Sydney housing affordability worse than when rates were at record highs

Paying off a Sydney home is now tougher than at any time in the past 40 years due to the unprecedented onslaught of interest rate hikes See how rates are affecting you.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Paying off a Sydney home is chewing up more of new homeowners’ wages than at any other time this century due to the Reserve Bank’s unprecedented onslaught of interest rate hikes.

And with more rate hikes expected in coming months, economists have warned city mortgages will become even less affordable than during 1990, when rates were 17.5 per cent.

The gap between average mortgage repayments and incomes is currently the highest since 2001, with average repayments eating more than half of typical income, CoreLogic figures showed.

Group head of research Tim Lawless said housing affordability could soon be worse than in the 1990s, despite rates being lower than they were then, because of the debt needed to buy a Sydney home.

“Back when rates were around 18 per cent, households weren’t anywhere near as sensitive to rate rises because they didn’t have as much debt,” he said.

“(Today) they’re far more sensitive to incremental changes to rates and as debt costs increase they will be more thinly stretched and have to adjust their balance sheets.”

It comes as new mortgage analysis provided exclusively to The Saturday Telegraph has laid bare the alarming toll of rising interest rates on home buyers’ ability to simply enter the market.

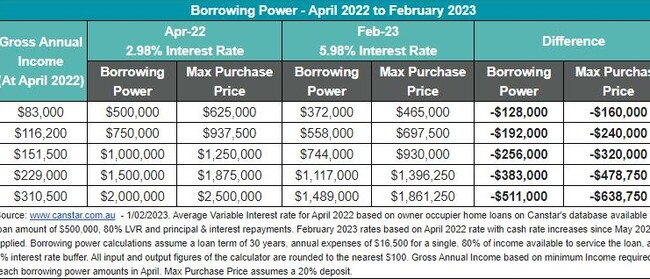

The Canstar data showed nine rate rises since May scrubbed up to $500,000 off buyers’ borrowing power.

A buyer who last year would have been able to borrow $1m can now only borrow $744,000, while a buyer who could get a $2m mortgage last year will now only get just under $1.5m.

Rate rises have put even more restrictions on lower income earners.

Someone earning $83,000 a year could have accessed a $500,000 loan before rates went up last year.

Armed with a 20 per cent deposit, this would have allowed them to buy an average-priced unit in 87 suburbs, although house purchases would have been off the cards even then.

The same buyer’s borrowing capacity has since dipped to $372,000, leaving only 19 suburbs with affordable unit prices.

Canstar analyst Steve Mickenbecker said borrowers at all income levels were now finding that they can no longer afford the loan size they expected.

“Buyers’ expectations will be dropping at all levels across the income board. The compromise for many will have to come in terms of location or housing style, standard or size,” he said.

Diminishing borrowing power will also squeeze more home seekers to the bottom end of the housing market, Mr Mickenbecker said.

“Buyers will potentially be chasing each other down the price ladder rung by rung, with an uncomfortable likelihood that at the bottom end, first home buyers and low income earners will find themselves crowded out again.”

Mr Mickenbecker added that home prices weren’t falling fast enough to improve housing affordability, with PropTrack data indicating Sydney home prices dropped nearly 7 per cent over the past year.

“The price fall is nowhere near the 25.5 per cent fall in purchasing power,” Mr Mickenbecker said.

“Some are expecting further price adjustments, but few are expecting the market to drop by the quarter needed to leave expectations intact … a uniform fall across price levels is unlikely.”

Blue Owl Finance broker Aidan Hartley said the high entry costs of Sydney housing were part of the reason buyers were so vulnerable to rate rises and had inflated mortgage repayments.

“Most first homebuyers would rather use a 5 per cent deposit than wait years to save a 20 per cent deposit,” Mr Hartley said, adding that the higher debt ratio made the loans more expensive.

Recent home buyers said they blamed Reserve Bank messaging during 2021 for encouraging them to take on more debt.

Bradford Jefferies and partner James bought a Dulwich Hill terrace last year thinking rates would be on hold until 2024, as had been indicated by RBA governor Phillip Lowe.

By the time they settled on the purchase, their interest rate had gone up three times.

They are now paying more than double their initial interest rate and have had to cut back on spending by cancelling subscription services, eating out less and only using their car for special occasions.

“The Reserve Bank had said rates weren’t going to go up until 2024,” Mr Jefferies said. “That was the official government position – we assumed that was a relatively safe bet. In retrospect, we probably wouldn’t have lent so heavily on that advice.

“I don’t think we expected the rate hikes to happen in such quick succession … there hasn’t been any time for our wages to adjust or for us to find alternative methods of income.”

PropTrack economist Angus Moore said the silver lining for would-be buyers and mortgage holders is that the peak of the cash rate was probably in sight.

“We’re expecting, and markets are pricing in, a couple further interest rate rises over the first half of this year before the RBA pauses,” he said.

“We expect prices will continue to decline this year, which will help make homes more affordable.”