‘Slow-motion breakdown’: Waleed reveals why Australia is at breaking point

The Project Host Waleed Aly says Australia is at breaking point as “wrong people” are burdened with fixing it.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

According to a comprehensive analysis of recent developments by Waleed Aly, the Australian economic landscape is facing a bleak outlook.

The Project host, in an op-ed published by the Sydney Morning Herald on Friday, painted a troubling picture of the current state of affairs, weaving together key indicators highlighting the economic challenges Australians are grappling with.

Aly pointed to ANZ’s chief executive’s assertion that home loans have become “the preserve of the rich,” underscoring the soaring costs of property ownership.

Exorbitant property prices and high-interest rates exert immense pressure on homebuyers, subsequently impacting the rental market.

This week’s The Rental Affordability Index concluded that renting has become less affordable than ever in every state and territory, further compounding the economic strain on citizens.

The rising interest rates, Aly contended, are to blame and a consequence of “stubbornly high” inflation, creating a domino effect that transcends economic realms.

He argued, “ … financial stress is seeping through the community and straining our social and even political relationships.”

The Scanlon-Monash index, measuring social cohesion, reveals that the nation is experiencing its lowest recorded levels.

Aly asserts that this is indicative of a “slow-motion breakdown.”

Delving into the human cost of these economic challenges, Aly cites alarming statistics: more than three-quarters of financially struggling individuals report feeling socially isolated, 12 per cent are skipping meals, and 22 per cent cannot afford essential medicines or healthcare.

Aly lamented: “When you’re financially struggling, you tend to lose trust. “That’s a problem because trust is the very basis of any functional society.”

Such an erosion of trust, Aly argued, manifests in increased political polarisation, diminished national pride, a weakened sense of belonging, and a “loss of faith that hard work brings a better life.”

Aly placed housing at the centre of this crisis, emphasising its elemental importance and the precarious situation that arises when it becomes the exclusive domain of the wealthy.

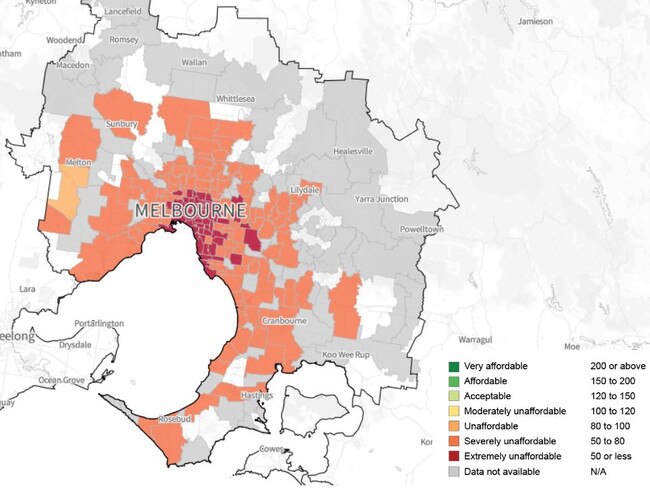

He said The Rental Affordability Index indicates that unaffordability is pervasive, affecting not only cities and suburbs but also regions, pushing people further away from economic opportunities and community connections.

The nature of inflation, Aly argues, disproportionately affects those who can least afford it – namely the young Australians.

He said the current tools to combat inflation, particularly repeated interest rate rises, exacerbate the insecurity of the most vulnerable while allowing the wealthy to maintain their spending habits.

He quotes Danielle Wood, head of the Productivity Commission, noting that people over 55 continue to “live large” while younger generations experience a substantial reduction in actual consumption, further widening the economic gap.

“For decades now, young people have spent more on essentials and less on discretionary things. That’s only getting worse,” griped Aly.

Aly scrutinised the federal government’s response, particularly its consideration of reviewing spending on infrastructure to mitigate inflation. However, he expresses concern about the government’s reluctance to address other major spending items like aged care, child care, the NDIS, and defence, due to political investments.

The looming introduction of stage 3 tax cuts raises further apprehension. Aly argues that delivering the highest earners an additional $9000 a year is inherently inflationary.

The initially projected timeline for inflation to return to routine, he argues, has been extended, with the Reserve Bank of Australia forecasting a return to normal levels by the end of 2025, an 18-month delay.

In Aly’s view, the persistence of high interest rates amid the delayed return to normal inflation levels foretells an extended period of economic stress, strained civic relations, declining trust in government and society, and a growing belief that hard work does not necessarily lead to prosperity.

Against this backdrop, the implementation of stage 3 tax cuts could further exacerbate discontent, amplifying the perception that the “wrong people” are bearing the brunt of inflation control efforts.

Aly concludes that in a climate where only 12 per cent of the population believes the current system of government works fine, the introduction of stage 3 tax cuts may prove to be “most truly unaffordable.”

Originally published as ‘Slow-motion breakdown’: Waleed reveals why Australia is at breaking point