Melissa Caddick: Lawyers detail how she pulled off alleged scam

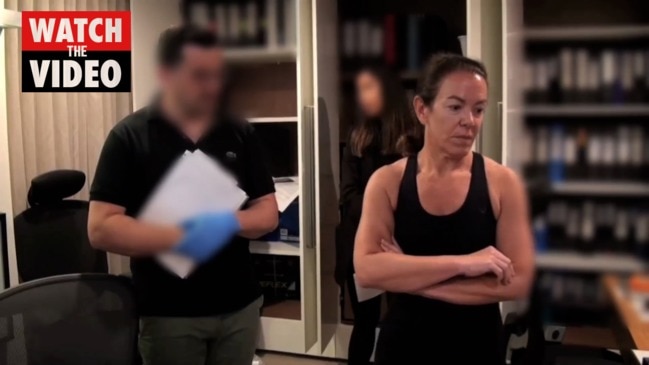

Missing businesswoman Melissa Caddick never honestly invested her clients’ money and used the same advisers and accountants who failed to discover her scam, it was alleged yesterday.

Police & Courts

Don't miss out on the headlines from Police & Courts. Followed categories will be added to My News.

Missing businesswoman Melissa Caddick never genuinely invested any of her clients’ millions and used the same advisers and accountants who failed to discover her seven-year scam, it was alleged yesterday.

The meticulous web of lies and false documents she allegedly used to rip off devastated investors has been revealed by liquidators, who say there was no genuine investment in a client’s name.

False bank statements, share contracts, share trading statements and documents using the letterhead of CommSec and the Commonwealth Bank have been discovered by provisional liquidators Jones Partners.

About $25 million was invested with Ms Caddick by around 60 clients before she disappeared from her Dover Heights mansion in November last year, two days after it was raided by ASIC investigators.

The investors, some of whom trusted her with their life savings, have been told they are unlikely to get much of their money back.

Jones Partners principal Bruce Gleeson said Ms Caddick used the same external accountant and auditor for “several years” in order to avoid suspicion.

“In our opinion (she) controlled who she wanted to give information to, to prepare financial statements rather than provide it to a small number of advisers (who) would have been able to more readily conclude everything was not right about the total picture,” Mr Gleeson said.

“There are hundreds of false bank statements, share contracts and share trading statements.”

He said she was “meticulous and systematic” in the way she “lured” investors into handing over money.

“She continually represented to investors that their investments were safe, that their investments were increasing in value,” Mr Gleeson said.

“All the investors believed that all was going well. But nothing could obviously be further from the truth.”

Ms Caddick, 49, persuaded some clients to take their money out of superannuation funds and invest in self-managed super funds of which she was trustee. She even set up her own self-managed fund using fictitious bank statements and accounts which she also had audited.

It was a move that was “quite bizarre but also quite risky for her,” lawyer Michael Hayter, who is working with the provisional liquidators, said.

Jones Partners were appointed by the Federal Court to investigate the finances of Ms Caddick and her company Maliver. Invested money was quickly transferred to her personal accounts. The case returns to court in April.