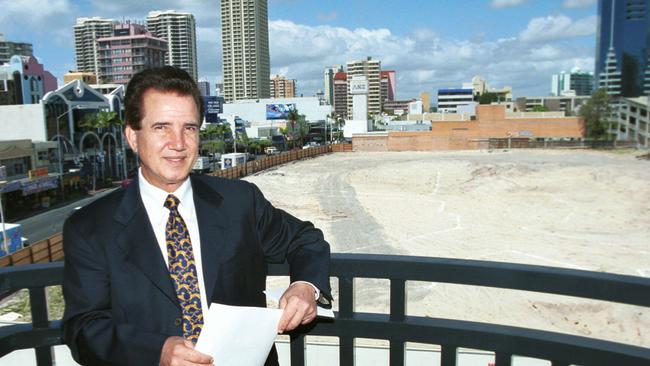

Thus, the industry veteran – whose past projects include Southport Central, Hilton Surfers Paradise, Chevron Renaissance and Bundall’s Corporate Centre – has had a very busy year.

While assets of many companies behind his current developments are covered by the freezing orders, the projects have gone ahead unhindered.

His $95m Gallery Residences had sold out by the end of last year, and he announced a new $200m, 35-storey tower, for Broadbeach’s Anne Ave, with construction due for completion in 2026.

The 30-storey, $160m Pearl is under constructions at Main Beach, while The Sterling, a 40-storey, $220m tower at Broadbeach is due for completion in 2024.

A $190m fifth tower at Chelsea Ave, Broadbeach, was due for completion in 2025, but the site has recently been placed on the market.

It’s owned by Chelsea Developments formerly named HS4 Sales, that is itself owned by Carefoot Group. Carefoot is solely directed by Mr Raptis but held by Malcolm Cory, secretary of the ASX-listed Raptis Group.

Mr Cory is also named in the court order, as sole director and shareholder of Kingsriver Services, subject to a $23.8m asset freeze.

Recent Raptis-linked property dealings haven’t been restricted to development sites.

A company directed and held by Mr Cory bought the five-bedroom house next-door to Mr Raptis’s $20m Paradise Waters mansion in a $4.75m sale that settled in March this year.

It was put back on the market eight weeks later, and sold for $5m in July.

Mr Raptis’s four-level homes was once described in a sales campaign as “possibly the Gold Coast’s most luxurious residence”.

It is owned by frozen Raptis company, Northernson, of which Mr Raptis is sole director but has no direct ownership.

That company’s sole $1 share is owned by Biggera Waters woman Merilee Lisle, who court documents said was a Raptis employee.

Asked how life had been, personally and professionally, for Mr Raptis in the past 12 months, the company line was strictly business.

“We continue to build and develop apartments on the Gold Coast, currently undertaking projects in Main Beach and Broadbeach which have been well received by the market.

“It has been business as usual over the last year for our companies, developing, building

and selling apartments,” a spokesman said.

“The fundamentals of the Gold Coast market are still strong. As everyone knows, there is also a critical undersupply of rental properties in the city.

“There will always be a desire to live on the Gold Coast and that will underpin the industry’s long-term sustainability.”

The ASX-listed group

The fortunes of public Raptis Group have been markedly less sustainably lucrative than its private counterpart.

RPG first listed on the ASX in 1986 but has twice been delisted, in 1991 owing investors $65 million and most recently in 2008.

While still in administration in early 2009, the group struck a restructure deal to settle more than $940m in claims from lenders.

Under the restructure, 35 million shares were issued to Raptis Group creditors and another five million went to creditors of failed subsidiary Rapcivic Contractors, the group’s builder.

Shares in the Group, which traded as high as $1.30 in 2007, had dived to 40c at that point.

For the past 12 months, Raptis Group shares have traded at 3.3c, a market capitalisation of $2.09m. It hasn’t paid a dividend since 2008.

Listed Raptis Group, which released its annual report late on Thursday, logged a modest net profit of $96,096 last financial year.

In the past 12 months, its cash reserves were drained by multi million-dollar management rights deals with the Raptis family.

However, the listed company received an unexpected boost after a subsidiary - directed by Mr Raptis and dormant for a decade - was mysteriously resuscitated and handed over $312,000.

The year also saw confusion over the listed group’s principal place of business and registered office, after the Raptis Group website gave its address as the Greek Consulate in Brisbane, where Mr Raptis is honorary consul.

Raptis representatives have been at pains to separate the private Raptis companies from the public Group, which is not subject to the freezing orders.

This week, they would not comment on the public group, asking the Bulletin to “please refer to the company’s statements on the ASX website for company information”.