Aussie shares rise on feverish Wall St rally

The Australian sharemarket lifted on Wednesday on the back of a rising Wall St bull run.

The Australian sharemarket lifted on Wednesday on the back of a rising Wall St bull run.

The latest numbers on new home starts are out and it isn’t good news for battlers struggling to live the Australian dream.

Some dark economic data out of China triggered a sell-off in heavyweight mining stocks on Tuesday, pulling the Aussie market down from record highs.

Aussies shares continued to rally higher on Monday, crossing the 8000 threshold for the first time in history on speculation of imminent rate cuts in the US.

Aussie shopping habits have changed under the weight of the ongoing cost-of-living crunch, which could lead to a big change this festive season.

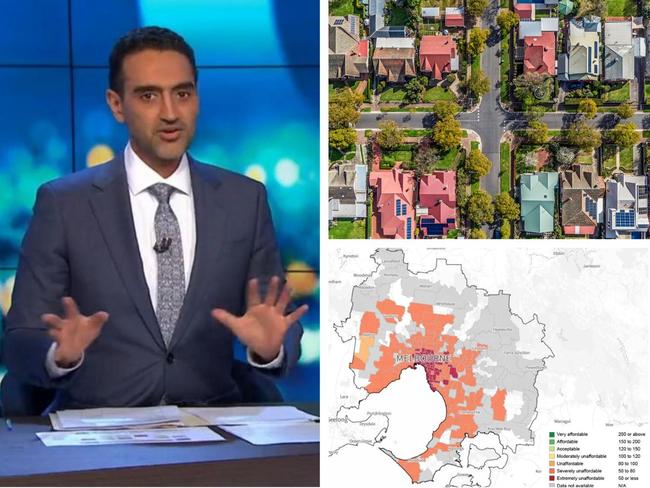

The Project Host Waleed Aly says Australia is at breaking point as “wrong people” are burdened with fixing it.

Despite a bumper 55,000 jobs added to the economy in September, the unemployment rate rose following a jump in the participation rate.

A better-than-expected US inflation print overnight pushed the ASX to an eight week high.

With annual wages growth hitting its highest levels in almost 15 years, economists are split on the RBA’s next move on interest rates.

One state’s parliament erupted in a shouting match over how vital roads and bridges will be funded, as the federal government tries to claw back billions in cost blowouts.

The head of banking giant ANZ has issued a stark warning to first home buyers as the great Aussie dream continues to slip out of reach.

A drop in energy and real estate stocks caused the Australian share market to lose ground on Monday.

Households and businesses shouldn’t expect the path to curtail persistent price pressures to be quick or direct, the Reserve Bank has warned.

There are now several suburbs across major cities without any spare rooms for desperate renters.

Original URL: https://www.goldcoastbulletin.com.au/business/economy/interest-rates/page/64