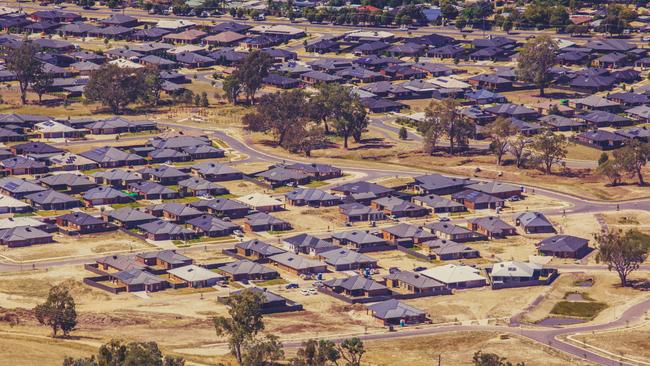

Real Estate NSW: regions enjoying huge price rises despite interest rate surge

Home prices in these parts of NSW are booming again despite the RBA’s interest rate surge.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Home prices in parts of regional NSW are booming again due to the Ukraine War driving up agricultural prices, new infrastructure and a scramble for cheap real estate brought about by record interest rate hikes.

Exclusive PropTrack data revealed multiple regional areas had average home value rises of more than $100,000 since the first of nearly a dozen cash rate increases since May last year.

The most extreme rises were recorded in some of the Hunter Valley’s lower priced suburbs, parts of the capital region and the Riverina area in the southwest of the state.

Some of these growth suburbs were near major wheat producers who have found new markets for their exports because of bad weather in normally high producing parts of the northern hemisphere and the Russian invasion of Ukraine - Europe’s traditional bread basket.

RELATED: Where regional home prices are soaring

“Regional NSW home prices have performed very strongly for a number of years,” said PropTrack economist Angus Moore.

“It was particularly strong during the pandemic, but since then there’s been a boost in towns linked to growing industries.”

It comes as trade figures showed more money was filtering into regional towns due to a spike in agricultural prices, especially for wheat, canola and cotton.

Ray White chief economist Nerida Conisbee said 2022 was an especially good year for some farmers and their higher earnings were boosting local businesses.

“Higher levels of wealth does impact growth in property prices,” she said.

PropTrack data showed Hunter Valley town Dungog had one of the biggest median property price increases over the past year, with growth of 26 per cent.

A typical house in the town cost about $502,000 in April last year. It now costs $635,000, $133,000 higher.

There was similar growth in the town of Cooma, where a typical residential property cost $450,000 in April last year before rising $110,000, or 24 per cent, to $560,000.

Home price rises in West Wyalong – a key grain producing region in NSW’s central west – averaged 32.7 per cent for the year, pushing the median up $90,000 from $275,000 to $365,000.

MORE: How govt watchdog helped create rental crisis

The state’s biggest percentage increase in home prices was in another wheat producing region, the town of Finley in the Murray region in southwest NSW. The rise was 36.2 per cent.

Experts said other regional areas had become more enticing for home buyers and investors who could no longer afford purchases in pricier markets after rate rises strangled their borrowing capacity.

MORE: Sad truth about Sam Kerr’s childhood home

Some of these buyers were fresh off of home sales in Sydney, Newcastle or Wollongong and could use the proceeds from their earlier transactions to outbid buyers based locally.

A listing slump in many of these areas also meant home seekers were competing with more rival buyers for the listings they liked, pressuring them to offer more.