Each suburb revealed: what your home is now worth after shock price rebound

There has been a spectacular rebound in home values across some of the regions ravaged by last year’s market slump, with new value data on every suburb revealing the biggest winners.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Home values have leapt up by more than $200,000 over the past year across much of Sydney in what has become one of the most unexpected housing market accelerations in recorded history.

Many of the areas with the steepest rises were within the traditional “mortgage belt”, middle- and outer-ring suburbs popular with middle-income families, according to exclusive PropTrack data.

There has also been a rebound in some of the regions ravaged by last year’s market slump, including the northern beaches, eastern suburbs and densely populated inner city areas.

The recent explosive growth has meant home values in these areas are now level or higher than during the peak of the Covid-era housing boom in early 2022 when interest rates were at record lows.

It’s the first time values have risen so significantly in an environment of interest rate hikes and pronounced affordability challenges, with the gap between prices and wages now the largest in three decades.

Home seekers are also saving less – soaring living costs and stagnant salary growth have meant those with plans to buy a home have much less to spend.

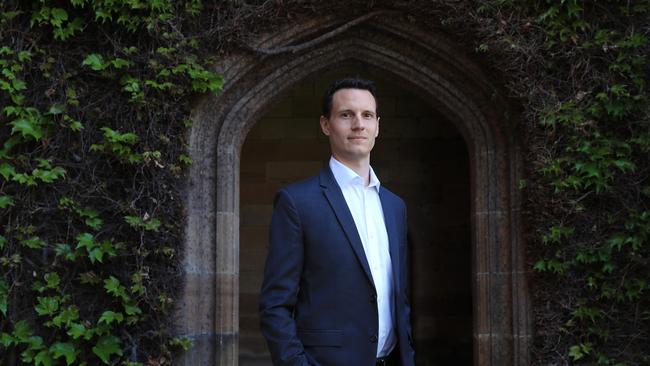

“Recent growth has been unexpected. Coming into 2023 we expected property prices to fall,” said PropTrack economist Angus Moore, noting prices have historically fallen as interest rates rise.

Veteran agent Peter Diamantidis of Ray White St Marys in Sydney’s far west said he had never seen a market like this.

“We’re surprised, our vendors are surprised,” he said. “Last year, some would struggle to sell their house for $750,000 in the west, now the same owners are getting nearly a million even though buyers have less to borrow.”

Areas with a more than $200,000 jump in median house values over the past year included west and northwest suburbs Kings Langley, Oatlands, Parramatta, Ryde, Castle Hill, Bella Vista and many more.

Locations with a circa $150,000 bounce up in values were once cheaper western suburbs Winston Hills, Dundas, Acacia Gardens, Parklea, Birrong, The Ponds and Ermington.

The biggest rises, more than $500,000 annually, were in affluent markets like Vaucluse and Rose Bay, but the rises came off a much higher base – median values in these areas were already above $5m.

There were multiple factors causing the unexpected home value rises, Mr Moore said.

He explained many of the buyers spending big and driving up home prices to record highs were purchasing properties with larger deposits and smaller loans and were not as affected by rate rises.

“They’re long-time homeowners who had substantial equity in their previous homes, which they’re using for their new purchases,” Mr Moore said.

Another factor was skyrocketing rents and swelling migration numbers which were pushing more renters into becoming first homebuyers. This was driving up competition at the bottom end of the market.

Low unemployment also meant that few homeowners were defaulting on their loans and there had yet to be a mass of distressed sales that would push down prices.

“There has actually been a shortage of listings for much of the year. Demand has exceeded supply and that’s been a decisive factor in pushing up prices,” Mr Moore said.

SQM Research analyst Louis Christopher said rising migration had disrupted some of the usual patterns seen in markets when interest rates rise and prices become too unaffordable for the average buyer.

“When prices become too high relative to wages and mortgage serviceability is too stretched, markets correct and essentially find a new point of equilibrium, a new point of affordability,” he said.

“But in a nation where population growth is over 2 per cent per annum like we are having, and underlying demand for housing continues to increase, we have a situation where the majority of housing can be unaffordable but prices still keep rising.”

Mr Christopher said Sydney’s housing market could become even less affordable if recent trends continue.

“Let’s just imagine that property pricing become so unaffordable that only the rich can afford it, which is heading that way in Sydney. Prices can still rise in that environment. If the number of rich people living here keeps increasing it will offset those who can’t afford to buy. That can happen if population growth is over 2 per cent due to migration, as we are seeing now.”

For now, some homeowners say they feel emboldened by the value rises.

George Jameson, a resident of the Mount Druitt area, where a home recently sold for $3m, said he felt encouraged to sell his property of 15 years.

“I have been watching the market for the last five years and looking when to press eject button,” he said. “It’s crazy how much prices have changed. Back in 2008, (our price) was $400,000. Now it will be over $1.3m. By the time we sell we will have done OK.”