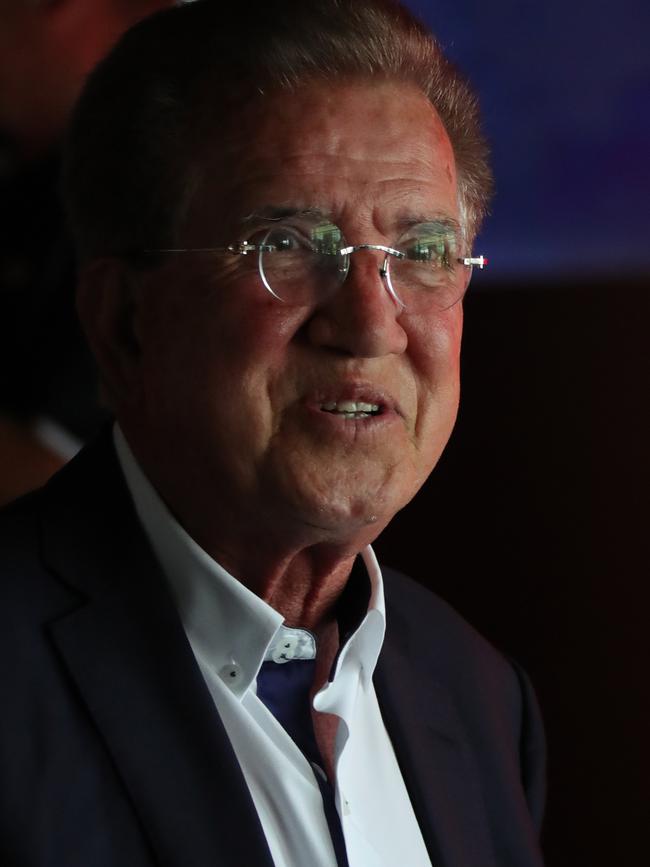

ATO’s $109.7m Federal Court tax case against Gold Coast developer Jim Raptis adjourned for 15th time

The ATO’s $109.7m case against Gold Coast developer Jim Raptis - and its $80m asset freeze - has dragged on more than two years. Read what he says about how the case has impacted him

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Enduring Gold Coast developer Jim Raptis says a freeze over $80m of his assets has “settled down” as the Australian Taxation Office’s $109.7m case against him was adjourned for the 15th time.

The Federal Court froze assets linked to Mr Raptis, wife Helen and son Evan, including the veteran developer’s $20m Paradise Waters mansion and a Lexus LS500 sedan, in a hearing without notice on October 1, 2021.

Under the orders, Mr Raptis was allowed to spend $10,000 a week on living expenses, fund legal expenses and stay in the family’s palatial waterfront mansion.

Despite the freezing order, Mr Raptis has continued to develop hundreds of millions of dollars worth of apartments as well as shift properties in his hefty portfolio.

“The orders were difficult in the beginning but have settled down to a much

better process,” he said this week.

“The orders have always allowed for the business to continue to develop and build as per usual.”

The freeze came as the ATO slapped a $109.7m tax assessment on Mr Raptis, members of his family and 11 companies it alleges are linked to him.

“Mr Raptis and entities with which he is associated have a long history of failing to file tax returns and pay tax debts,” the ATO alleges in documents.

According to the court filing, the ATO alleges Mr Raptis has a long-time association with criminal accountant Vanda Gould, who was convicted for providing offshore tax avoidance services for Australian taxpayers.

Mr Raptis’ family members are not accused of wrongdoing, criminal or otherwise, and it is not suggested Mr Raptis engaged in any offending.

A case management hearing scheduled for Tuesday this week was adjourned to February 21 – the 15th pre-hearing adjournment since the judgment more than two years ago.

Neither the ATO nor Mr Raptis would detail why the case had taken so long to be heard.

The ATO’s media department said it was unable to comment on the matter at all.

Mr Raptis said “we are working towards concluding settlement with the ATO”.

“The issues have been complex and have required clarifications and significant time to resolve,” he said in a statement.

The freezing orders have been altered by the court three times since they were made in 2021.

Among the alteration was one that allowed Mr Raptis and the companies to dispose of property if they had written permission from the ATO.

Shortly before the freezing order, Mr Raptis signed a $16m contract to buy a 6525 sqm site on the Gold Coast Hwy, formerly home to Sizzler at Mermaid Beach.

A year later he was looking to sell the site.

In October last year, Mr Raptis sold a site on Broadbeach’s Ann Street to Soheil Abedian for $12.1m, after paying $12.5m for the land and getting approval for a 35-storey tower.

That sale came after the $9.792m settlement of another Broadbeach site at Chelsea Ave in March last year, on which he made a $3.7m gain.

In October 2022 he sold a two-level riverfront house at Paradise Waters, bought for $4.75m in March that year, for $5m.

The ASX-listed Raptis Group, which is not subject to the asset freeze, paid out $2.8m – almost all its cash – to private Raptis companies in 2022.

Mr Raptis and wife Helen were paid more than $2.8m of the company’s $2.9m reserve for management rights in two Gold Coast towers, as well as on a development management agreement for the Pearl project, currently under construction at Broadbeach.

“Pearl is finishing in April and The Sterling Broadbeach apartment project is

under construction and will near completion mid-2025,” Mr Raptis said this week.

“The Gold Coast market is in a very solid position in apartments and housing

and will continue to be for the next three to four years.”