Don’t buy here: Qld’s property ‘no go zones’ revealed

A “no go zones” report for investors has revealed a number of Queensland suburbs where an oversupply of housing has sent prices into a downward spiral. Here are nine of the worst.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

A “no go zones” report for investors has revealed a number of Queensland suburbs where an oversupply of housing has driven up vacancies and sent prices into a downward spiral.

City suburbs with a glut of newly built homes, mining towns and areas that led Australia’s property price boom last year have been flagged as the riskiest locations to buy real estate.

The report reveals multiple pockets around the state where an oversupply of housing, plummeting buyer demand and an uncertain economic landscape would drive down property values.

The bulk of the “no go zones” revealed in the analysis of ABS, SQM Research and property transaction data were in Queensland and NSW.

The prospect of freefalling prices in these locations meant purchasers had a high chance of losing money if forced to sell.

Rental demand in some areas was also classified “unstable”, leaving real estate investors vulnerable to long vacancies.

Positive Property founder George Markoski, who authored the report, noted rising interest rates could exacerbate the weak conditions in “no go zones” by squashing buyer demand and further pulling down prices.

He added that there was a high chance of property owners in the worst markets going into negative equity, where they owed more on their mortgages than their properties were worth.

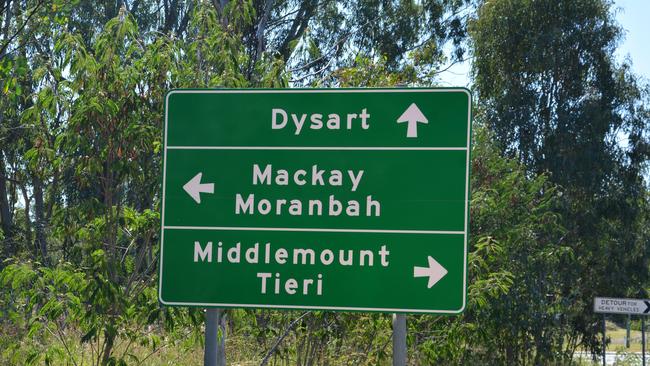

The Queensland suburbs labelled “no go zones” include the coal mining towns of Moranbah and Dysart, along with parts of nearby Mackay — one of the main ports for servicing the coal-rich Bowen Basin.

Suburbs of Greater Townsville, including Burdell, Mount Low and South Townsville, were also flagged due to an oversupply of housing relative to demand, among other factors.

Mr Markoski said mining towns were among the riskiest real estate investments because they were unpredictable.

Many investors were drawn to these markets due to the unusually high rental returns, but this was often a trap, he said.

“The tenancy base is unstable,” he said. “There are times when the vacancy rates are horrendous … the mine can shut or part of the operation can change.

“Investing in a mining town is like buying shares. Values are constantly going up and down. It’s too unpredictable and the whole point of investing in bricks and mortar is it should be solid and reliable.”

QLD ‘NO GO’ ZONES FOR INVESTORS

Dysart

Burdell

Lutwyche

Andergrove

Moranbah

Caboolture South

Mackay

South Townsville

Mount Low

Source: Positive Property analysis of ABS, SQM Research and other property transaction data

Originally published as Don’t buy here: Qld’s property ‘no go zones’ revealed